Big finds rarely lead to more big finds – here’s why ‘nearology’ is a load of rubbish

Mining

Mining

“Nearology” continues to attract explorers and millions of dollars in investor capital like moths to the proverbial flame — despite a distinct lack of success over time.

It puts a spotlight on any explorer that holds ground within cooee of a huge, company-making mineral discovery.

After a big discovery is made, investors rapidly jump into these neighbouring stocks — hoping they can emulate the original find — causing a crazy, collective but often short-lived share price explosion.

But over the long term, history shows us that nearology rarely bears fruit.

Resources expert Gavin Wendt says grassroots discoveries like the DeGrussa cooper-gold mine or the Nova nickel deposit – exploration successes that generated huge interest in the market — don’t come along very often.

“There is a distinct lack of success based on the so-called ‘nearology factor’,” Mr Wendt says.

“I think it’s fair to say that just moving into an area based on nearology isn’t enough — pegging ground, and saying ‘hey, we’re 50km, 30km, 15km from the deposit’ isn’t enough.”

‘Sometimes these discoveries do occur in isolation, and it may be a period of a decade or more before a follow-up deposit is found.”

Sandfire and Sirius hit pay dirt — but everyone else is still looking

In early 2009, struggling explorer Sandfire Resources (ASX:SFR) had just dropped a large number of exploration licences and retrenched most of its team in response to the impact of the global financial crisis.

In the first half of that year it discovered what would later become the world-class DeGrussa copper-gold mine, rapidly transforming its fortunes.

By July 2009 Sandfire’s share price had already jumped from 7c to about $2.15.

By 2010 there were countless explorers pegging ground in the region hoping to emulate Sandfire’s success.

The nearology effect saw many of them enjoy short term share price gains as investors poured millions into the ground searching for another company-making DeGrussa-style deposit in the region.

But so far, none have.

In 2012, the Mark Creasy-backed Sirius Resources made an entirely new type of nickel discovery in the Fraser Range of Western Australia.

Sirius had barely any cash left when it found the globally significant Nova deposit, sending an otherwise dour market into a frenzy.

Within two months the Sirius share price was up 4000 per cent, from 5c to over $2.50.

Its market cap went from $7.5 million to an incredible $500 million over the same period.

When Sirius was acquired by major miner Independence Group (ASX:IGO) in 2015 the former penny stock was valued at $4.38 per share, or $1.8 billion.

Upwards of 40 ‘nearology’ plays flooded the region, sinking millions of investor dollars into exploration to find the next Nova-Bollinger – but so far results have been disappointing.

Now, in 2018/2019, explorers and investors are feeding off the buzz around potentially huge copper discoveries by major miners Rio Tinto (in the Paterson Province of Western Australia), and BHP (near its Olympic Dam mine in South Australia).

For long term investors, nearology plays don’t stack up

So, are nearology plays prime feeding grounds for stock speculators and a money drain for long term investors?

The answer is probably the latter.

Hedley Widdup, director of junior resources focused investment firm Lion Selection Group, says nearology plays are betting the unexplored ground they have holds something similar to what has been found next door.

“In most nearology examples, the ground was worthless before the adjacent discovery, so fundamentals for the company haven’t actually changed,” he says.

“[But] if you are backing a geologist who always thought this was prospective then you’ve got the right champion.”

There are many explorers with strong management teams with honourable intentions who believe they can get their hands on acreage that is highly prospective.

For many small cap explorers this is the primary motivation.

But there are also some companies that will do almost anything to survive, resources expert Mr Wendt says.

“If that means hitching their wagon to the latest and great exploration fad, then that’s what they will do,” he says.

“There will always be companies that are jumping from one ship to the next – those companies do tend to get a bit of a reputation in the market.”

Management’s track record tells you (almost) everything

Good quality management will typically have some sort of track record of exploration success.

For example, the only meaningful discovery near DeGrussa so far – the small but high grade Monty deposit – was made in May 2015 by an experienced joint venture between Talisman Mining (ASX:TLM) and Sandfire Resources.

When a company can attract a joint venture partner it’s another good indication that they are the real deal, Mr Wendt says.

“On the other hand, if a potential shareholder looks at management’s track record, and they have been diving from one commodity to the next, from one project to the next, and from region to the next – that raises some red flags,” he says.

“That company isn’t particularly concerned with meaningful exploration.

“It’s probably more about generating some share price momentum rather than achieving any meaningful long-term exploration success.”

But for stock speculators, nearology can be very lucrative

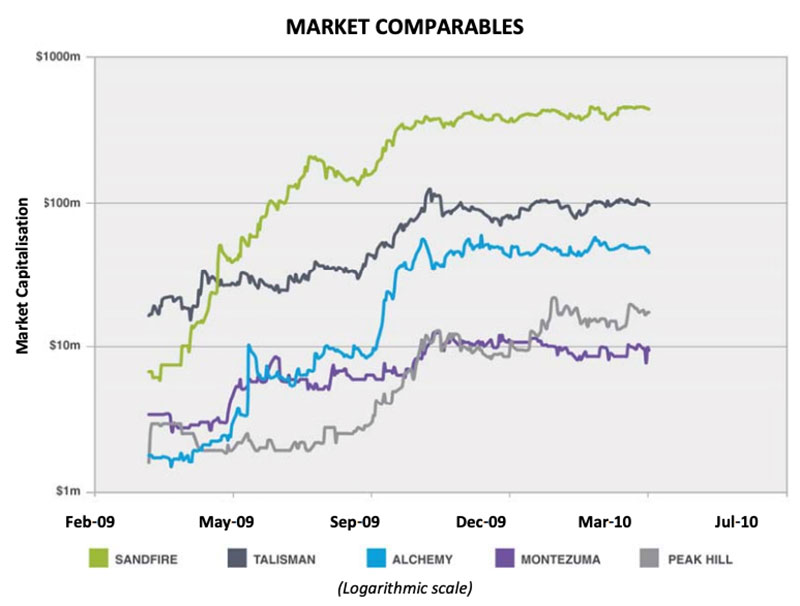

The graph below is an example of how the share prices of some explorers around DeGrussa were essentially wed to the news flow coming out of Sandfire — which is common for many examples of nearology.

More recently, a group of miners and explorers searching for iron-oxide copper-gold deposits right next door to BHP’s big copper find in South Australia saw their share prices fly as nearology fever took hold.

In one day, the Aeris Resources (ASX:AIS) share price was up 27 per cent, and Argonaut Resources (ASX:ARE) and Cohiba (ASX:CHK) both got “please explain” notices from the ASX after their share prices jumped 41 per cent and 100 per cent, respectively, for what looked like no reason at all.

Mr Widdup says the investors he knows who play nearology best are short term players.

“They get in early and sell shortly after – knowing they missed the absolute bottom.

“You’re speculating on an awful lot to have anything other than a short run.”