No spin: The federal election tax policies that will affect ASX stocks

Mining

As the major parties switch up the spin cycle ahead of the May 18 federal election, we’ve hunted down the policies that will affect listed companies — so you don’t have to.

About 1.5 million people have already voted in the election being held this Saturday, but if you still haven’t made up your mind which party you plan to back, here is a little more “no spin” info on tax to help out.

The tax election policies have sparked quite a bit of discussion, specifically around the proposed negative gearing and capital gains changes.

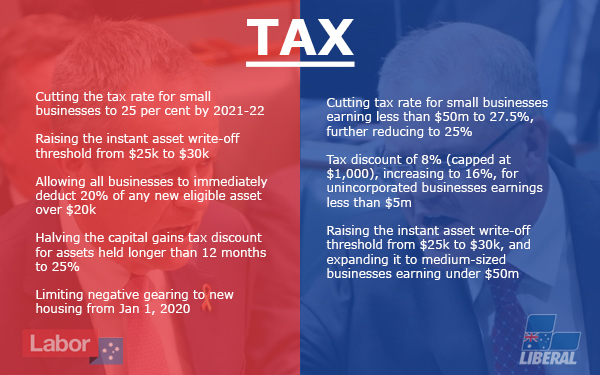

But there are some benefits for small businesses. Let’s start with the detail on that – but first, in a nutshell:

According to an OECD report released in January this year, Australia’s headline corporate tax rate of 30 per cent was the second highest tax rate in the OECD. Only France was worse off with a 34.4 per cent rate.

Deloitte said these statistics further demonstrated the validity of concerns about Australia’s competitiveness in respect to attracting and retaining investment.

“Despite this, and conscious of the reality of politics, it appears unlikely that either party will propose further corporate tax cuts in the medium term,” the Big Four accounting firm noted.

“However, Labor has a policy platform to ‘ensure the corporate tax rate is fair and competitive’.

“Labor has also promised to deliver preferential taxation assistance measures to small business consistent with recommendations from the Henry Tax Review. Details on how these will materialise will be eagerly awaited.”

Both the Coalition and the Labor Party have promised cuts to the corporate tax rate for businesses earning less than $50m.

Labor has also committed to allowing an extra 20 per cent tax break for every business that invests in productivity-boosting equipment above $20,000, whether that’s a “big manufacturer buying new technology or a tradie getting a new ute”.

The small business tax cuts will have far-reaching benefits for many ASX-listed small caps, particularly in the areas of biotech and resources where companies might have some small early cash flow coming in to help them fund other projects.

One such company is Emmerson Resources (ASX:ERM), which is making a bit of cash from small-scale production at its Edna Beryl gold mine, but is also undertaking exploration on its other projects.

The company is receiving a 12 per cent royalty from the production at Edna Beryl, which is being managed by partner Territory Resources.

In the meantime, Emmerson is using the cash it’s earning to fund ongoing exploration at its broader Tennant Creek project in the Northern Territory.

Bug killing germ warrior Zoono (ASX:ZNO) is also making a bit of cash while at the same time expanding its operations.

Just this week the company said it had inked a deal with US partner MicroSonic to sell a bespoke antimicrobial “system” to car care company Turtle Wax, developed specially for the business over the last 12 months.

MicroSonic has to buy a minimum of $US23m ($33m) worth of the Zoono Z-71 Microbe Shield by 2023.

Genetic Technologies (ASX:GTG) is developing two new tests for colorectal and breast cancer, but it is also generating some cash.

Currently, investors who hold shares for a year or more get a 50 per cent discount on the tax they need to pay on any capital gain — that is, any profit they make on the sale of the stock.

Labor wants to cut that to 25 per cent for all assets bought after January 1, 2020. Any shares bought before that date would be exempt.

This may not have much of an impact for small cap investors, a section of the market where high volatility and rapid change encourages active portfolio management rather than buying and holding.

Bridge Street Capital director Alex Sundich says small cap investors tend to buy in or sell out on a catalyst, be that drilling results from a resources company or clinical trial results from a biotech, and the majority can be short term holders.

There may, however, be some impact for directors and institutions who tend to have longer term horizons.

Dividends are paid out of after-tax profit; franking credits allow the recipients to avoid paying a second round of tax on that money by offsetting it against their other income.

If they don’t pay tax or don’t have a tax bill, a change in 2001 allows them to take the credits as a cash refund.

Labor wants to stop these cash refunds.

While dividends are led by the likes of heavyweights Alumina (ASX:AWC), Rio Tinto (ASX:RIO) and Fortescue Metals Group (ASX:FMG), there are a number of small cap resources companies which also pay out, from Neometals (ASX:NMT) to Rand Mining (ASX:RND).

Deloitte said that in light of this possible change, many investors were currently reviewing whether to reweight their investment strategy (where franked dividends are a major source of income) and companies are assessing their distribution and capital management policy.

“These decisions also raise a host of other tax and non-tax issues to consider as a consequence,” the firm said.

“The proposed Labor policy may also have wider implications for businesses and their competitors on returns on investment and stock market valuations more generally.”