You might be interested in

News

Market Highlights: Tesla surges after Q1 update, iron ore slumps, and 5 ASX small caps to watch today

News

Things you may not know about Made in Australia, and ASX stocks that manufacture right here

News

News

That went quick.

But that’s Friday afternoons for you. Time flies when knock-offs beckons and suddenly you’re an hour late to the fun.

Yet Wednesday drags on forever.

Whatever. Some weeks, every day is hard to keep up with, so we’re here for you with this wrap of all the important bits you might have missed on Stockhead this week.

Kick back. Dive in.

This sound:

Because electric vehicles are quiet. Deathly quiet, and that’s a safety problem that needs solving.

The best option we’ve heard so far has to belong to Mercedes-AMG, which is currently collaborating with rock band Linkin Park on a “potent” artificial sound.

Regardless, the question got most of Stockhead’s readers into our weekly battery metals report, which also has some handy tips on how to tell if a battery metals project is any good and a junior explorer that jumped 90 per cent after striking brine in Argentina’s exotically named “Lithium Triangle”.

Here we go again with the escrow watch.

You lot can’t get enough news about several hundred million shares getting dumped on the ASX, and this fortnightly look has 300 million of them in it.

90 million are coming from Exore Resources (ASX:EXR) on March 29, but first up on Monday we’ll see the impact of meals provider Marley Spoon’s (ASX:MMM) release of 43 million shares.

And on Tuesday, CommsChoice (ASX:CCG) will lob more than half the company out there – 54 per cent of its shares come out of escrow.

There are 16 dumps all up in our cut-out-and-keep table. Shop till you drop, speculators.

Okay, so why did this 29-year-old investor took a six-figure stake in a $17m biotech company instead of buying 1,307,692 smashed avos on toast a house?

‘Cos he loves his grand-pappy, that’s why.

Especially when said grand-pappy is the former head of research at Johnson & Johnson Australia, and invented a synthetic antibiotic that can fight superbugs.

James Graham figured the owner of that tech, Recce Pharmaceuticals (ASX:RCE) is a better place for his life savings than the Great Australian Dream.

We’d love to think you clicked on this for the sage advice about whether childcare stocks will get a solid boost from the likely incoming federal Labor government.

We’d like to think you wanted to know how the kind of policy Labor is kicking around worked in other countries.

But we know you most likely got pulled in by the idea of “buying some babies”. And definitely had to get a better look at this adorable Bad Baby Panda:

Around this time last week, thousands of school kids around Australia were learning about the joys of protest.

Specifically, trying to get their peers and country’s leadership to acknowledge they’d cocked up the globe, possibly their future, and what were they going to do about it?

So far, sadly, not a whole lot. So we might have to rely on shaking our elders a bit and saying things like “Hey, your super could be in trouble here” to get their attention.

And we wouldn’t even be lying. Livestock darling Elders is now trading at 17-month lows and openly blames drought conditions. Here’s the skinny on all the other stocks that could be hit by global warming.

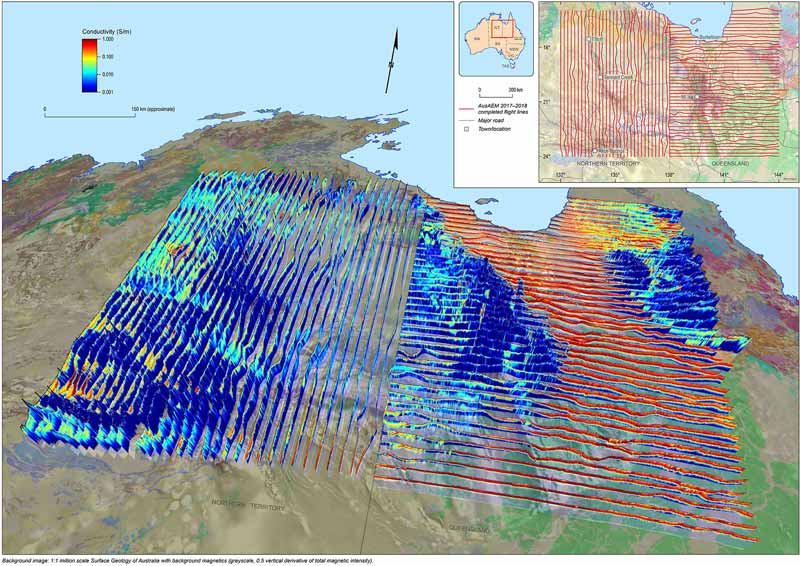

We really did. Look:

Basically, that’s a CT scan of where the metals are most likely to be. You’re looking for the red “high conductivity” bits.

At some points, the gadgets can scan down to 2km below the surface.

Federal government-backed Geoscience Australia has been collecting airborne electromagnetic (AEM) data since 2006 to more fully uncover the mineral potential of the country.

And it works — 13 explorers have already signed up for the next round of infill flying which is being done over an “equally large” area of the Northern Territory and Western Australia.

But for now, here are the ASX-listed small caps are playing in the hotspots.

“Have we got a video?”

Yes, we’ve got a video. Or to be precise, a new video format where we give company execs 90 seconds to explain what they’re up to.

Our first guinea pig was Talga Resources’ (ASX: TLG) managing director Mark Thompson, and he wanted to tell us about their new lithium batteries. His 90 seconds starts… now:

90 Seconds With Talga Resources from Stockhead on Vimeo.

Later in the week, Talga released news to the ASX to say it reckons it can make lithium ion batteries that defy freezing cold conditions.

Gamers were a little bit excited, a lot dubious when Google surprised everyone by announcing it was rolling out Google Stadia.

It’s a game-streaming platform. The “Netflix for gamers”.

But wait just a darn minute, wasn’t that the term kicked around for the past few months by Emerge Gaming (ASX:EM1)?

It’s been spruiking a new platform to hit Australia, the US and South Africa this year called ArcadeX.

So what do you do when Google takes your lunch and sits down to eat it before you can even try a bite?

Team up and try to take that bully down, like Emerge has done with fellow ASX-listed gaming stock iCandy (ASX:ICI).

Ah, election time. Annoying business, all that going to the local school to fill out a bit of paper that for the most part will turn out to have no relevance whatsoever to what it promised.

But we get a snag. And before the snag, comes the pork-barrelling.

The free stuff is heating up, and at a mining conference in WA last week federal shadow minister assisting for resources Madeleine King announced the previously promised “Australian Future Mines Centre” would be located in Perth.

That’s $23 million dropped right there. And WA unis will get $2 million worth of engineering scholarships.

Pinky promise.

Ever heard of a “prospect generator”?

In a nutshell, they’re “mineral explorers that focus on finding numerous, very promising early stage prospects using very technical methods”.

Which sounds like the kind of very rational business model you’d find a lot of use for in Australia, yet it’s not a hugely popular concept.

So we found a couple of prospect generators, Encounter Resources (ASX:ENR) and Predictive Discovery (ASX:PDI), and asked them what they’re all about.

Hint: There are good returns to be made, but they’re for the patient investor.

There’s a so-called set of “news values” journos used to be taught before it all got replaced with “does it have a funny fail GIF in it?”

Before even writing a story, you had to consider whether it ticked boxes like currency, impact, proximity, and conflict.

For some reason, “schadenfraude” was never one of them.

But holy frejoles, we love a loser. Especially a loser that isn’t us, like poor IOOF (ASX:IFL) shareholders who four months ago got lumped with 13 million shares in those healthy options takeways by the highway.

And last week walked away from 6 million of those shares, and wore a 62 per cent loss and gave us one of our most popular stories of the week.

What is wrong with you people?