You might be interested in

Mining

Monsters of Rock: Second big bank upgrades gold forecasts. Can miners catch up?

News

Hot Money Monday: 'Cut losses and let winners run' - advice from legendary momentum trader Paul Tudor Jones

News

Gold miner/rare earths developer Alkane Resources (ASX:ALK) is in a pretty enviable position right now.

For years, Alkane has sat on the large Dubbo rare earths project in NSW, waiting for prices to improve. Now, speculation that China may ban rare earths exports to the US has seen investors flock to ASX-listed rare earths players.

This has seen the Alkane share price rocket 70 per cent to a ~2 year high of 37.5c.

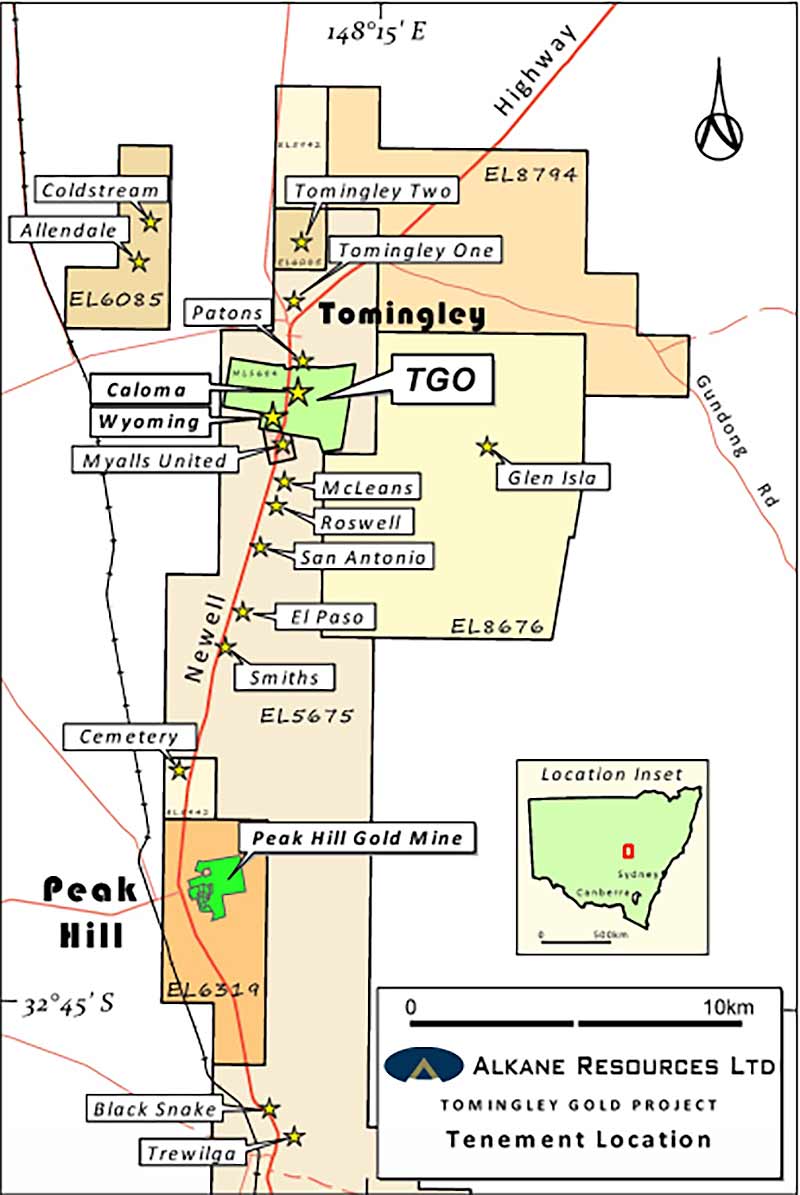

But Alkane isn’t a speculative stock; the miner is also uncovering more gold near its Tomingley Operations (TGO), an open pit which is transitioning underground in 2019.

Which is handy because with an underground mine life of just three-and-a-bit years, Alkane will need additional resources to feed the hungry 1 million tonnes a year TGO processing facility.

Exploration drilling in the last 12 months has focused on the Roswell, San Antonio and El Paso prospects, all within 7km of the TGO processing facility.

So far this year, significant broad high-grade gold results have been reported for all three.

Now, the last of the assay results have now been received from the latest seven-month, 15,000m drilling program.

Alkane boss Nic Earner says the continuity of high-grade mineralisation between Roswell and San Antonio means 1,600m of strike within 4km of the processing plant. Together with El Paso, there is a cumulative strike length of 2,500m of gold mineralisation within 8km of TGO.

That should keep them going for a while.

“These prospects are open to the north, south and at depth,” Earner says.

“Our resource drilling is commencing this month with the purpose of confirming the potential for substantial mine life extension.”

This 60,000m resource definition drilling program at the San Antonio and Roswell prospects is due to start in mid-June.

Vango Mining (ASX:VAN) says there is a 2km-long high grade gold corridor between two deposits at the Marymia gold project in WA. Vango says linking the high‐grade Marwest and Trident gold deposits could lead to further expand the high‐grade gold resource base and “develop this area into a high‐ grade gold mining centre”. New high-grade intersections at the Marwest deposit include 4m at 9.62 g/t gold, 121m from surface. Vango is growing gold resources to support a new stand‐alone, high‐ grade gold mining and processing operation at Marymia.

Alliance Resources (ASX:AGS) hits thick, high grade gold at the Wilcherry project in South Australia. Results from a five-hole, 600m diamond drilling campaign at the Weednanna deposit included 9.4m at 12.45g/t, 100m from surface. A 38-hole, 5740m RC drilling program was also completed during May, with results due soon. Alliance is dedicated to growing the high grade, 181,000oz Weednanna deposit, with new drilling expected to commence during July.

Canada-based Matador Mining (ASX:MZZ) is embarking on a big, 12,000m exploration drill program to expand the 1.02moz Cape Ray resource and test a number of “high priority” greenfields (unexplored) targets. 70 per cent of drilling will focus on the 810,000oz Central Zone, which remains open in all directions, Matador exec Keith Bowes says.

“Recent analysis has identified a number of interpreted high-grade plunges which remain open,” he says. “Success in extending these trends offers a significant opportunity for additional high-grade resource expansion at Central Zone.”