IPO Watch: Gold Tiger looking for success where others have failed

Mining

Mining

Gold Tiger Resources reckons it has the tools to find big gold deposits where others have failed.

The newly formed explorer has launched an initial public offering to raise up to $5 million on the back of its early stage Credo gold project in Western Australia.

Incorporated in October, Gold Tiger wants to raise between $4 million and $5 million selling up to 25 million shares at 20c each.

The IPO opened on March 14 and is set to close on May 10, with listing – all going well — pencilled in for May 22.

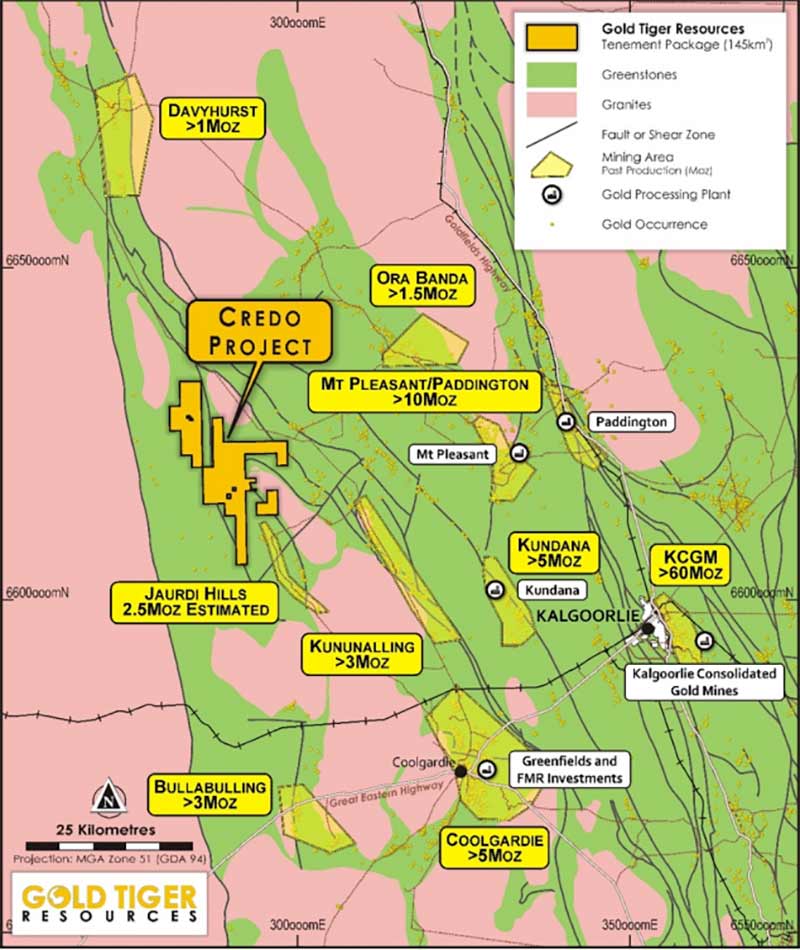

Its focus is the Credo gold project, about 50km from Coolgardie in the Goldfields region of Western Australia.

This is one of the most productive gold, nickel, and base metal regions in the world.

Credo is not a new project.

In fact, the various tenements have been shuffled from company to company for the last 40-odd years, with very little exploration success.

But Gold Tiger reckons previous exploration was “limited and ad hoc”, and even when something was found, the drilling was far too shallow.

Gold Tiger is planning something far more extensive using modern exploration methods, it says.

Independent geologist Simon McCracken of Kracken Rocks (excellent name) says most of the tenement package has been explored in the past by many different companies focused mainly on gold, but also nickel and copper.

This included geochemical sampling, geophysics and drilling.

But much of the previous sampling failed to penetrate through the lateritic (near surface) material.

More than half of the drilling does not extend beyond 50m depth.

“Gold Tiger Resources recognise that the mineralisation that has been shown to exist below the laterites in saprolite is underexplored and that mineralisation may be continuous underneath the laterite horizon,” Mr McCracken says.

“Although much of the Credo project area appears to have been explored in the past, opportunities for finding or extending mineralised deposits using more sophisticated geochemical sampling techniques exist.

“Several soil anomalies remain untested or have been tested only by limited or shallow drilling.”

The company is also looking to define a small, near surface mining operation alongside its main exploration program.

The explorer is ideally located if it does prove up an economic gold resource at Credo, with four established gold treatment facilities nearby.

Five of the nine tenements are currently subject to plaints for forfeiture for alleged failure to comply with the expenditure requirements – but Gold Tiger says this isn’t a problem.

These forfeiture claims, which are currently being defended in the Wardens Court, are “opportunistic”, it says.

And these are the least prospective tenements anyway.

“While the company does not expect that the tenements would be forfeited and it considers that it has good prospects of defending the claims, in the worst case that the Minister makes a declaration that a tenement is forfeited, the company does not consider this to be a materially adverse matter,” Gold Tiger says.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Any documents linked or referred to in this article were not selected, modified or otherwise controlled by Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in the documents linked or referred to in this article.