Canterbury’s odds of a big discovery are good with Rio Tinto in its corner

Mining

Mining

Special Report: Copper and gold explorer Canterbury Resources Limited has mining heavyweight Rio Tinto in its corner and is headed by a team that is no stranger to making big discoveries.

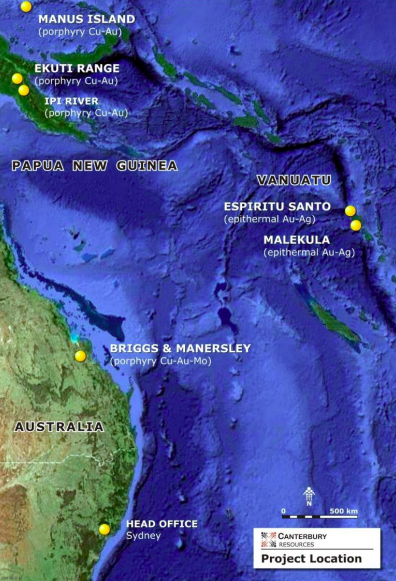

Canterbury (ASX:CBY) only listed on the ASX in March this year, but it did so with three drill-ready projects and deals with Rio Tinto on two of them.

Not a bad place for a newly listed junior explorer to start.

Rio is managing and sole funding exploration at Canterbury’s Bismarck project on Manus Island. The major can earn up to an 80 per cent stake in the project.

Canterbury also has a couple of projects in mainland Papua New Guinea, where it has pinpointed several large porphyry style copper and gold targets with geological similarities to Newcrest Mining (ASX:NCM) and Harmony Gold’s nearby Wafi-Golpu project.

Porphyry deposits are formed from fluids and igneous intrusions that flow up from magma chambers deep below the earth’s surface. They are typically very large, but relatively low-grade, and can be mined at low cost due to their scale.

Globally, over 60 per cent of copper, all the world’s molybdenum, 10-15 per cent of uranium and a significant amount of gold are produced from porphyry style deposits.

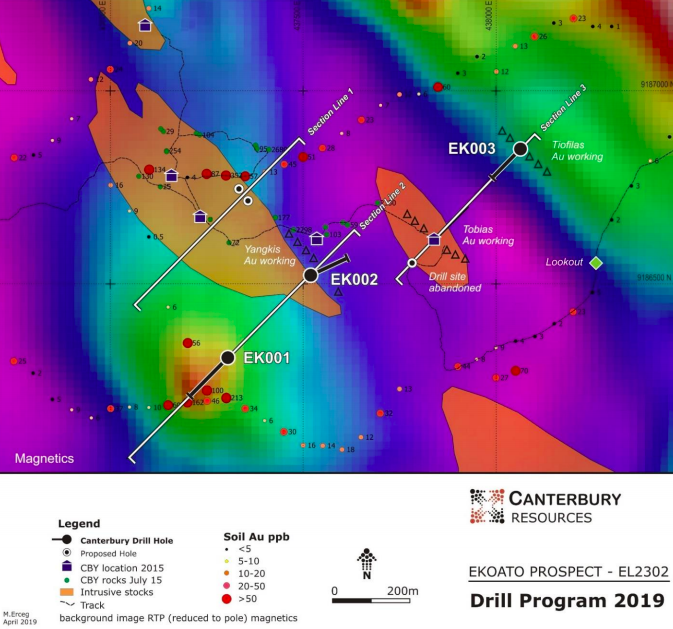

Canterbury is completing its fourth drill hole at the Ekoato prospect, within the Ekuti Range project area, and it’s looking promising.

“We’re seeing enough in the rocks and the assays to know that we’ve got a large, fertile system, but we don’t yet know where the core of the system is,” managing director Grant Craighead told Stockhead.

“So, we’ll finish that initial drilling phase soon, absorb the results for a few months and continue discussions with several major resource companies about the next phase of exploration, which will inevitably involve more drilling.

“We’ve drilled 250m to 300m holes into it, but we’re only flirting with the top of the system and it’s going to take deep holes and someone with deep pockets to really do justice to the long-term exploration potential.”

Canterbury also previously acquired the Briggs and Mannersley projects in Queensland from Rio, which has the right to earn back into the projects if a major discovery is made.

A large systematic drilling program is about to commence at the Briggs porphyry copper deposit and has potential to hit a milestone that triggers a Rio option to come back into the project.

“Once we delineate a billion dollars’ worth of metal in the ground, Rio has the right to come back in as a 60 per cent partner, but they will have to pay us $15m in cash and sole-fund the next $50m of evaluation if they want to take up that right,” Craighead explained.

“We think that the next phase of drilling, which is just days away, has every chance of reaching that milestone based on what we understand of the deposit.

“We’re optimistic that we’ll delineate a significant amount of copper mineralisation in the current program.”

>>NOW WATCH: Canterbury Resources’ MD Grant Craighead discuss its engagement with Rio Tinto

Canterbury’s strategy is a smart one: steadily build up a portfolio of large-scale opportunities, advance exploration as far as it can and then bring in a major with deep pockets.

“We think if we can generate the ideas, corner the land positions and drive them far enough up the value curve to attract partners, we can generate a broad portfolio of assets where we retain meaningful equity positions but with modest funding commitments that are affordable for a junior,” Craighead said.

“By having that portfolio approach, we defray risk and enhance the potential of gaining exposure to any discoveries that are made and any discoveries, because of their scale, tend to be measured in the billions of dollars, rather than the millions.

“If we can retain 20, 30 or 40 per cent exposure to that and not spend too much money, we’ve got something that’s very valuable and represents massive appreciation for our shareholders under a success scenario. There’s a lot of leverage.”

Craighead and exploration manager Mike Erceg have been successful in making big discoveries in the past.

Specifically, the pair were responsible for drilling the discovery hole at the world-class Golpu deposit when it was a joint venture between Elders Resources and CRA (now Rio Tinto).

The Wafi-Golpu project currently hosts resources of 26 million ounces of gold, 8.8 million tonnes of copper and 48 million ounces of silver. This includes reserves at the Golpu deposit of 11 million ounces of gold and 4.8 million tonnes of copper.

Project owners, Newcrest and Harmony, have successfully completed feasibility studies based on a large scale, long life operation, and are awaiting final licence approvals ahead of likely development.

Craighead, a geologist and mining analyst with around 40 years of experience, has also had other development successes including the Red Dome, Selwyn and Kidston mines in Queensland, and Glendell and Narama mines in New South Wales.

Erceg, meanwhile, is the “technical brains”, according to Craighead.

He is a geologist with 40 years of experience in exploration, mine development and operations in New Zealand, Australia, Papua New Guinea, Vanuatu, Philippines and China.

He is a specialist in southwest Pacific porphyry copper-gold and epithermal gold-silver systems, and has a strong understanding of their geological, geochemical, geophysical and alteration footprints.

Besides his involvement in the discovery of the Golpu deposit, Erceg has been involved in the discoveries and/or delineation of Red Dome Northwest Mungana in Queensland, Ok Tedi in Papua New Guinea, New Holland underground in Western Australia, and the Murrawombie/Larsens/Northeast ore bodies in New South Wales.