Why Aussie zinc king Tolga Kumova is loving the current market

Mining

Mining

Barry FitzGerald writes his legendary Garimpeiro resources column weekly for Stockhead

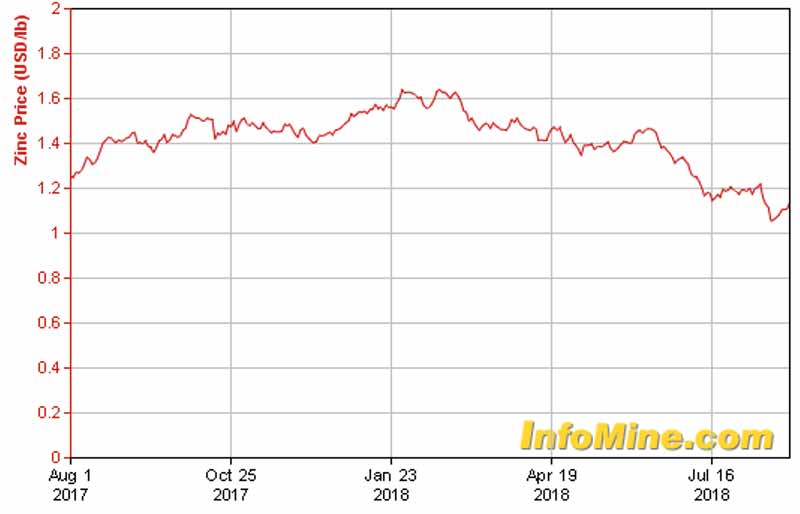

The zinc stocks are having a rough year as a result of the metal’s sharp fall from a June half average of $US1.48/lb to $US1.15/lb this week (see table below).

But it’s not all gloom according to the bustling Tolga Kumova, Australia’s “zinc king’’ thanks to his 9 per cent share and option position in New Century (ASX:NCZ) which has just started its tailings re-treatment project at the Century mine in north Queensland.

“I’m loving it,’’ Kumova said of zinc’s new price level of $US1.15/lb.

His enduring love is a result of New Century’s forecast C3 costs (fully allocated) of a robust US50c/lb.

Then there is the news just in from China that its zinc production plunged 8.6 per cent in the June half due to environmental inspections and shutdowns of small-to-medium mines.

The production set-back for the world’s biggest producer comes as London Metal Exchange warehouse zinc stocks remain at near five-year lows.

Like other industry players, New Century based the Century project on the expectation that zinc price would give up its elevated levels and revert to a long-term price around the $US1.10-$US1.15/lb level, supported by the market fundamentals mentioned above.

Here’s a graph showing the price of zinc over the past year:

Century’s forecast robust economics at the current zinc price is a result of all of the processing infrastructure being in place from its previous life as a hard-rock mine.

It is why New Century’s share price has been less damaged by the fall in zinc prices than has been the case with some other ASX-listed zinc stocks where share price falls of as much as 50 per cent have been recorded.

The grade of Century’s tailings at 3.1 per cent zinc equivalent is low compared with standard zinc mines but it has to be remembered that the material has already been mined.

Superior Lake Resources

Kumova’s other zinc play, and today’s real interest, is Superior Lake Resources (ASX:SUP). It is at the other end of the grade spectrum with its super-high grade namesake project in north-west Ontario.

SUP recently announced a maiden resource estimate of 2.15mt at 17.7% zinc, 0.8% copper, 0.4gpt gold and 33.5gpt silver.

So what it currently lacks in terms of tonnage – exploration upside for future resource additions is strong – it makes up for with its stellar grade.

It’s what attracted Kumova to the junior which last traded at 4.4c for a market cap of $38m on capital increased by the recent placement of 142.85m shares at 3.5c, with BW Equities the lead manager.

Kumova told this column he was squeezed out of the placement but continues with his SUP exposure through a diluted equity position of 9 per cent — and his involvement in the partnership that owns 30 per cent of the Superior Lake project.

SUP has swum against the tide since the placement as investors warm to the news that Tribeca Investment Partners has been mandated to arrange $US60 million in project finance (it also took up $1.5 million of the placement).

There is also background chatter that as SUP advances towards first production, it will increasingly come to the notice of growth hungry and ever-acquisitive Canadian base metals producers.

Like Century, Superior Lake is a past producer.

It was previously owned by some big Canadian mining names and was put on ice in 1999 when zinc sunk as low as US45c/lb.

Historically the project processed 3.3mt over 11 years for the production of 900m/lbs of zinc, 53m/lbs of copper, and more than 50,000 oz of gold.

While much of project was dismantled when it was closed, major infrastructure components like power, mine shafts, access roads, and tailings and fresh water dams remain.

It means the project can be fast-tracked in to production on the assumption that a definitive feasibility study due for completion in the second quarter of next year confirms a robust project.

The grade more or less guarantees it will.

SUP is working towards bringing the project in to production in 2020.