De Grey in pole position as gold price takes off

Mining

Mining

Special Report: The Pilbara-focused gold explorer is on the right track for success and rapidly advancing towards production, as the gold price continues its strong performance.

Very few gold players tick all the boxes when it comes to establishing a foundation for a successful business – but De Grey Mining has all the right ingredients.

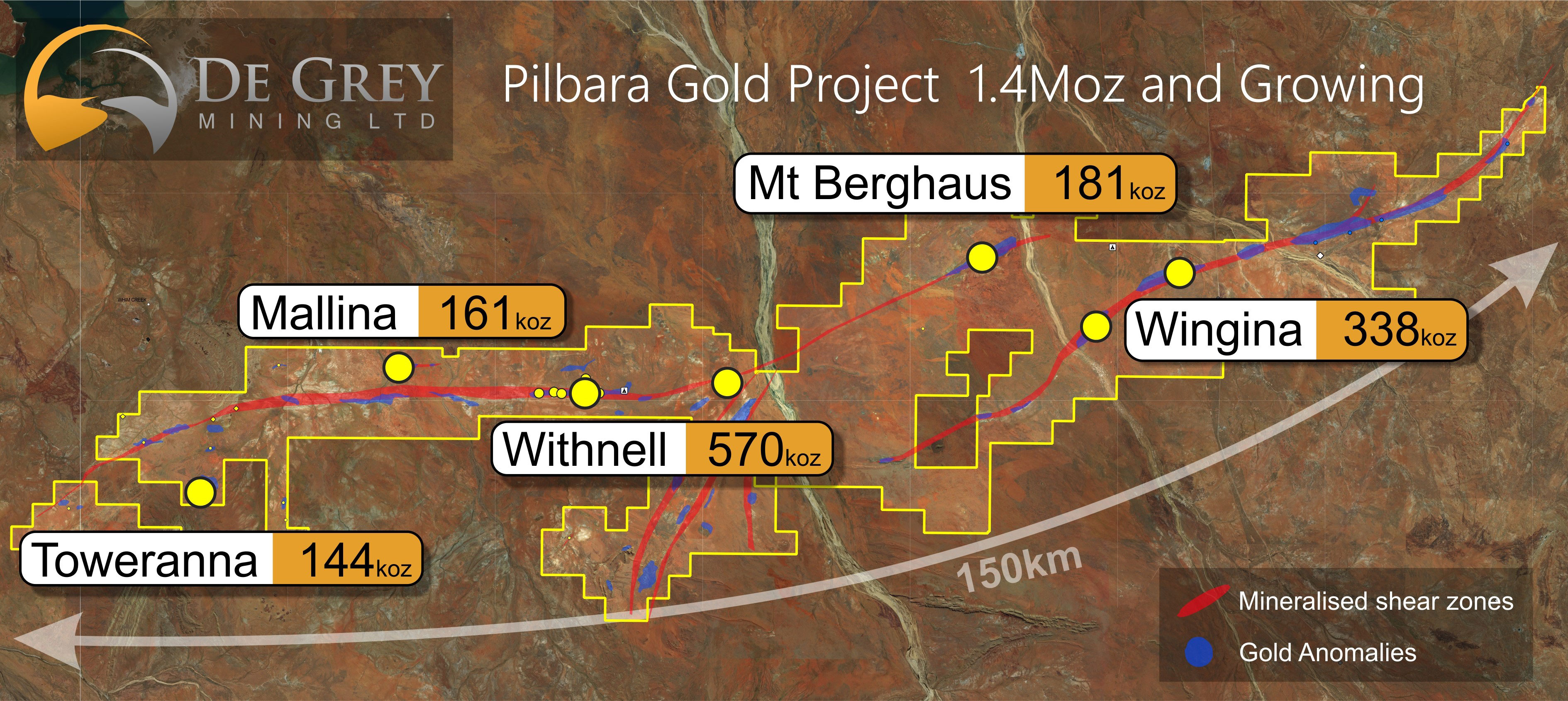

The explorer (ASX: DEG) not only has a well-advanced project with a hefty 1.4-million-ounce gold resource.

It is also targeting high grade underground lodes beneath several targets that could grow the resource further and benefiting from continued exploration success and the solid backing of other industry gold players.

Notably, the directors and management keep upping their skin in the game, proving they have every confidence in where De Grey is headed.

Bigger and better

2018 was a big year for De Grey.

The company’s Pilbara Gold Project, located 60km south of Port Hedland in Western Australia, hosts over 200km of mineralised shear zones within the its vast 1500 sq. km landholding.

De Grey released a string of encouraging drill intercepts during the year, many high-grade, from Mt Berghaus, Mallina, Toweranna and also the high-grade underground lodes at Withnell.

In October, it increased total gold resources to 1.4 million ounces on the back of this aggressive and highly successful 2018 exploration program. All deposits remain open.

The company is currently investigating the economics and is setting a corporate goal of defining a significant development production profile greater than 100,000 ounce per year of gold production, sustained by a 7 year mine life.

Study results are due in the first quarter of 2019.

This current study is focussing on open pit mining, however, the company says Withnell underground also looks interesting with high-grade drilling results (>5g/t Au) defined on more than one lode.

>> Here’s a plain language guide on how miners ‘grade’ mineral discoveries

Eyes on De Grey

De Grey has strong backing including the support of two major shareholders – Kirkland Lake Gold, chaired by billionaire Eric Sprott and DGO, led by well-known Australian geologist Ed Eshuys.

DGO Gold (ASX: DGO) picked De Grey out of the roughly 100 companies that it took a look at to inject $5m in cash into back in July 2018.

It said De Grey met all of its investment criteria including a large, under-explored landholding with very little drilling below 100m depth, low discovery costs and a high hit rate, 3.0 million ounce potential, discovery upside for a big +5Moz deposit and a competent board and management.

Late last year, the De Grey directors and management demonstrated their confidence in the company’s Pilbara Gold Project by exercising their listed and unlisted options (~$700,000 invested).

In total, the company received about $6M from the exercise of options in November 2018, with only a small shortfall taken-up by underwriter Taylor Collinson. This leaves De Grey well placed to push into 2019.

Gold price races ahead in 2019

Timing couldn’t be better for De Grey, with the gold price taking off just before Christmas and remaining high.

The gold price touched as high as $1851.78 an ounce on January 2 in Aussie dollar terms, a price not seen for 18 months.

While it has come back a bit, the consensus is that there will be a longer-term bull run, with several market watchers suggesting further rises through to at least 2021.

“I think the market could well consolidate over the next couple of weeks, but the dynamics that are pushing the price higher are fairly firmly in place now,” precious metals analyst Jordan Eliseo told Stockhead.

Goldman Sachs is probably the most bullish on gold, forecasting an average of $US1313 ($1834.25) an ounce this year, before rising rapidly to $US1413 in 2020 and then up to $US1510 in 2021.

At the current Aussie dollar exchange rate of 72 US cents, $US1515 would amount to over $2100 an ounce.