Dampier Gold tells shareholders to ‘take no action’ on hostile Vango Mining takeover bid

Mining

Mining

Dampier Gold is telling shareholders not to take any action on Vango Mining’s unsolicited all-scrip takeover bid.

Dampier (ASX:DAU) is reviewing Vango’s bidder’s statement and offer and will outline its formal recommendation in detail in its target’s statement, chairman Malcolm Carson said in a statement late yesterday.

“The board is of the view that the timing of the announcement and lodgement of the bidder’s statement is a direct response to the dispute between Dampier and Vango in respect of the K2 gold mine project joint venture which has not been resolved,” Mr Carson said.

“Dampier will provide additional guidance on the status of that dispute shortly.”

Shareholders have expressed frustration over the lack of progress at the West Australian-based K2 mine. Dampier blames Vango for not earning its 50 per cent stake in the project.

Vango’s main focus, meanwhile, is its “Plutonic Dome” gold project and bringing that into production.

Mr Carson says “Vango has consistently demonstrated material financial uncertainty”.

At the end of June, the suitor had $36,000 worth of cash and roughly $8.8 million worth of outstanding debt. Vango estimated it would spend over $2 million in the September quarter.

But Vango noted in its most recent quarterly that it had raised a further $5.2 million post the end of the quarter.

In Vango’s most recent half-yearly results, the company’s auditors emphasised material uncertainty relating to its ability to continue as a going concern, Mr Carson noted.

“Vango has a long-term history of dilutive capital raisings, share consolidations and a reliance upon unsecured loans (convertible notes) with interest rates of up to 25 per cent,” he said.

The all scrip offer made by Vango valued Dampier at 5.6c per share, or around $6.7 million — an 87 per cent premium — when it was announced earlier this week, but Mr Carson says “the offer premium claimed by Vango is completely reliant on the changing share prices of both Vango and Dampier”.

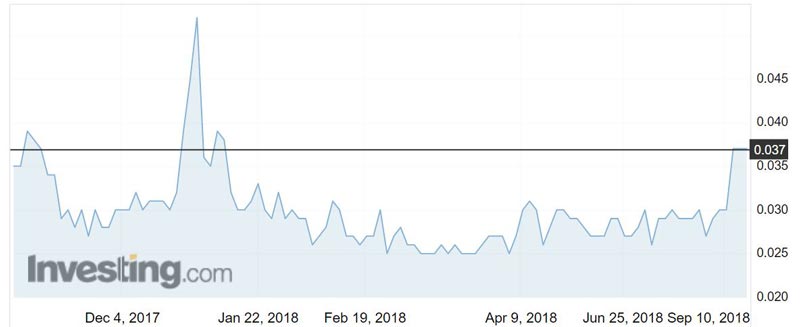

Vango’s share price has since dropped 5.3 per cent to 18c while Dampier’s share price has appreciated over 23 per cent to 3.7c.

The offer is for two Vango shares for every seven Dampier shares.

Mr Carson also said Dampier’s shareholders would not get the 7 per cent stake that Vango claimed they would.

“An analysis of both the issued and unissued share capital of Vango … reveals that on a fully diluted basis Vango’s share capital will expand from the current 492,932,464 shares to a total of 705,038,437 shares (including the 34,182,897 shares that would be issued by Vango pursuant to the takeover offer),” he explained.

“As such, in the event that Vango acquires 100 per cent of Dampier, Dampier shareholders will represent only 4.84 per cent of Vango’s expanded share capital and not ‘approximately 7 per cent’ as incorrectly announced by Vango.”

Vango has become a substantial shareholder in Dampier, reporting a 12.6 per cent stake just after it launched its takeover offer.

Dampier shareholders accounting for about 13 per cent have already signed pre-bid acceptance agreements.

Dampier could not comment further on the matter. Stockhead is seeking comment from Vango.