You might be interested in

Mining

China's housing market is burning to a crisp but these iron ore price forecasts would have mining giants smiling

Mining

These four resources players are sprinting towards production and development

Mining

Mining

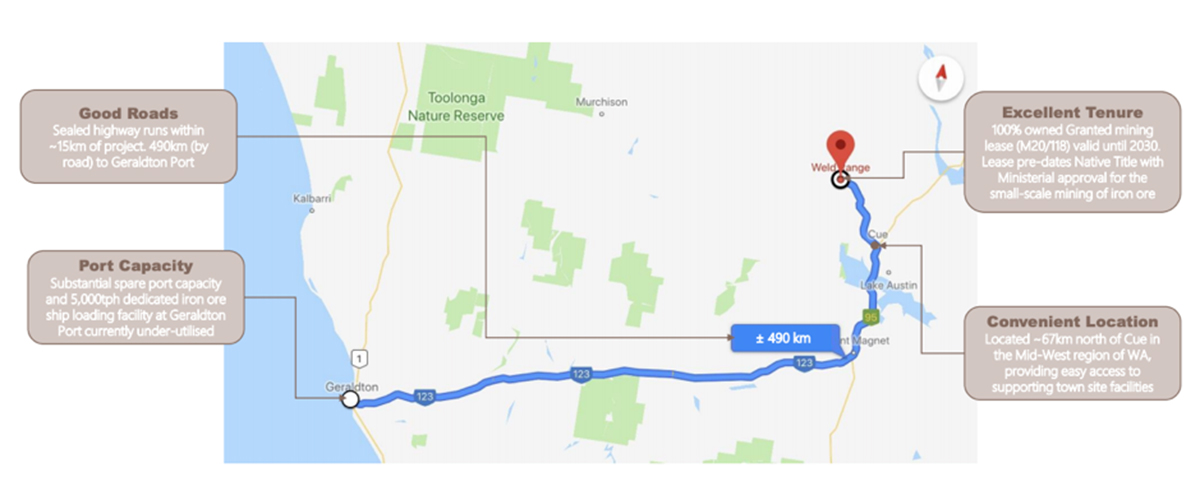

Special Report: The deal could mean bigger profit margins for Fenix by slashing the project’s most significant operating cost – transport from Iron Ridge to Geraldton Port, 490km away.

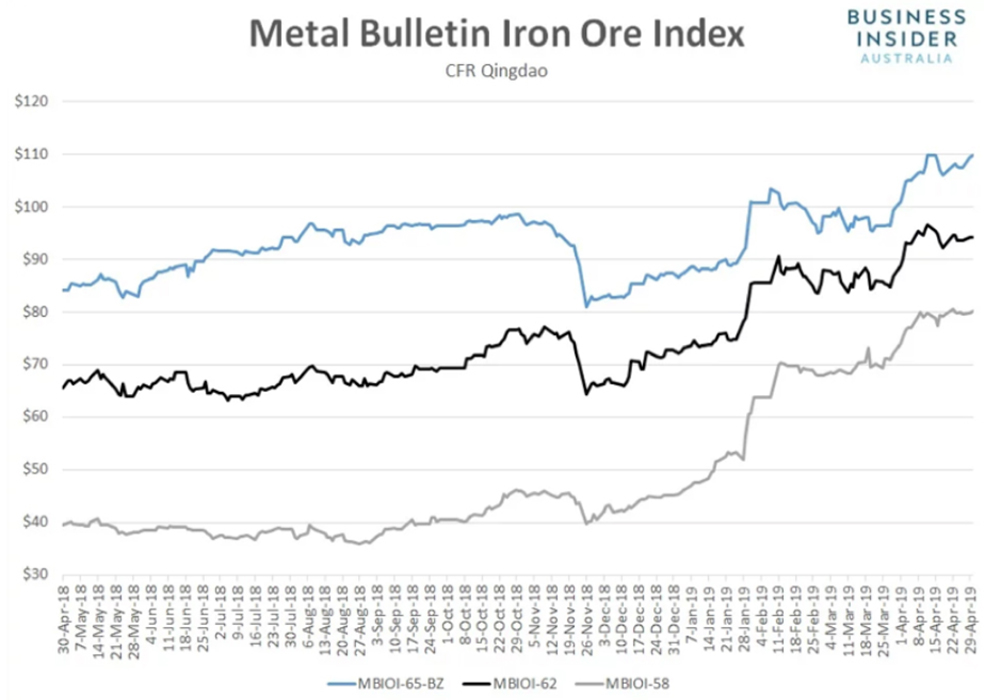

High grade iron ore just hit its highest point since Metal Bulletin first reported pricing for this 65 per cent grade at the start of 2016.

Check this out:

High grade iron ore play Fenix Resources (ASX:FEX) is serious about getting its open pit DSO project into production ASAP to take advantage of these positive market dynamics.

The goal is to produce a high-grade product approaching 65 per cent iron content from its Iron Ridge project, which boasts a total resource at its Iron Ridge project in Western Australia of 9.2 million tonnes at 64.1 per cent iron.

This is a product that buyers are prepared to pay a big premium for.

In a significant step towards development, Fenix has entered into a Strategic Alliance with trucking specialist partner Minehaul.

This is a crucial deal that could result in bigger profit margins by slashing the project’s most significant operating cost – transport from Iron Ridge to Geraldton Port, 490km away.

Fenix and Minehaul will form a new 50/50 joint venture company which will provide all trucking services to the project, called Premium Minehaul.

Premium Minehaul will be run by Craig Mitchell, an experienced mining transport and logistics executive.

Mr Mitchell founded Mitchell Corp, a major transport and logistics services supplier to the Western Australian mining industry, which was sold for about $110m in 2011.

Fenix managing director Robert Brierley says the JV will provide meaningful benefits as the company accelerates toward development of Iron Ridge.

“Significant benefits include reduction and transparency of trucking costs, greater control over the logistics chain, reduction in the initial capital outlay and, most importantly, by introducing Craig Mitchell into the operations the company stands to benefit significantly from his extensive experience in the industry,” Mr Brierley says.

“We already have a well-developed road transport model with detailed cost estimates for the task at hand and this model will be refined further now that we have created the JVC.”

“The creation of this joint venture company represents a significant step for the company as we strive towards development of the Iron Ridge Project.”

Demonstrating its confidence in the project, Minehaul will also make an $250,000 investment in Fenix.

This will be part of a broader $1.25 million share placement which will fund a significant part of Fenix’s expected equity contributions to the JV, on its way to achieving production-ready status.