Closing Bell: ASX rallies as RBA considers hiking rates; Bitcoin ETF to start trading on Thursday

News

News

Aussie stocks bounced back by +0.8% on Tuesday as the RBA expectedly left interest rates on hold at a 12-year high of 4.35%, following its two-day meeting.

In the press conference, Governor Michele Bullock said the board deliberated on the possibility of raising interest rates.

“In the end, it decided that its current strategy of staying the course and trying to bring inflation back down by bringing supply back to demand was the right way to go,” she said.

The market now believes that the likelihood of a rate cut before the end of 2024 has diminished due to slower-than-expected inflation reduction in the March quarter.

Despite economic slowdown, strong employment growth and a low jobless rate of about 4% have helped households manage rising living costs here in the country.

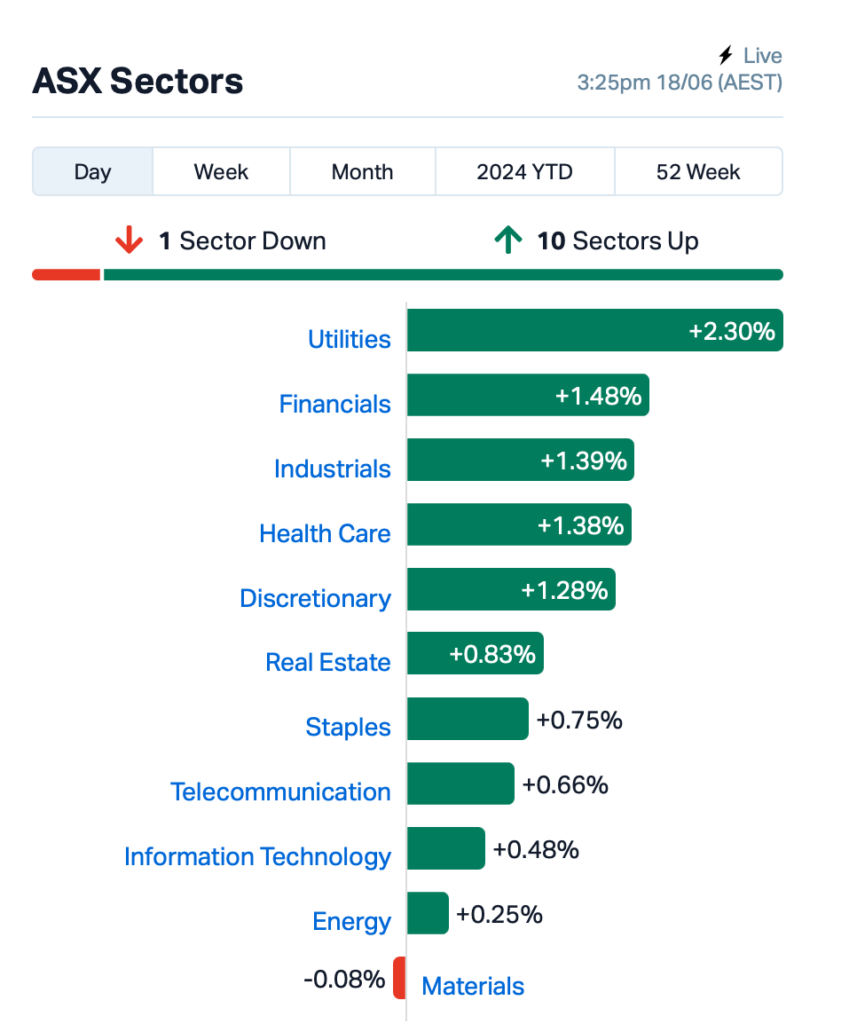

To the ASX, almost all sectors flashed green today, led by Utilities, Financials, and Industrials.

Among the biggest movers were lithium stock Pilbara Minerals (ASX:PLS), which was up more than 3%.

The big four banks all rallied by around 1% each, but Fortescue (ASX:FMG) tumbled by -5%.

There was no specific news released by FMG but there were reports by the AFR suggesting there was a $1.1 billion block trade in the iron ore giant after yesterday’s closing bell, done at $21.60 a share which was much lower than the closing price.

Still in large caps, Beach Energy (ASX:BPT) fell -2% after the company released a strategy paper that involves a cost-reduction program to cut over $150 million in annual field operating costs and capital expenditures.

Meanwhile, Bitcoin has fallen to a one-month low, trading now at US$65,580.

The downturn comes just as the ASX is set to launch its first bitcoin-linked exchange-traded fund (ETF) on Thursday. Approved after a three-year effort by VanEck, this ETF is expected to pave the way for more crypto-related products in the local market.

Across the region, Asian stock markets mainly rallied today, driven by a surge in major US tech shares that pushed Wall Street to a new record high last night.

Tesla’s China suppliers advanced on news of regulatory approval for testing its advanced driver-assistance system in Shanghai.

Meanwhile, an article written by Robert O’Brien, Trump’s last national security advisor, in the Foreign Affairs magazine has raised tensions between the US and China.

O’Brien said that if Donald Trump returns to the White House, his foreign policy might include cutting all economic ties with China, deploying the US Marine Corps to Asia, and resuming nuclear-weapons testing.

O’Brien, who could hold another key position if Trump is re-elected, argues for a strong response to China’s actions against the US. He suggests that Washington should actively work to separate its economy from China’s to counter its influence.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Glb Health | 0.040 | 33% | 1,364,667 | $1,093,493 |

| AKM | Aspire Mining Ltd | 0.390 | 30% | 1,265,898 | $152,291,096 |

| CCZ | Castillo Copper Ltd | 0.007 | 27% | 1,766,458 | $7,147,279 |

| WBE | Whitebark Energy | 0.014 | 27% | 244,033 | $2,112,004 |

| 88E | 88 Energy Ltd | 0.003 | 25% | 1,056,371 | $57,785,344 |

| RML | Resolution Minerals | 0.003 | 25% | 5,000,000 | $3,220,044 |

| RCR | Rincon | 0.090 | 22% | 13,428,707 | $21,334,620 |

| PL3 | Patagonia Lithium | 0.115 | 21% | 2,041,521 | $4,667,208 |

| JRV | Jervois Global Ltd | 0.018 | 20% | 13,669,739 | $40,541,457 |

| ION | Iondrive Limited | 0.012 | 20% | 1,367,432 | $6,048,566 |

| KRR | King River Resources | 0.012 | 20% | 19,396,561 | $15,535,249 |

| SI6 | SI6 Metals Limited | 0.003 | 20% | 2,995,833 | $5,922,149 |

| CYP | Cynata Therapeutics | 0.310 | 19% | 109,709 | $46,704,264 |

| IR1 | Irismetals | 0.330 | 18% | 132,602 | $37,389,795 |

| TNY | Tinybeans Group Ltd | 0.073 | 18% | 1,627,986 | $8,890,808 |

| NVQ | Noviqtech Limited | 0.041 | 17% | 75,072 | $5,205,584 |

| AS2 | Askarimetalslimited | 0.055 | 17% | 286,972 | $4,591,472 |

| BFC | Beston Global Ltd | 0.004 | 17% | 3,921,877 | $5,991,141 |

| VML | Vital Metals Limited | 0.004 | 17% | 1,035,537 | $17,685,201 |

| CDX | Cardiex Limited | 0.067 | 16% | 705,125 | $17,062,125 |

| PPY | Papyrus Australia | 0.015 | 15% | 536,583 | $6,405,004 |

| SRI | Sipa Resources Ltd | 0.015 | 15% | 109,224 | $2,966,056 |

| MM1 | Midasmineralsltd | 0.069 | 15% | 13,677 | $6,199,781 |

| BIO | Biome Australia Ltd | 0.425 | 15% | 2,176,954 | $78,795,014 |

Lithium brines explorer Patagonia (ASX:PL3) was boosted on Tuesday morning by reports “exceptional” results from well 2 at the Formentera project in Argentina.

“These results are exceptionally encouraging – high porosity, with lithium values concentrating at depth,” PL3 exec chair Phil Thomas said. “I have never seen core porosity at such high levels of 47% at 280m depth and lithium values at that porosity of 572ppm.

“Pumping from well 2 during the 48 hours didn’t reduce the brine level in well 1, 300m away, so we are confident we have a very large aquifer open at depth.”

Independent aerospace composite business Quickstep Holdings (ASX:QHL) was also flying high, after delivering an update to the market on how things are progressing with its role in producing components for the F-35 fighter jet, as it approaches the midpoint of its initial volume buildout.

While the company notes that overall demand for its product related to the F-35 project is going to decline by as much as 8% in the near term, it has streamlined its production process to ensure that program margins remain consistent despite this lower demand.

And privacy-focused photo sharing app Tinybeans (ASX:TNY) has secured a major US strategic partnership with leading digital parenting platform Babylist. The partnership is expected to deliver brand awareness, subscriber growth and sales revenue for Tinybeans in the US, the company says.

Cardiex (ASX:CDX) jumped +15% after reporting a sales update. The company said its sales have been strong, pointing towards potential record revenues for FY24. Significant contributions have come from its pharmaceutical sales division and markets serving research and clinicians. Projected revenues for FY24 are now expected to exceed $12 million, a substantial increase from $6.01 million in FY23. Sales to the research market in May marked a six-month high, and with June historically being its strongest month in this sector. Additionally, under new leadership, CDX’s pharmaceutical team is actively exploring multiple new opportunities, aiming to sustain sales growth from FY24 into FY25.

Thie critical metals (REEs, niobium, copper, gold) junior, Rincon Resources (ASX:RCR), announced the identification of three “high-priority” iron oxide copper-gold (IOCG) targets following the results of a geological survey (DDIP – dipole-dipole induced polarisation) at the Pokali Prospect, within its West Arunta Project in Western Australia. The project is prospective for IOCG style mineralisation as well as “orogenic” gold mineralisation.This latest surveying has highlighted a 2.7km-long ‘induced polarisation’ (IP) chargeability trend along the southern extent of the Pokali IOCG mineral system and remains open to the west and east, although with the caveat that it appears to weaken in the eastern direction.

Antilles Gold (ASX:AAU) announced that it’s undertaking a non-renounceable entitlement offer of one new share for every one held by ‘Eligible Shareholders’ on Thursday, 20 June 2024 at an issue price of $0.004 per share, along with one free attaching option for every two shares applied for. The plan there is to raise up to $3,986,139, to be applied in various ways, but namely towards the completion of an in-fill drilling program, revised Mineral Resource Estimate, Preliminary Feasibility Study and permitting for the company’s flagship Nueva Sabana gold-copper mine development in Cuba.

In early May Antilles revealed results from a Scoping Study regarding the proposed Nueva Sabana gold-copper mine.

Details from that reveal that the Nueva Sabana deposit has a small 3g/t gold cap, an underlying copper-gold zone, and a deeper sulphide copper zone open at depth at 150m, and could potentially transition into the El Pilar porphyry copper deposit which is offset to the south.

Dreadnought Resources (ASX:DRE)’s recent mapping and sampling at Tiger in Mangaroon has confirmed the presence of high-grade copper (Cu), gold (Au), zinc (Zn), and silver (Ag) in multiple layers of exposed gossan spanning approximately 500m. This includes some of the highest grades recorded so far, such as TIG026 with 8.7% Cu, 9.0% Zn, 40.7g/t Ag, and 1.0g/t Au, and TIG027 with 10.5% Cu, 4.6% Zn, 16.3g/t Ag, and 1.0g/t Au. These findings highlight significant mineralization potential in the area.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 11,757,380 | $11,649,361 |

| 1MC | Morella Corporation | 0.002 | -33% | 1,172,891 | $18,536,398 |

| MTB | Mount Burgess Mining | 0.001 | -33% | 97 | $1,947,220 |

| RIL | Redivium Limited | 0.002 | -33% | 40,000 | $8,192,564 |

| SFG | Seafarms Group Ltd | 0.002 | -33% | 15,518,639 | $14,509,798 |

| MAY | Melbana Energy Ltd | 0.044 | -33% | 64,145,120 | $222,433,471 |

| RC1 | Redcastle Resources | 0.018 | -31% | 4,121,337 | $8,535,388 |

| EVR | Ev Resources Ltd | 0.005 | -29% | 277,554 | $9,248,900 |

| ERL | Empire Resources | 0.003 | -25% | 45,000 | $5,935,653 |

| LSR | Lodestar Minerals | 0.002 | -25% | 317,734 | $4,046,795 |

| NMR | Native Mineral Res | 0.026 | -24% | 110,000 | $7,134,917 |

| IS3 | I Synergy Group Ltd | 0.010 | -23% | 1,500,000 | $4,603,045 |

| HXG | Hexagon Energy | 0.011 | -21% | 481,402 | $7,180,823 |

| BCT | Bluechiip Limited | 0.004 | -20% | 109,207 | $5,910,198 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 800,000 | $15,000,000 |

| ROG | Red Sky Energy. | 0.004 | -20% | 1,649,752 | $27,111,136 |

| YPB | YPB Group Ltd | 0.002 | -20% | 517,333 | $2,019,904 |

| NYM | Narryermetalslimited | 0.033 | -20% | 75,000 | $4,358,549 |

| EOF | Ecofibre Limited | 0.034 | -19% | 743,238 | $15,912,704 |

| EMH | European Metals Hldg | 0.260 | -19% | 124,542 | $66,382,306 |

| EG1 | Evergreenlithium | 0.053 | -18% | 819,987 | $3,654,950 |

| ZLD | Zelira Therapeutics | 0.365 | -17% | 16,604 | $4,992,748 |

| TFL | Tasfoods Ltd | 0.015 | -17% | 34,250 | $7,867,719 |

| AMD | Arrow Minerals | 0.003 | -17% | 9,150,383 | $31,618,095 |

Cosmo Metals’ (ASX:CMO) 4000m aircore drill program across the Don Álvaro prospect at its Kanowna gold project will target historical intercepts which returned up to 5.3g/t gold.

CuFe’s (ASX:CUF) geology team have uncovered further niobium and tantalum potential from rock chip results at the North Dam project near Coolgardie.

Frontier Energy (ASX:FHE) has signed a contract with Western Power, which will start detailed design and procurement of long lead items for interconnection works for FHE’s Waroona renewable energy project.

The US FDDA has extended Rare Paediatric Disease Designation (RPDD) to Race Oncology’s (ASX:RAC) oncology drug – RC220. This gives the drug eligibility to receive a Priority Review Voucher (PRV) upon marketing approval.

Recharge Metals (ASX:REC) has started its 2024 exploration season at the Wapistan project in the lithium-rich James Bay region of Quebec, Canada.

Sprintex (ASX:SIX) has taken a key step forward in supplying its G15 commercial blowers to a leading US vacuum pump and blower manufacturer after signing an evaluation contract.

Latest field work at St George Mining’s (ASX:SGQ) Destiny project near Coolgardie has uncovered the large, intrusive C1 target with potential for niobium-REE mineralisation.

Sun Silver (ASX:SS1) has discovered a new high-grade target at its globally significant Maverick Springs project in Nevada with hits of up to 6216g/t silver.

Comet Ridge (ASX:COI) has expanded its position in the Mahalo gas hub in Queensland with the award of a new block that hosts part of a high quality, shallow fairway that has been extensively appraised and proven to be capable of excellent gas production from three separate pilot production tests.

And Corazon Mining (ASX:CZN) has received firm commitments to raise around $340,000 via a placement at $0.0065 per share – plus up to $1m via a share purchase plan – to fund accelerated exploration at its Mt Gilmore project in NSW, with a maiden drilling program at the May Queen porphyry copper-gold target planned for July.

Elixir Energy (ASX:EXR) – pending an announcement by the Company with respect to new acreage in Queensland.

City Chic Collective (ASX:CCX) – pending the proposed divestment of Avenue and an equity capital raising.

Sacgasco (ASX:SGC) – pending an announcement to the market in relation to a capital raising.

Antipa Minerals (ASX:AZY) – pending an announcement in relation to a proposed capital raising.

MMA Offshore (ASX:MRM) – pending an update in relation to a Scheme of Arrangement between MRM and Cyan MMA Holdings.

At Stockhead, we tell it like it is. While Comet Ridge, Corazon Mining, Cosmo Metals, CuFe, Frontier Energy, Recharge Metals, Sprintex, St George Mining and Sun Silver are Stockhead advertisers, they did not sponsor this article.