High Voltage: here’s all the news driving battery metals stocks

Mining

Mining

Each week our High Voltage column wraps all the news driving ASX battery metals stocks with exposure to lithium, cobalt, graphite, manganese and vanadium.

Scroll down for a table showing the recent performance of 200 ASX battery metal stocks >>

High prices may hamper the EV boom

HSBC says delayed or cancelled mining projects – alongside “robust” battery demand – means lithium and cobalt supply will remain “reasonably tight”, according to Bloomberg.

This will lead to higher lithium and cobalt prices, which will slow electricity vehicle (EV) uptake over the next few years, according to analysts.

HSBC now says 776,000 tonnes per year of lithium will be required by 2025 — a 88 per cent increase from its last estimate more than a year ago.

HSBC revised down its market share projections for full EVs to 9.4 per cent, compared with an earlier estimate of 10.5 per cent by 2025.

It also went against the grain by doubling its forecast for plug-in hybrid EVs (or PHEVs) from 2.4 per cent to 5.5 per cent of the market by 2025.

A PHEV is a type of hybrid electric vehicle that combines a gasoline or diesel engine with an electric motor and battery.

“High lithium and cobalt prices – but also limited supply and lower demand for pure EVs -– now favour more plug-in hybrids in the short to medium term vs. our previous expectation,” HSBC analysts say.

But other analysts reckon the decline of PHEV vehicles has already started.

Mass #EV production approaching: #GM to shut 5 plants in #USA & lay off 15% of its workers to focus on EV. GM will stop production of PHEV Volt in a shift to pure EVs. The same day #SKInnovation announced 9.8GWh ($1Bn) #battery plant in USA to supply #Volkswagen. #lithium #cobalt

— Jose Lazuen (@JoseLazuen) November 27, 2018

As we’ve always said, why would anyone want a half way house technology when pure EVs are superior https://t.co/kEEuOJWFod

— Simon Moores (@sdmoores) November 27, 2018

Non-DRC cobalt projects just got more attractive

It’s official – the Congo is raising royalties on cobalt.

The Democratic Republic of Congo – which controls about 60 per cent of global supply — has labelled cobalt a “strategic” metal and slapped a 10 per cent royalty on it.

That is almost triple the 3.5 per cent previously levied on the battery metal.

(As a point of reference; in Australia cobalt royalties are somewhere between 2.5 per cent and 5 per cent across the various states.)

The royalty hike represents a bit of a double-edged sword for battery metals stocks.

On one hand, it’s a crappy turn of events for ASX-listed juniors like Nzuri Copper (ASX:NZC) which is trying to bring a copper and cobalt mine called “Kalongwe” into production in the Congo.

On the other hand, junior stocks with cobalt projects in more stable jurisdictions (like Australia) are looking a lot more attractive to investors and off-take partners right about now.

Hornsdale is a Rockstar

For stationary storage, that decisive moment when cost and performance reach parity with established alternatives is arguably here.

Stationary storage systems are big batteries often designed to store excess power from the power grid, including from renewable sources, for use during expensive peak demand periods.

It also includes residential and industrial ‘behind the meter’ systems.

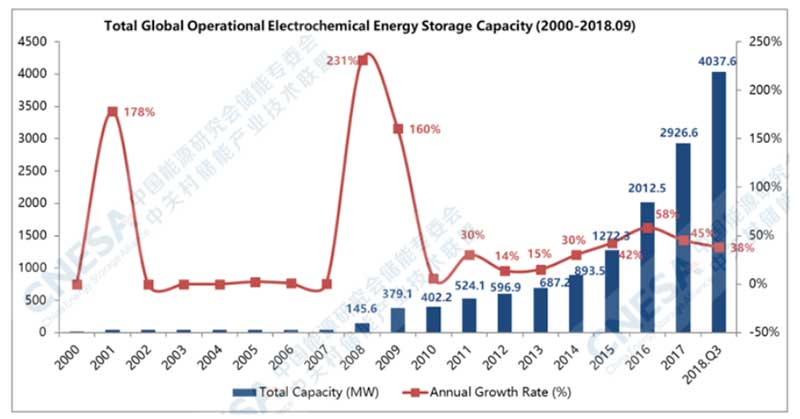

Analysts and industry insiders are constantly revising their stationary storage projections upwards as the industry accelerates.

In 2016, for example, BNEF expected 25GW of installed storage by 2028, and for the market to be worth $US250 billion by 2040.

BNEF now reckons the global energy storage market will grow to a cumulative 942GW by 2040, worth about $US620 billion in investment over the next 22 years.

The main driver for the bullishness? Faster-than-expected falls in storage system costs.

Matt Canavan, Australia's minister for resources, is dismissive of the large Tesla battery in South Australia. "It's the Kim Kardashian of the energy world: it's famous for being famous. It really doesn't do very much." #CERAWeek2018

— Ed Crooks (@Ed_Crooks) March 7, 2018

In December, it was revealed that the misunderstood and much maligned 129MWh Hornsdale power reserve in South Australia, better known as ‘Tesla’s big battery’, had already saved $40 million in wholesale market costs after just one year in operation.

The world’s largest lithium-ion battery energy storage system was built at a cost of about $90 million and is owned and operated by French company Neoen.

The positive impact of the battery’s services have already been recognised by the Australian Energy Market Operator(AEMO), which stated that frequency and ancillary services (FCAS) provided by Hornsdale were more “rapid and precise, compared to the service typically provided by a conventional synchronous (usually gas) generation unit”.

FCAS is a group of services that help stabilise the grid.

If the frequency falls or rises outside a certain range, blackouts will happen such as the one South Australia experienced in September 2016.

Franck Woitiez, Managing Director Neoen Australia, said the success of Hornsdale had strengthened the commercial case for new battery projects in Australia.

“Hornsdale Power Reserve is an example of the projects that will underpin a modern energy system in Australia and Neoen is excited to continue leading this sector.”

Incredibly, batteries for stationary storage will make up just 7 per cent of total demand by 2040, with EVs taking dominant market share.

It’s been a rough week — of the ~200 battery metals stocks on our list, about 104 lost ground, 27 were ahead and 57 were steady.

Major small cap winners included Celsius Resources (ASX:CLA) up 16 per cent, Vital Metals (ASX:BKT) up 14 per cent, and European Metals (ASX:EMH) up 11 per cent.

There was also some great news for lithium-focused Kidman Resources (ASX:KDR) today.

Objections to Kidman’s application for exemption from minimum spending requirements on its Mt Holland tenements have been withdrawn, and forfeiture applications at Mt Holland will be dismissed.

This settlement provides certainty for Kidman and its joint venture partner SQM, and will enable them to progress the integrated project development at Mt Holland “unimpeded”, the company says.

“This settlement resolves this matter completely,” Kidman managing director Martin Donohoe said.

“With the settlement concluded, funding secured through to final investment decision and our recent lithium hydroxide offtake agreements with Tesla, Inc. and Mitsui & Co. Ltd, we will be able to wholly focus on progressing the development of the Mt Holland lithium project.”

Here’s a table of ASX battery metal stocks with exposure to lithium, cobalt, graphite, manganese and vanadium>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| Ticker | Name | Weekly Price Change | 12 Month Price Change | Current price (Monday intraday) | Market Cap |

|---|---|---|---|---|---|

| FEL | FE | 0.214285714286 | -0.392857142857 | 0.017 | 6.3M |

| LML | LINCOLN MINERALS | 0.166666666667 | -0.78125 | 0.007 | 4.0M |

| CLA | CELSIUS RESOURCES | 0.156862745098 | -0.562962962963 | 0.059 | 39.9M |

| VML | VITAL METALS | 0.142857142857 | 0.142857142857 | 0.008 | 13.9M |

| SUH | SOUTHERN HEMISPHERE | 0.125 | -0.7 | 0.045 | 4.0M |

| EMH | EUROPEAN METALS | 0.107692307692 | -0.485714285714 | 0.36 | 52.8M |

| CAZ | CAZALY RESOURCES | 0.105263157895 | -0.5625 | 0.021 | 4.8M |

| CZR | COZIRON RESOURCES | 0.0909090909091 | -0.454545454545 | 0.012 | 21.4M |

| BSX | BLACKSTONE MINERALS | 0.0833333333333 | -0.759259259259 | 0.13 | 10.6M |

| THR | THOR MINING | 0.08 | -0.289473684211 | 0.027 | 18.5M |

| WCN | WHITE CLIFF MINERALS | 0.0769230769231 | -0.915662650602 | 0.014 | 3.2M |

| HGM | HIGH GRADE METALS | 0.0769230769231 | -0.702127659574 | 0.014 | 6.3M |

| BOA | BOADICEA RESOURCES | 0.0769230769231 | -0.125 | 0.14 | 7.9M |

| THX | THUNDELARRA | 0.0714285714286 | -0.605263157895 | 0.015 | 9.5M |

| SCI | SILVER CITY MINERALS | 0.0714285714286 | -0.5 | 0.015 | 3.7M |

| PUR | PURSUIT MINERALS | 0.0689655172414 | -0.786206896552 | 0.031 | 4.6M |

| KDR | KIDMAN RESOURCES | 0.062962962963 | -0.130303030303 | 1.435 | 535.4M |

| RDS | REDSTONE RESOURCES | 0.0625 | 0.307692307692 | 0.017 | 7.9M |

| E25 | ELEMENT 25 | 0.0526315789474 | -0.230769230769 | 0.2 | 16.8M |

| CGN | CRATER GOLD MINING | 0.0526315789474 | 0 | 0.02 | 5.6M |

| OKR | OKAPI RESOURCES | 0.046511627907 | -0.476744186047 | 0.225 | 7.7M |

| CHN | CHALICE GOLD MINES | 0.0434782608696 | -0.351351351351 | 0.12 | 32.0M |

| VXR | VENTUREX RESOURCES | 0.0285714285714 | -0.2 | 0.18 | 43.2M |

| HAV | HAVILAH RESOURCES | 0.0277777777778 | -0.075 | 0.185 | 39.3M |

| ARL | ARDEA RESOURCES | 0.0245901639344 | -0.606918238994 | 0.625 | 61.9M |

| SO4 | SALT LAKE POTASH | 0.0222222222222 | -0.132075471698 | 0.46 | 94.0M |

| BMT | BERKUT MINERALS | 0.0126582278481 | -0.692307692308 | 0.08 | 4.3M |

| ZEU | ZEUS RESOURCES | 0 | -0.0714285714286 | 0.013 | 2.3M |

| VRC | VOLT RESOURCES | 0 | -0.230769230769 | 0.02 | 30.6M |

| TON | TRITON MINERALS | 0 | -0.461538461538 | 0.042 | 38.9M |

| SXX | SOUTHERN CROSS | 0 | -0.444444444444 | 0.005 | 5.4M |

| SVM | SOVEREIGN METALS | 0 | -0.383333333333 | 0.074 | 20.5M |

| SEI | SPECIALITY METALS | 0 | -0.1875 | 0.013 | 7.2M |

| SBR | SABRE RES | 0 | -0.222222222222 | 0.007 | 2.8M |

| RMX | RED MOUNTAIN MINING | 0 | -0.588235294118 | 0.007 | 4.7M |

| RIE | RIEDEL RESOURCES | 0 | -0.823529411765 | 0.015 | 6.3M |

| PSM | PENINSULA MINES | 0 | -0.75 | 0.005 | 4.3M |

| PSC | PROSPECT RESOURCES | 0 | -0.509803921569 | 0.025 | 49.1M |

| POW | PROTEAN ENERGY | 0 | -0.230769230769 | 0.02 | 6.4M |

| PNN | PEPINNINI LITHIUM | 0 | -0.837837837838 | 0.006 | 4.1M |

| PMY | PACIFICO MINERALS | 0 | -0.166666666667 | 0.005 | 8.1M |

| PM1 | PURE MINERALS | 0 | -0.518518518519 | 0.013 | 4.1M |

| PIO | PIONEER RESOURCES | 0 | -0.448275862069 | 0.016 | 22.6M |

| OAR | OAKDALERESOURCES | 0 | -0.585365853659 | 0.017 | 974.7k |

| NZC | NZURI COPPER | 0 | 0.0188679245283 | 0.27 | 79.9M |

| NVA | NOVA MINERALS | 0 | -0.371428571429 | 0.022 | 17.1M |

| NMT | NEOMETALS | 0 | -0.483146067416 | 0.23 | 125.1M |

| MZN | MARINDI METALS | 0 | -0.571428571429 | 0.006 | 11.9M |

| MTB | MOUNT BURGESS | 0 | -0.5 | 0.005 | 2.2M |

| MRR | MINREX RESOURCES | 0 | -0.857142857143 | 0.02 | 1.9M |

| MLS | METALS AUSTRALIA | 0 | -0.5 | 0.003 | 9.4M |

| LRS | LATIN RESOURCES | 0 | -0.6 | 0.004 | 8.6M |

| LI3 | LITHIUM CONSOLIDATED | 0 | -0.657142857143 | 0.06 | 5.4M |

| KNL | KIBARAN RESOURCES | 0 | -0.161290322581 | 0.13 | 33.1M |

| KAI | KAIROS MINERALS | 0 | -0.537037037037 | 0.025 | 20.5M |

| IRC | INTERMIN RESOURCES | 0 | 0 | 0.145 | 34.1M |

| IEC | INTRA ENERGY | 0 | 0.571428571429 | 0.011 | 4.3M |

| HMX | HAMMER METALS | 0 | -0.405405405405 | 0.022 | 6.4M |

| GWR | GWR GROUP | 0 | 0.166666666667 | 0.105 | 26.6M |

| GPP | GREENPOWER ENERGY | 0 | -0.8 | 0.004 | 6.3M |

| GBE | GLOBE METALS AND MINING | 0 | -0.0526315789474 | 0.018 | 8.4M |

| EUR | EUROPEAN LITHIUM | 0 | -0.52 | 0.12 | 65.8M |

| EUC | EUROPEAN COBALT | 0 | -0.8125 | 0.045 | 35.0M |

| ESR | ESTRELLA RESOURCES | 0 | -0.285714285714 | 0.02 | 9.8M |

| ENT | ENTERPRISE METALS | 0 | -0.277777777778 | 0.013 | 5.0M |

| EME | ENERGY METALS | 0 | 0.0416666666667 | 0.1 | 21.0M |

| DTM | DART MINING | 0 | 0 | 0.007 | 6.5M |

| DHR | DARK HORSE RESOURCES | 0 | -0.736842105263 | 0.005 | 9.9M |

| DEG | DE GREY MINING | 0 | -0.342105263158 | 0.125 | 50.4M |

| CUL | CULLEN RESOURCES | 0 | -0.596153846154 | 0.021 | 2.9M |

| CNJ | CONICO | 0 | -0.565217391304 | 0.02 | 7.0M |

| CMC | CHINA MAGNESIUM | 0 | 0.304347826087 | 0.03 | 10.6M |

| CGM | COUGAR METALS | 0 | -0.727272727273 | 0.003 | 2.9M |

| CDT | CASTLE MINERALS | 0 | -0.72972972973 | 0.01 | 2.2M |

| CAD | CAENEUS MINERALS | 0 | -0.666666666667 | 0.001 | 14.1M |

| BYH | BRYAH RESOURCES | 0 | -0.51 | 0.098 | 6.0M |

| BGS | BIRIMIAN | 0 | -0.578947368421 | 0.2 | 46.7M |

| BEM | BLACKEARTH MINERALS | 0 | 0 | 0.087 | 5.3M |

| BDI | BLINA MINERALS | 0 | -0.5 | 0.001 | 4.4M |

| BAU | BAUXITE RESOURCES | 0 | -0.3 | 0.056 | 12.0M |

| AYR | ALLOY RESOURCES | 0 | 0 | 0.004 | 5.5M |

| ARM | AURORA MINERALS | 0 | -0.447368421053 | 0.021 | 2.5M |

| AMD | ARROW MINERALS | 0 | -0.734693877551 | 0.013 | 4.1M |

| AEE | AURA ENERGY | 0 | -0.173913043478 | 0.019 | 20.4M |

| WKT | WALKABOUT RESOURES | -0.010989010989 | -0.513513513514 | 0.09 | 27.1M |

| WML | WOOMERA MINING | -0.0121951219512 | 0 | 0.081 | 9.1M |

| AVZ | AVZ MINERALS | -0.0123456790123 | -0.659574468085 | 0.08 | 153.0M |

| GME | GME RESOURCES | -0.0131578947368 | -0.418604651163 | 0.075 | 36.2M |

| ZNC | ZENITH MINERALS | -0.0133333333333 | -0.408 | 0.074 | 15.7M |

| AXE | ARCHER EXPLORATION | -0.0140845070423 | -0.333333333333 | 0.07 | 13.0M |

| TAW | TAWANA RESOURCES | -0.015873015873 | -0.138888888889 | 0.31 | 179.2M |

| OMH | OM HLDGS | -0.0178571428571 | 1.2 | 1.375 | 1.0B |

| TAR | TARUGA MINERALS | -0.0181818181818 | -0.584615384615 | 0.054 | 7.6M |

| IDA | INDIANA RESOURCES | -0.0185185185185 | -0.302631578947 | 0.053 | 5.1M |

| LPI | LITHIUM POWER | -0.0188679245283 | -0.490196078431 | 0.26 | 66.9M |

| COB | COBALT BLUE | -0.0222222222222 | -0.47619047619 | 0.22 | 26.1M |

| POS | POSEIDON NICKEL | -0.0232558139535 | 0 | 0.042 | 116.3M |

| BPL | BROKEN HILL PROSPECTING | -0.0294117647059 | -0.410714285714 | 0.033 | 4.9M |

| RIO | RIO TINTO | -0.0301373516469 | 0.0219193480399 | 72.73 | 108.0B |

| GLN | GALAN LITHIUM | -0.037037037037 | 2.46666666667 | 0.26 | 26.0M |

| PAN | PANORAMIC RESOURES | -0.0384615384615 | -0.0105540897098 | 0.375 | 185.4M |

| NWC | NEW WORLD COBALT | -0.04 | -0.76 | 0.024 | 12.7M |

| PLL | PIEDMONT LITHIUM | -0.0416666666667 | -0.361111111111 | 0.115 | 76.6M |

| VMS | VENTURE MINERALS | -0.0434782608696 | -0.6 | 0.022 | 11.5M |

| DEV | DEVEX RESOURCES | -0.0444444444444 | -0.644628099174 | 0.043 | 4.0M |

| MNS | MAGNIS ENERGY TECH | -0.047619047619 | -0.347826086957 | 0.3 | 183.3M |

| HWK | HAWKSTONE MINING | -0.047619047619 | -0.428571428571 | 0.02 | 12.0M |

| AUZ | AUSTRALIAN MINES | -0.047619047619 | -0.6 | 0.04 | 115.3M |

| LIT | LITHIUM AUSTRALIA | -0.05 | -0.486486486486 | 0.095 | 44.5M |

| GPX | GRAPHEX MINING | -0.05 | -0.366666666667 | 0.19 | 15.7M |

| JMS | JUPITER MINES | -0.0526315789474 | 0 | 0.27 | 528.9M |

| RNU | RENASCOR RESOURCES | -0.0526315789474 | -0.470588235294 | 0.018 | 20.8M |

| KSN | KINGSTON RESOURCES | -0.0526315789474 | -0.142857142857 | 0.018 | 22.0M |

| CFE | CAPE LAMBERT RESOURCES | -0.0526315789474 | -0.379310344828 | 0.018 | 19.2M |

| CHK | COHIBA MINERALS | -0.0555555555556 | 0.416666666667 | 0.017 | 9.5M |

| ANW | AUS TIN MINING | -0.0555555555556 | 0.416666666667 | 0.017 | 33.6M |

| CZI | CASSINI RESOURCES | -0.0555555555556 | 0.180555555556 | 0.085 | 31.1M |

| LPD | LEPIDICO | -0.0588235294118 | -0.764705882353 | 0.016 | 53.7M |

| FCC | FIRST COBALT | -0.0588235294118 | -0.834482758621 | 0.24 | 81.4M |

| AOU | AUROCH MINERALS | -0.0625 | -0.625 | 0.075 | 7.4M |

| BSM | BASS METALS | -0.0666666666667 | -0.125 | 0.014 | 38.1M |

| AUR | AURIS MINERALS | -0.0681818181818 | -0.316666666667 | 0.041 | 16.8M |

| CLQ | CLEAN TEQ HOLDINGS | -0.0705882352941 | -0.748407643312 | 0.395 | 298.5M |

| TRT | TODD RIVER RESOURCES | -0.0705882352941 | -0.423357664234 | 0.079 | 12.7M |

| N27 | NORTHERN COBALT | -0.0714285714286 | -0.893442622951 | 0.065 | 3.3M |

| BUX | BUXTON RESOURCES | -0.0714285714286 | 0 | 0.13 | 17.7M |

| KOR | KORAB RESOURCES | -0.0714285714286 | 0.04 | 0.026 | 8.0M |

| AML | AEON METALS | -0.0727272727273 | -0.0892857142857 | 0.255 | 146.9M |

| KTA | KRAKATOA RESOURCES | -0.0740740740741 | -0.509803921569 | 0.025 | 2.9M |

| AJM | ALTURA MINING | -0.075 | -0.525641025641 | 0.185 | 345.9M |

| HNR | HANNANS | -0.0769230769231 | -0.2 | 0.012 | 25.8M |

| INF | INFINITY LITHIUM | -0.0789473684211 | -0.681818181818 | 0.07 | 12.9M |

| AGY | ARGOSY MINERALS | -0.0789473684211 | -0.222222222222 | 0.175 | 166.2M |

| GXY | GALAXY RESOURCES | -0.0791366906475 | -0.326315789474 | 2.56 | 1.1B |

| RTR | RUMBLE RESOURCES | -0.08 | -0.19298245614 | 0.046 | 16.4M |

| FGR | FIRST GRAPHENE | -0.0810810810811 | 0.259259259259 | 0.17 | 68.7M |

| SYA | SAYONA MINING | -0.0833333333333 | -0.576923076923 | 0.022 | 39.5M |

| BAT | BATTERY MINERALS | -0.0833333333333 | -0.645161290323 | 0.022 | 25.6M |

| MIN | MINERAL RESOURCES | -0.0850383631714 | -0.268030690537 | 14.31 | 2.7B |

| SRK | STRIKE RESOURCES | -0.0877192982456 | -0.1875 | 0.052 | 7.6M |

| S32 | SOUTH32 | -0.0903614457831 | -0.0591900311526 | 3.02 | 15.7B |

| MQR | MARQUEE RESOURCES | -0.0909090909091 | -0.72 | 0.07 | 3.0M |

| PLS | PILBARA MINERALS | -0.0952380952381 | -0.26213592233 | 0.76 | 1.4B |

| GED | GOLDEN DEEPS | -0.0952380952381 | -0.254901960784 | 0.038 | 6.9M |

| SYR | SYRAH RESOURCES | -0.0997229916898 | -0.602689486553 | 1.625 | 544.6M |

| CXO | CORE LITHIUM | -0.1 | -0.485714285714 | 0.054 | 39.3M |

| HXG | HEXAGON RESOURCES | -0.103448275862 | -0.037037037037 | 0.13 | 39.4M |

| DGR | DGR GLOBAL | -0.103448275862 | 0.3 | 0.13 | 85.8M |

| ORN | ORION MINERALS | -0.103448275862 | -0.103448275862 | 0.026 | 48.7M |

| ASN | ANSON RESOURCES | -0.103896103896 | -0.288659793814 | 0.069 | 34.7M |

| JRV | JERVOIS MINING | -0.108695652174 | -0.661157024793 | 0.205 | 48.0M |

| LCD | LATITUDE | -0.111111111111 | -0.272727272727 | 0.016 | 4.4M |

| TLG | TALGA RESOURCES | -0.114942528736 | -0.358333333333 | 0.385 | 81.7M |

| LTR | LIONTOWN RESOURCES | -0.115384615385 | -0.323529411765 | 0.023 | 26.1M |

| VMC | VENUS METALS | -0.117647058824 | -0.0625 | 0.15 | 13.9M |

| MZZ | MATADOR MINING | -0.12 | -0.266666666667 | 0.22 | 11.9M |

| ARE | ARGONAUT RESOURCES | -0.12 | -0.214285714286 | 0.022 | 34.2M |

| ORE | OROCOBRE | -0.122807017544 | -0.36948297604 | 4 | 1.1B |

| RLC | REEDY LAGOON | -0.125 | -0.820512820513 | 0.007 | 2.8M |

| PGM | PLATINA RESOURCES | -0.126984126984 | -0.717948717949 | 0.055 | 15.1M |

| ARU | ARAFURA RESOURCES | -0.129032258065 | -0.465346534653 | 0.054 | 32.7M |

| TKL | TRAKA RESOURCES | -0.130434782609 | -0.615384615385 | 0.02 | 7.6M |

| MEI | METEORIC RESOURCES | -0.133333333333 | -0.835443037975 | 0.013 | 8.0M |

| ADN | ANDROMEDA METALS | -0.142857142857 | -0.142857142857 | 0.006 | 7.0M |

| BAR | BARRA RESOURCES | -0.142857142857 | -0.411764705882 | 0.03 | 16.2M |

| CCZ | CASTILLO COPPER | -0.142857142857 | -0.672727272727 | 0.018 | 11.0M |

| TNO | TANDO RESOURCES | -0.145454545455 | 0.424242424242 | 0.094 | 19.2M |

| SGQ | ST GEORGE MINING | -0.151515151515 | -0.705263157895 | 0.14 | 41.7M |

| TMT | TECHNOLOGY METALS | -0.152941176471 | 0.636363636364 | 0.36 | 27.3M |

| TNG | TNG | -0.154545454545 | -0.311111111111 | 0.093 | 95.1M |

| MCT | METALICITY | -0.157894736842 | -0.627906976744 | 0.016 | 9.6M |

| AVL | AUSTRALIAN VANADIUM | -0.157894736842 | 0.777777777778 | 0.032 | 54.4M |

| LKE | LAKE RESOURCES | -0.165217391304 | -0.531707317073 | 0.096 | 34.7M |

| SI6 | SIX SIGMA METALS | -0.166666666667 | -0.6875 | 0.005 | 2.3M |

| MTH | MITHRIL RESOURCES | -0.166666666667 | -0.827586206897 | 0.005 | 1.2M |

| CZN | CORAZON MINING | -0.166666666667 | -0.736842105263 | 0.005 | 6.3M |

| AZI | ALTA ZINC | -0.166666666667 | -0.583333333333 | 0.005 | 6.8M |

| INR | IONEER | -0.1731 | -0.1591 | 0.19 | 279.3M |

| HIG | HIGHLANDS PACIFIC | -0.184782608696 | -0.210526315789 | 0.075 | 82.0M |

| TKM | TREK METALS | -0.2 | -0.741935483871 | 0.008 | 2.5M |

| MLM | METALLICA MINERALS | -0.2 | -0.450980392157 | 0.028 | 9.0M |

| 4CE | FORCE COMMODITIES | -0.210526315789 | -0.7 | 0.015 | 7.6M |

| MTC | METALSTECH | -0.228571428571 | -0.905263157895 | 0.027 | 3.2M |

| CRL | COMET RESOURCES | -0.228571428571 | -0.724489795918 | 0.027 | 6.9M |

| BKT | BLACK ROCK MINING | -0.238095238095 | -0.448275862069 | 0.032 | 17.2M |

| SRN | SUREFIRE RESOURCES | -0.25 | -0.647058823529 | 0.006 | 2.6M |

| ADV | ARDIDEN | -0.333333333333 | -0.777777777778 | 0.004 | 8.4M |

| KLH | KALIA | -0.5 | -0.866666666667 | 0.002 | 5.0M |