Kick Back: The 10 biggest stories you might have missed on Stockhead this week

News

News

It’s the end of the first week of April and how did that even happen and when.

You need a holiday.

Or at least a couple of hours between another week at work and weekend at home to sit back and have a proper look at what just happened.

Here are all the good bits from our end of things. Enjoy your down time a bit like:

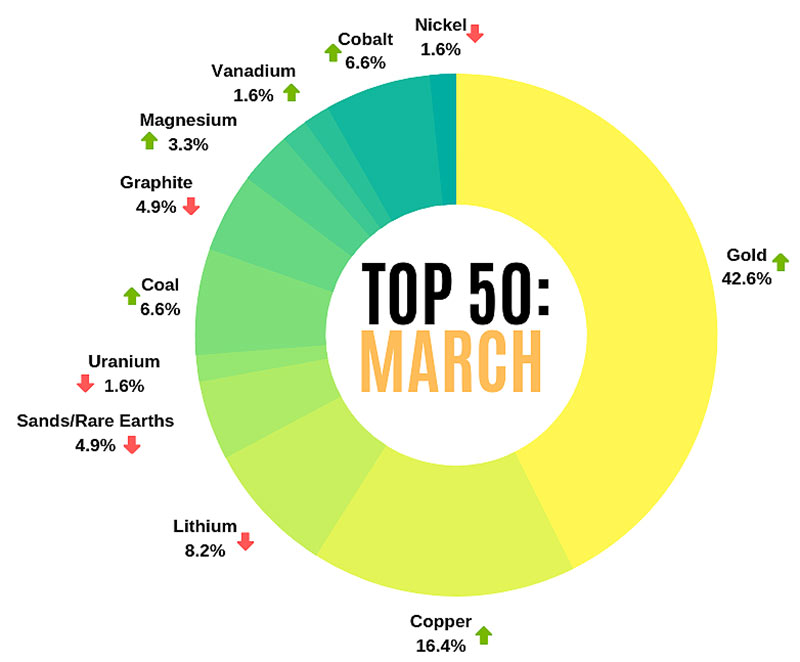

Our top 50 mining stocks for March were – no surprise here – dominated by gold. But stocks with a gold focus actually jumped another 6 per cent on last month.

Here are the winners and losers:

And here are the stocks to watch that produced those winners and losers.

Labor sets aggressive target of all car sales to be 50 per cent EV by 2030? Meh.

Thermal storage out-performs lithium-ion on a number of key metrics? Pfft.

Elon Musk mumble-raps an ode to Harambe the dead gorilla and posts it on SoundCloud? Click.

It’s all here in our wrap of all the news driving ASX battery metals stocks.

Coming in hot at #3 is… federal Budget coverage. You really do care!

Treasurer Josh Frydenberg’s mum and a handful of unfortunate journalists locked in a room watched as PM Scott Morrison’s soon-to-be not-government unleashed a $7.1 billion surplus while still spending $302bn on us.

And a solid chunk will make its way into smallcap-land. These are the energy, water, agriculture, medical research, education and defence companies whose stocks may get a boost if ScoMo somehow pulls off a miracle at the election.

Otherwise known as The Actual Budget, there was a lot of talk after Bill Shorten’s reply praising Labor for making cancer treatment affordable for all.

But small caps had plenty to be happy with, from tax cuts to lots more EVs to big infrastructure plans.

But over in the West, anyone interested in all things lithium would have had their ears pricked up by this promise out of the blue from Shorten:

“Here’s the remarkable thing, we already have every single resource to make a lithium battery right here in Australia.

“So instead of the usual trope of shipping the minerals overseas and buying back the finished product at largely inflated prices, let’s make the batteries here…”

The average cost of a cannabis script in Australia is $415 – that’s up over 11 per cent on the last six months.

So is cannabis already getting pricier? No.

Australian users are just buying bigger dosages. And Australian Gen Ys are throwing their money at weird pot stocks Really Old People have never heard of.

This is our weekly wrap of whoopieweed news, including the winners and losers (i.e. anyone who believes in the “entourage effect”).

Old and busted: Kardashians. New hotness: Nickel.

Macquarie Bank said so, after running the ruler over which metal had the best prospects in the next one, two and five years.

Nickel came in first, first, and equal second respectively. Why?

A rise from $13,000 to $20,110 a tonne should do it.

In this weekly column, Stockhead overviews all substantial holder filings of ASX small caps.

Substantial shareholders are those holding 5 per cent or more. These could be company directors, individual investors or major institutions.

We know they’ve traded places because they have to tell the ASX.

And this week, Silver Lake Resources (ASX: SLR) welcomed a substantial holder in small cap fund manager Paradice Investment Management with a 5.25 per cent stake.

Here are the other big moves, including the Commonwealth Bank’s sudden interest in an electricity generation business.

Things got a bit awkward in Tanzania back in 2017 when the government decided it could renegotiate existing agreements and now wanted 16 per cent government ownership of mining projects.

Oh, and the right to acquire up to 50 per cent of mining companies under certain conditions.

There are now 18 ASX-listed companies with resources projects in Tanzania. There were more.

But the CEO of the Australia-Africa Minerals & Energy Group just told us that it’s not all that bad, really, and investment money is starting to flow again for Australian explorers.

No public holiday? Check.

No monsoon or climate-related disasters? Check.

No US President saying something monumentally off-the-cuff stupid? Unusually enough, check?

So where is everyone in Beijing and why are all the shops closed?

Here’s Beijing Airport on a Wednesday afternoon last week, when Niv Dagan, executive director at boutique investment firm Peak Asset Management, landed:

And as he took off later, looking down at the city, “the streets were also empty, there were no traffic jams and evidence of little activity down below”.

“It also appeared that the majority of skyscrapers were empty, and we quickly came to the realisation that Beijing is really just a ‘ghost-city’.”

These types of anecdotes are sometimes worth paying attention to.

It’s got Tolga Kumova in it. What more do you need?

How about why he just increased his Meteoric stake to 10.6 per cent, fresh out of raising more than $500,000 at a kid’s charity day with his broker mate Ben Kay at their polo club in country Victoria.

Meteoric is in Brazil, at “the scene of a gold rush in the 1980s when 20,000 of Garimpeiro’s Brazilian cousins swarmed in to the area to recover 500,000oz of gold from surface scratchings”.

We finally convinced a real broker with 35 years of stockbroking for some of the biggest houses and investors in both Australia and the UK to tell us their best war stories.

And loosely link them to current movements.

Promise we’ll never tell you who they are, but the stories are real, starting with this one about hanging out in Venezuela in the 80s to check out the oil scene, and what it has to do with the price of Bitcoin today.

Have a great weekend, and thanks for being a Stockhead this week. Go the Swans.