You might be interested in

News

ASX Small Caps Lunch Wrap: Which US politicians have clearly had a brainfart this week?

Mining

Renascor Resources wins $185m loan from Canberra to fast-track upstream graphite operation at Siviour

Mining

Mining

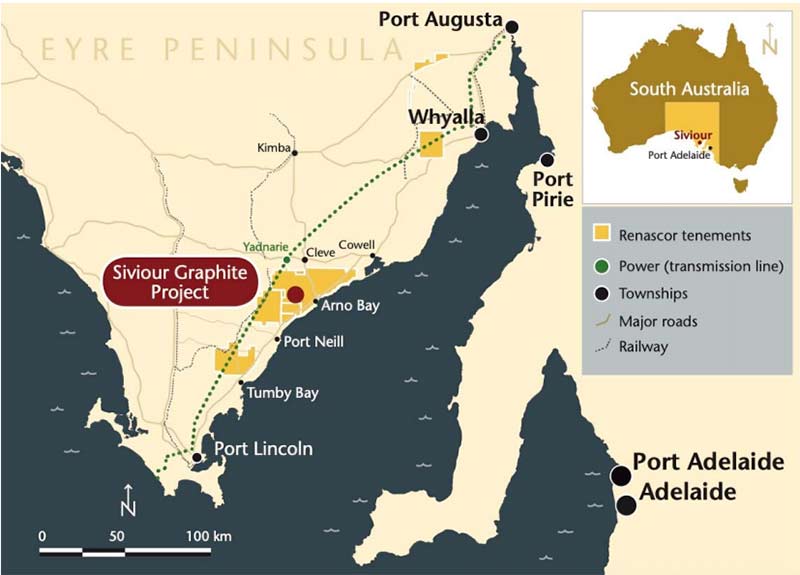

In April, Renascor Resources (ASX: RNU) caught a rocket after its Siviour graphite project scored potential project finance support from the Dutch government.

This news, alongside an updated resource estimate for Siviour, saw the South Australian explorer spike 30 per cent over a few days.

Now, the company says this potential funding means it can expand Stage 1 production by a whopping 400 per cent.

The new, optimised plan envisages Stage 1 production of 83,400 tonnes of graphite concentrate a year – up from 22,800t previously.

Construction costs are up from $40m to $108m, but the Dutch finance contribution could potentially cover around 60 per cent of this, Renascor says.

Renascor is completing a Definitive Feasibility Study (DFS) based on this new development plan, expected in late July.

Renascor managing director David Christensen says potential funding for up to 60 per cent of the stage‐one capital costs was a major breakthrough.

“As we continue to advance the development of Siviour through more advanced project finance and offtake negotiations, we are pleased with the potential of the new development plan to attract project financing and create opportunities to deliver stronger returns to shareholders sooner,” he says.

Tando Resources (ASX:TNO) says its SPD vanadium project will be an early, low-cost starter operation with margins of about $US17m ($24.3m) a year.

An updated scoping study confirms potential for Phase 1 could have a “short payback period of less than 2 years due to the high-grade nature of the mineralisation and the low CAPEX requirement of $18 million”, managing director Bill Oliver says. The company is currently engaged in securing binding offtake agreements for its vanadium concentrate “with a number of interested parties”.