Cobalt stocks guide: Here’s everything you need to know

Explainers

It’s not an obvious connection but cobalt got its name from a rather unpleasant mythical creature from Middle Ages Germany.

The story goes that around 1500CE, German miners encountered an ore that looked a lot like silver but instead of smelting, the metal released toxic fumes causing many to fall ill or die.

As a result of this misfortune the miners decided to name the metal ‘kobold’, after a troublesome and devilish gnome-like mountain dwelling spirit from German folklore.

Today, the silver-grey element known as the ‘accidental metal’ is still usually discovered unintentionally as a result of mineral exploration targeting other materials. Some 98% of the world’s cobalt is mined as a by-product.

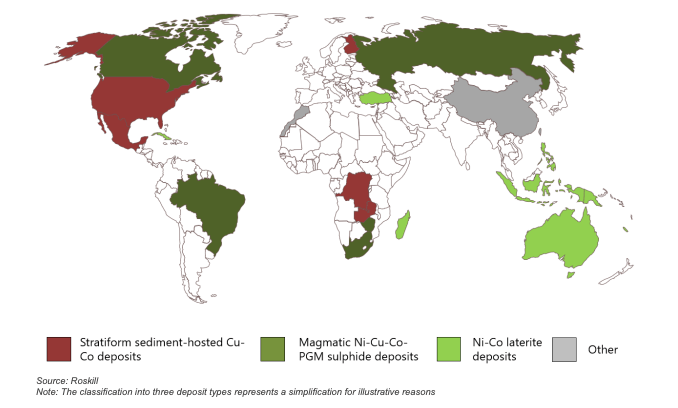

Economic concentrations of cobalt are usually discovered in the following five different geological settings:

In this guide we’ll explain the factors that have been driving ASX cobalt stocks and what could drive demand – and stock prices – into the future.

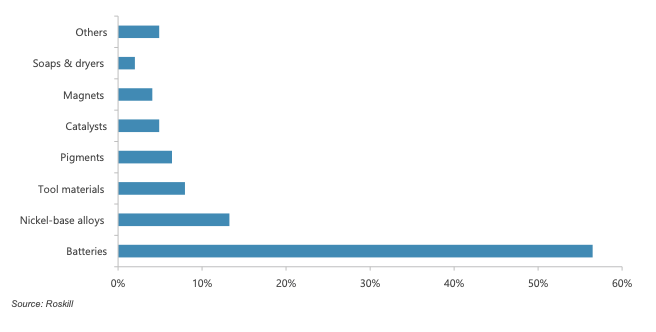

Cobalt as an alloy has a wide range of applications including in gas turbines for jet engines, in heat resistant cutting tools, and even in the medical industry as magnetic elements in MRI machines.

But it is cobalt in its chemical form, either as sulphate or hydroxide, otherwise known as ‘battery cobalt’, that continues to drive the price and demand, particularly with its use in lithium-ion batteries for the manufacture of electric vehicles (EV).

Cobalt is used to stabilise the chemistry in the cathode of a lithium-ion battery with the typical EV battery requiring up to 9kg of cobalt.

And according to Cobalt Blue chief exec Joe Kaderavek, volumes of ‘battery cobalt’ to support electric vehicles is currently larger than the line-of-sight trading houses currently have vision over.

“In other words, EV companies are now reaching out to mines and primary sources and asking the question: ‘Can you supply me for a 5-to-7-year production run of a particular electric vehicle model?’” he said.

“It is no longer a year-to-year thing, it is now ‘before I build this Gigafactory, which will support this particular model, I need to know that we can underpin it with a lithium, cobalt, and nickel required for a 6- or 7-year run at the absolute minimum.”

He says the cobalt price – which is currently sitting at US$29/lb – will continue to be tensioned by the demand which is currently going through “a multiplication upwards”.

However, major car makers such as Tesla, Ford, and German giant Volkswagen have recently announced their adoption of lithium-iron-phosphate (LFP) chemistry batteries within their fleet of EVs.

Tesla, for example, announced last month that it will adopt LFPs for its high volume, standard range Model 3 and Model Y electric vehicles.

LFPs are cheaper than NCA (nickel cobalt aluminium) or NCM (nickel cobalt manganese) cells, mainly because they don’t require scarce and price-volatile metals such as nickel or cobalt.

But Kaderavek says the idea that LFPs will somehow cause cobalt demand to stagnate is a fallacy.

“Cobalt demand is not only strong, but it is stronger in line with the EV model rollout that is currently being projected and that is unprecedented,” he said.

“The EV market is so big that there can exist quite successfully a low-end, shorter range but cheaper LFP battery as well as NCA and NCM batteries where for middle- to long-range passenger vehicles cobalt is embedded into those chemistries and even Tesla has acknowledged that.”

Benchmark Mineral Intelligence says producers and traders alike remain bullish about the outlook for both demand and prices heading into 2022.

“Despite some headwinds, most notably linked to the power restrictions and the ongoing global semiconductor shortage, cobalt demand from the battery industry is projected to experience a further step change in 2022, as post-Covid legislation continues to hasten the transition to electrification and auto OEMs roll out new EV models.”

With batteries and hydrogen fuel cells being the most likely to replace the world’s existing fossil fuel fleet, an important question remains: are there enough raw material reserves to replace the existing vehicle stock?

In a November 2021 report, Supply Chains for Vehicle Power Packs: Li-Ion Batteries and Hydrogen Fuel Cells Challenges and Opportunities, Foresin argues that “the limited reserves of cobalt cannot support the replacement of more than half of the world’s vehicle fleet.”

Li-ion batteries for battery electric vehicles (BEV) requires a few raw materials such as lithium, graphite, cobalt, nickel, and manganese, with lithium and cobalt being the rarest.

The study says that while lithium reserves – currently estimated at 86 million tonnes – would be enough to manufacture around 5.3 billion vehicles, the same cannot be said for cobalt.

Currently, the report says, “cobalt reserves are estimated at 25 million tonnes which would only be sufficient to manufacture around 600 million vehicles if all cobalt is used for this purpose.”

And while researchers have recognised the challenges posed by limited cobalt reserves and have started to explore for alternative cathode formulations for cobalt-free power packs, they are still at a ‘research stage’, with most substitutes for cobalt “resulting either in decreased power pack performance or increased production costs.”

Extraction and production rates can also impact the battery or fuel cell production capacities. In 2020, Foresion says that 82,000 tonnes of lithium and 140,000 tonnes of cobalt was produced – supporting a yearly production of 3.5 million Li-ion batteries for BEV.

But to replace about 40 million older vehicles, the world needs to produce around 880,000 tonnes of lithium and 2.2 million tonnes of cobalt.

Total world reserves, estimated by the United States Geological Survey, include around 7.1 million tonnes of cobalt with 140,000 tonnes produced globally in 2020.

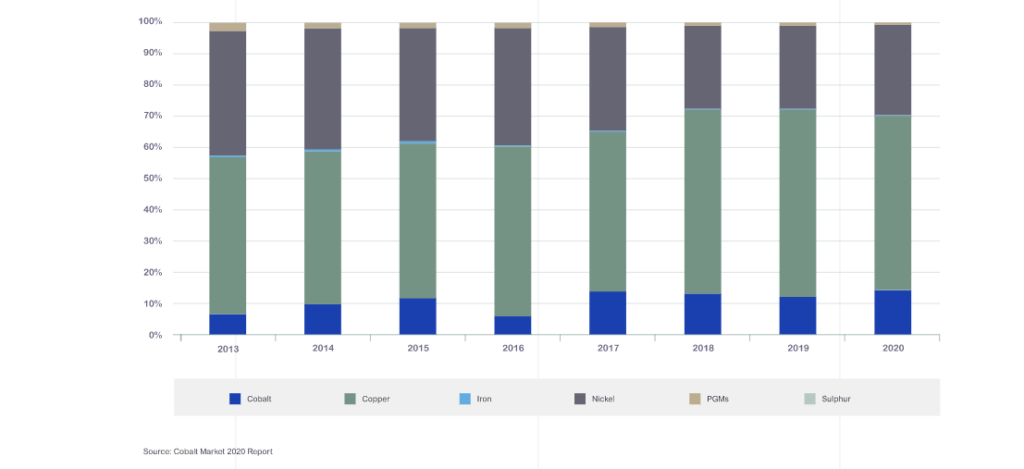

The metal is mainly either mined as a by-product of copper (55% in 2020) and nickel (29% 2020) with exceptions including at the Bou Azzer Mine in Morocco where cobalt is produced as a primary commodity.

It is also mined as a primary commodity at numerous artisanal and small-scale mining sites in the DRC, where primary sources accounted for 14% of the global cobalt mine supply in 2020.

According to the Cobalt Institute, the balance comes from China, where some production occurs as a by-product of iron ore extraction, as well as from South Africa and Zimbabwe, where cobalt is recovered as a by-product of platinum group metals (PGM) production.

Over the course of 2020, the DRC retained its status as the world’s major source of mined cobalt, contributing 66% of global supply.

Glencore (LON:GLEN) is the biggest producer in the DRC and is the world’s largest producer, making up 29% of DRC mine production at its Katanga mining assets while the Mutanda Mine remains on care and maintenance.

The second largest producer was China Molybdenum (CMOC) which operates the Tenke Fungurume mine, accounting for 17% of DRC cobalt output.

Here are some ASX small cap explorers that have exposure to cobalt.

Jervois Global Limited (ASX:JRV) is a battery metals development company with its current asset suite including a cobalt-copper development mine in Idaho, USA, a nickel-cobalt refinery in Sao Paulo, Brazil, a nickel cobalt resource in NSW, and is undertaking exploration in Uganda.

The scope of work for its Bankable Feasibility Study (BFS) at the San Miguel Paulista (SMP) Nickel Cobalt Refinery in Brazil has been expanded to include an increase in the forecast pressure oxygen (POX) leach circuit capacity.

JRV says the BFS will leverage the technical expertise gained through the acquisition of Jervois Finland to include a dedicated crystalliser circuit to produce nickel sulphate crystals, a premium product able to be delivered to both the plating and battery industries.

At its Idaho Cobalt Operations, Jervois has committed more than US$30 million towards equipment, material, and labour costs with commissioning of the mine expected to take place in mid-2022.

Kuniko (ASX:KNI) made its ASX debut back in August making a 325% first day gain.

Its flagship ‘Skuterud’ cobalt project in Norway includes the historically significant Skuterud mine, thought to represent one of the world’s oldest mined cobalt deposits.

It was successfully mined for cobalt from 1773–1898, and at the time was both the world’s largest cobalt producer and the largest company in Norway, KNI says.

Recent geophysical results identified a conductor at “Middagskollen” or “Middagshvile”, a historic mine site along the Skuterud cobalt trend, suggesting that the highest encountered conductivity in the area is located deeper than the existing drilling has penetrated.

Chalice Mining (ASX:CHN) released its long awaited maiden resource earlier this month after making its Gonneville nickel sulphide discovery more than 18 months ago at its Julimar Nickel-Copper-PGE Project northeast of Perth in Western Australia.

The resource contains 330Mt of ore at 0.94g/t platinum, palladium and gold, 0.16% nickel, 0.1% copper and 0.016% cobalt (0.58% nickel equivalent or 1.6g/t palladium equivalent) and has been descried as the largest nickel sulphide discovery in 20 years.

Cobalt Blue Holdings (ASX:COB) has one of the only primary cobalt projects in Australia with cobalt accounting for 85% of its revenue

“Typically amongst our peer group it is between 10 to 15 per cent,” chief exec Joe Kaderavek said.

COB plans to deliver a BFS at the Broken Hill Cobalt Project (BHCP) in NSW by the end of the 2022 in parallel with work being undertaken at the pilot plant which is making cobalt sulphate.

During the quarter the pilot plant manufactured mixed hydroxide product which was despatched to global cobalt sample partners.

The samples produced a range of assays within the following limits: 35-41% cobalt and 3-10% nickel.

The BHCP project has a mineral resource of 118Mt at 859ppm cobalt equivalent (687ppm cobalt, 7.6% sulphur and 133ppm nickel) for 81,100t contained cobalt, (at a 275ppm cobalt equivalent cut-off).

NickelSearch Ltd (ASX:NIS) listed on the ASX on October 18 with substantial shareholders including Medallion Metals (ASX:MM8) holding a 15.1% stake.

An initial drilling program kicked off at the RAV8 deposit within the Carlingup Nickel Project in Ravensthorpe, Western Australia last month, which is the most advanced project within its portfolio having historically produced 16.1kt nickel at 3.45% from four shoots.

Panoramic Resources (ASX:PAN) owns the Savannah Nickel-Copper-Cobalt Mine in the Kimberley region of Western Australia.

The project was mothballed in mid-2016 following the decline of the nickel price but was brought back online in late 2018. Following a 12-month process of review and implementation of operational strategies to improve and de-risk the project, the board approved its restart in April.

Savannah has a 12-year mine life with an average production target of 9,072t nickel, 4,683t copper and 676t cobalt in concentrate.

PAN produced the first nickel-copper-cobalt concentrate post quarter end in October with first shipment expected to leave Wyndham Port in December.

Aeon Metals (ASX:AML) owns the advanced Walford Creek Copper-Cobalt Project in New South Wales.

The company expects to achieve commercial production at the project in 2025 and believes Walford has the potential to become “Australia’s largest producer of cobalt metal when in operation.”

A scoping study was completed in June on the development of a 3Mtpa open pit and underground mining operation, producing around 243kt copper and 33kt cobalt (plus zinc, silver, and nickel) for sale to global metal markets.

A pre-feasibility study is targeted for completion in Q1 CY2022.

Ardea Resources (ASX:ARL) is undertaking a feasibility study at its Kalgoorlie Nickel Project (KNP) for a high-pressure acid leach and atmospheric leach processing operation to initially produce mixed hydroxide precipitate.

The Goongarrie Project, within the KNP, was remodelled to maximise resource utilisation and nickel-cobalt production with the Goongarrie Hill and Highway deposits being the current test work focus.

KNP’s resource now stands at 830Mt at 0.71% nickel and 0.46% cobalt (5.9Mt nickel, 380kt cobalt).