You might be interested in

Mining

Reporting Rodeo: Here's how analysts think the ASX's big miners will shape up in March quarter reporting season

Mining

Want a chart that shows good things could be on the cards for copper? OFC you do

News

Mining

In 2009 Sandfire Resources discovered what would become the world-class DeGrussa copper-gold mine, rapidly transforming its fortunes from struggling small cap to mid-tier miner.

But now it has a problem.

DeGrussa is due to run out of ore by early 2022 (although there’s talk the miner could prolong that a tad), and there’s nothing near-term in the pipeline to replace it with.

Sandfire’s advanced Black Butte copper-silver-cobalt project in Montana is progressing though the approvals process but there’s a good chance it won’t be up and running in time.

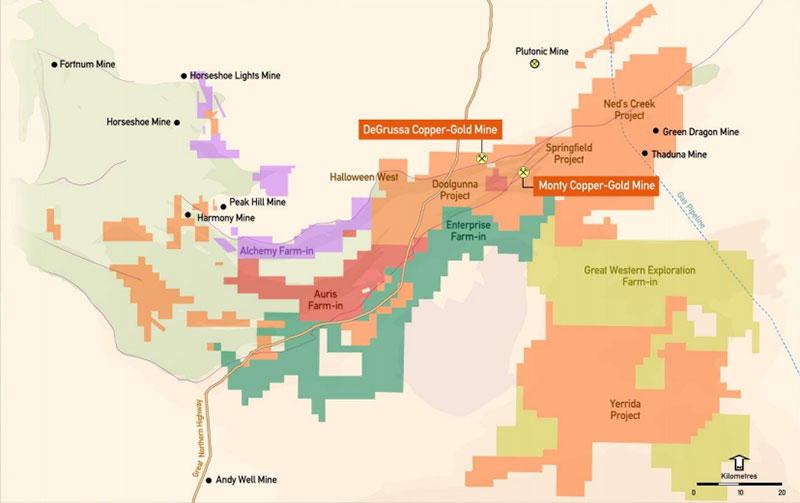

Which is why Sandfire is sinking holes left, right and centre to find the next De Grussa in the greater Doolgunna region in Western Australia.

But other issue is that despite years of exploration the only meaningful discovery near De Grussa so far has been the small but high grade Monty deposit.

Sandfire must be confident though.

Multi-pronged exploration programs continue across the miner’s 6600sqkm Greater Doolgunna project, which includes a number of joint venture and farm-in arrangements with neighbouring small cap explorers.

These include Enterprise Metals (ASX:ENT), Great Western Exploration (ASX:GTE), Auris Minerals (ASX:AUR) and Alchemy Resources (ASX:ALY). Click on the tabs at the bottom to cycle through their prices right now.

This morning, Alchemy reported that Sandfire was kicking off a huge aircore drilling program at their JV, right next door to De Grussa.

Alchemy managing director Leigh Ryan says Sandfire will spend $3 million on its Bryah Basin project this year — but he reckons they aren’t desperate.

“I don’t see that SFR are desperate; they’re just better incentivised than most, and are more educated about the geology, geophysical signatures and geochemical pathfinders associated with De Grussa style copper-gold mineralisation,” Mr Ryan told Stockhead.

“They understand that the Alchemy ground contains 40km of strike of the De Grussa host rocks, commencing just 25km along strike from the De Grussa mine.

“It’s a highly prospective area and they’re the ideal JV partner for us.

“We’re very excited about the massive amount of drilling they’re about to undertake.”

The project area looks like this:

In another morning announcement, Auris Minerals says the JV with Sandfire has spent $9.4 million (and counting) at the Morcks Well project.

Despite some deep drilling – including a 775.6 metre diamond hole (which cost an absolute fortune, by the way) the Auris-Sandfire JV haven’t found the motherload just yet.

But Auris isnt giving up yet, and reckons the “significant geology and anomalous intersections made in RC and Diamond drilling continue to highlight the regional prospectivity” of Morcks Well.

Auris were contacted for comment.

Trek Metals (ASX:TKM), formerly Zambezi Metals, has managed to offload its cursed Kangaluwi copper project — even though Zambian courts have indicated no mining will ever take place.

Maybe the Dubai-based buyer thinks they have a shot. Investment company Grand Resources has just paid $1.1 million for a project that was once a single environmental approval away from becoming a major producer.

Trek had impaired the value of this asset to nil several years ago, while waiting written judgement from the Lusaka High Court on the validity of the mining licence originally issued by relevant government departments in Zambia. This decision is still pending after nearly five years.

Orion Minerals (ASX:ORN) has raised $8 million at a 29 per cent premium to the last closing share price, underpinned by “high-profile South African investors”. The news sent the Orion share price up 29 per cent to 4c per share.

The placement was related to a major restructure of Black Economic Empowerment (BEE) holdings in the advanced zinc-copper Prieska project in South Africa. New BEE partners will acquire 20 per cent of the project and fund their proportionate share of Prieska project development costs, Orion says.

NOW WATCH:Is Nearology fact or fiction?