You might be interested in

Mining

Gold: Former jewellery seller and dead duck Plukka flags big Chilean gold acquisition

Mining

Gold: Cardinal recovers from savage hit, unleashes big feasibility study on 5.1moz Namdini project

Mining

Mining

Special report: Greenpower Energy’s decision to acquire privately-owned cobalt and vanadium explorer Ion Minerals comes at a time when market forecasters see substantial growth in the demand for both commodities.

Battery minerals are fuelling the mining industry in Australia – global demand for cobalt and vanadium far exceeds supply.

The global cobalt market is witnessing considerable growth as demand for electric vehicles and renewable energy storage solutions takes off.

Baseline forecasts suggest demand from the battery sector will increase at a rate of over 15 per cent each year through to 2026.

Meanwhile, China’s push for stronger steel following a string of earthquakes that led to building collapses, and its environmental drive that has seen the Asian powerhouse shut down polluting operations is impacting vanadium supply and demand.

Vanadium is the best performing battery metal – more than doubling in the past year and rocketing over 500 per cent since January 2016.

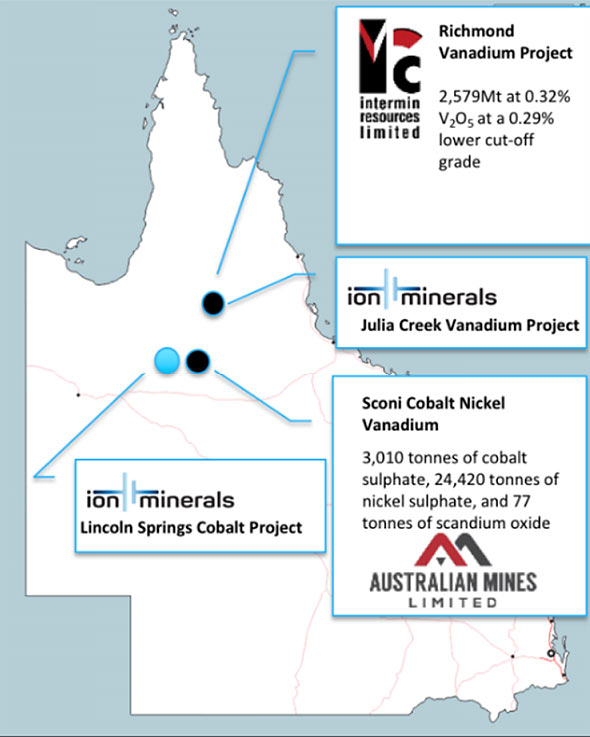

Ion is earning into the Lincoln Springs cobalt and Julia Creek vanadium projects in Queensland and the Ashburton cobalt project in Western Australia.

The flagship Lincoln Springs projects has delivered rock chip samples with grades of up to 3.16 per cent cobalt – more than 10 times the grade considered very good – and 10.4 per cent copper.

Cobalt grades of above 0.1 per cent are considered economic while grades of 0.3 per cent are considered very good.

In terms of copper, anything above 1.5 per cent is considered high-grade.

“Ion has got some of the highest-grade cobalt in Australia,” says Cameron Mclean, mnaging director of the merged group.

“So it’s a big step forward for Greenpower to be in that electric vehicle battery minerals space.”

Lincoln Springs is located near Australian Mines’ (ASX:AUZ) Sconi project, which recently produced 40kg of battery-grade nickel sulphate and 4kg of battery-grade cobalt sulphate and shipped it to its Korean partner, SK Innovation.

The Lincoln Springs project hosts an extensive vein system within a shear zone that can be traced for 12km.

The Ashburton project, meanwhile, hosts cobalt anomalism over a 15km by 7km area and has returned rock chip samples with grades of up to 1.89 per cent cobalt.

Top notch team

Ion was formed by Mr Mclean and London-based Alistair Williams – both experienced mining executives that will take on the roles of managing director and non-executive director, respectively, of Greenpower on completion of the acquisition.

Mr Mclean is responsible for the creation of Mineral Intelligence – one of the largest mining registers in the world.

He has also served as CFO for explorer Atrum Coal (ASX:ATU) and Snowden Mining Industry Consultants, and in the role of general manager – commercial for miner Kagara.

Mr Williams is an experienced London-based finance executive with a background in resources and has handled the finances of majors like BG Group and Rio Tinto (ASX:RIO).

Greenpower (ASX:GPP) is currently well-funded with around $3 million in cash to back the acquisition and maintain its existing portfolio.

The company is planning an aggressive exploration push that includes drilling on the cobalt projects in the next quarter.

This special report is brought to you by Greenpower Energy.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.