ASX peeved with WestStar over Rio Tinto contract news

Mining

Mining

Mining services player WestStar Industrial has received a grilling from the ASX over the way in which it announced a major contract with big wig miner Rio Tinto.

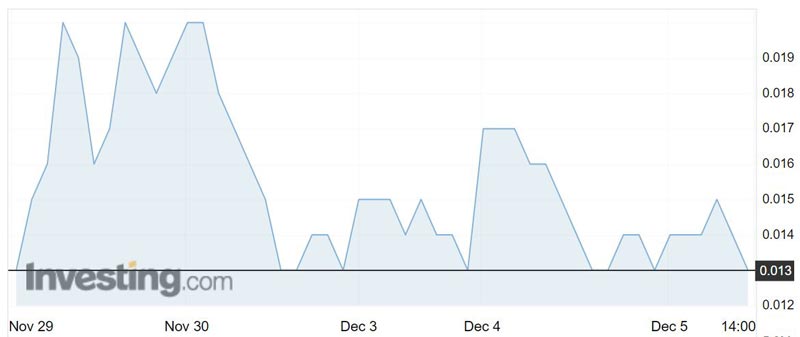

WestStar (ASX:WSI) shares shot up nearly 54 per cent on Tuesday on news that its engineering business SIMPEC had won a $4m contract for Rio’s (ASX:RIO) West Angelas iron ore mine in the Pilbara.

But less than an hour and a half before the company released the announcement to the ASX it delivered its response to a prior “aware” query letter assuring the bourse WestStar was in compliance with listing rule 3.1.

Listing rule 3.1 states that once a company becomes aware of any information that would likely move the share price it must tell the ASX immediately.

WestStar then requested a trading halt, which was dialled back to a “pause in trading”, and 20 minutes later the company told the market of its major contract win.

ASX head of compliance Kevin Lewis told Stockhead last year there are occasions where companies say they have nothing to declare “and lo and behold a few weeks later it turns out they were working on a big deal”.

That’s when they get an ‘aware’ letter asking them to explain when they knew about the news.

Share price moves

The ASX pointed to a general market update WestStar released just five days earlier that provided details of the company’s current order book.

In the update WestStar also highlighted the fact that it had a 25 per cent stake in a company that had projects near BHP’s (ASX:BHP) big new Oak Dam copper discovery in South Australia.

Shares rallied nearly 54 per cent the day before the update was released and over 10 million shares changed hands.

That prompted the first ASX grilling.

The ASX now wants to know why WestStar said it was in compliance with listing rules when it still had news to announce.

WestStar told the bourse it received news of the contract win at 8.20pm on December 3 and made the announcement to market prior to resuming trading the next day.

The company conceded it made an “administrative oversight” with respect to its confirmation that it was in compliance with the listing rules.

WestStar said its response should have read: “The company is in compliance with listing rule 3.1 subject to an announcement on a material contract award received aftermarket the previous day”.

“The company’s intention was to lodge the announcement, once compiled and approved, prior to resuming trading,” company secretary Derek Hall said in the response to the ASX.

“The company did this. The company notes that WSI securities were not capable of being traded between the time that the company became aware of the information and lodgement of the announcement.”