Gold: Perseus produced nearly two tonnes of African gold last quarter

Mining

Perseus Mining (ASX: PRU) have announced its quarterly production results from its African gold mines. All up it produced 67,144 oz (1,903kg), which was 5 per cent more than the March quarter in 2018.

Of this, 44,680 oz came from the Edikan gold mine in Ghana and 22,464 oz came from the Sissingue gold mine in Cote d’Ivoire.

This puts the company on course to achieve its 2019 FY target which is between 271,000 and 291,000 oz (around 8 tonnes) and according to Perseus CEO Jeff Quartermaine, the ninth straight quarter Perseus recorded “strong operating performances”.

But Perseus is also looking longer term aiming to produce 500,000 oz of gold per year from 2022. Quartermaine said this objective, “appears well within our operating capacity once the Yaoure Gold Mine [in Cote d’Ivoire] is developed and we are looking forward to delivering this outcome in due course”.

Perseus’ gold production increase also comes as gold prices have risen 8 per cent since December and are nearly three and a half times higher than in 2004.

Both Cote d’Ivoire and Ghana are popular destinations for gold explorers. Cote d’Ivoire are has traditionally been known for coca and coffee but explorers have began to flock to the West African nation. Among the other companies present there are Newcrest Mining (ASX: NCM) and recently listed African Gold (ASX: A1G).

Just recently, Exore described Cote d’Ivoire as “like WA 50 years ago”.

Ghana has also had its fair share of ASX-listed gold explorers, including Cardinal Resources (ASX: CDV) and Azumah Resources (ASX: AZM).

Perseus shares only jumped 1 cent at the open although the stock is up nearly 40% since September.

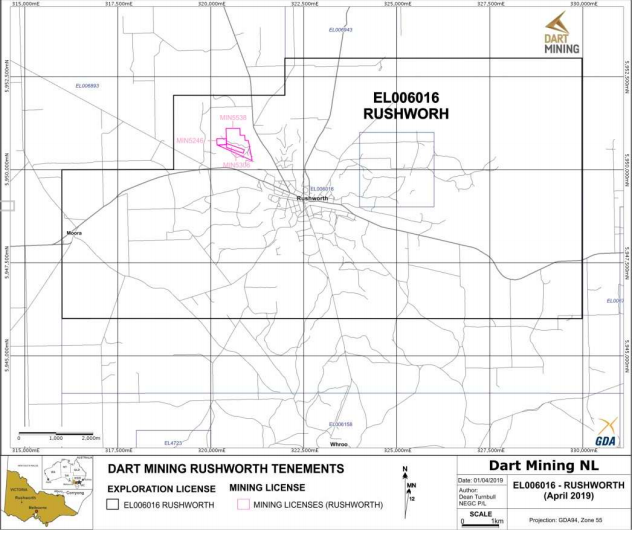

Victorian gold miner Dart Mining (ASX: DTM) has acquired an exploration licence from a private company called Ostract. The licence covers an area of 82 sq km near three existing licences surrounding northern Victorian town Rushworth. Dart will pay $30,000 and issue Ostract 6 million shares.

Maximus Resources (ASX: MXR) has reaped $5.8 million from the sale of its gold milling facility. The plant will be bought by a private gold miner and Maximus told shareholders the cash benefit will open opportunities for the company. Maximus will use the cash to repay debt and pursue its West Australian gold projects.

Kingston Resources (ASX: KSN) will get a larger stake in the Misima Gold Project. After earning into 70 per cent of the project last year, it this morning announced funding 100% of exploration at Misima. Kingston boss Andrew Corbett told investors the company was “very happy” with this increase.

Four weeks after receiving a takeover bid from Chinese investment firm Phoenix Bridge, Anchor Resources (ASX: AHR) shareholders have been informed by Phoenix’s lawyers that the offer is now free of Defeating Conditions. In short, this means the takeover is going ahead.

As of today, Phoenix holds 96.5 per cent in Anchor and the offer is at 2 cents – a hefty premium to its current share price of 1.3 cents.