Hannan family buys $12k more Ovato shares, but now face purchase restrictions

Mining

Mining

Marketing distributor Ovato (ASX: OVT) has had a busy few months. It has rebranded from PMP Group, unifying all its brands as one and expanding into data-driven analytics and design.

37 percent of the company is owned by the Hannan family. According to BRW, the Hannans are the 17th wealthiest family in Australia, worth $600 million.

Michael Hannan is non-executive director and was previously Executive Chairman of IPMG, a printing group that merged with PMP in 2017.

Michael’s brother Lindsay Hannan, who does not appear on Ovato’s website, bought nearly 128,000 for $12,106 and declared the purchase to the ASX yesterday. He now holds 43.3m direct shares and 159.9m indirect – owned by his family trust.

With 510 million shares on issue, this amounts to 31 percent of the company.

But this will likely be their last purchase for a few months. They’ve now reached their limit under the ‘creep rule’ provisions in the Corporations Act.

While the law prevents individuals from acquiring over 20 percent in a company without a formal takeover bid, the ‘creep rule’ is an exemption.

This allows individuals to buy up to 3 percent in a company every 6 months even if they hold 20% or more. However, they have to wait another 6 months before making any formal acquisitions.

This means there’ll be no more shares bought by the family unless they launch a formal takeover of the business.

There is no evidence there will be a takeover and it is unlikely considering the recent rebrand. However, the company put out a letter in addition to the ‘Directors Interest’ notice clarifying this law.

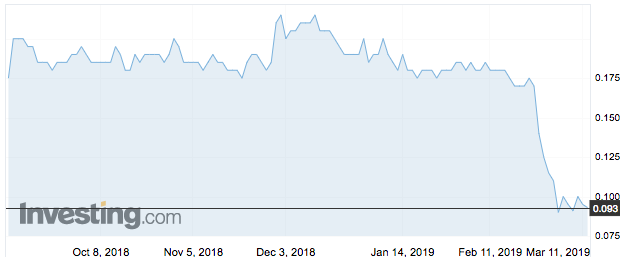

Shares in Ovato had been stable for much of the last 12 months but have nearly halved in the last two weeks. This was triggered by its half yearly loss of $10.9m.