ASX Small Cap Lunch Wrap: Who’s more interesting than Harry and Meghan today? (Hint: everyone.)

News

News

For those tired of the Harry and Meghan tell-all spectacle on TV hosted by talk show queen Oprah Winfrey there is another distraction.

Airline and travel stocks. Both are starting to climb again with the roll-out of COVID-19 vaccines worldwide and on rising optimism that people will be able to take international trips.

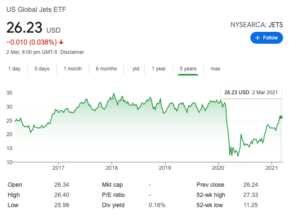

The US Global Jets exchange-traded fund is up 18 per cent so far this year, after falling 61 per cent over February to May 2020.

The fund invests in US and international passenger airlines, aircraft manufacturers, airports and terminal services companies.

Stocks included in the fund are Southwest Airlines, Delta Air, American Airlines, Air Canada, Cargojet and Alaska Air Group.

If anything, the US Global Jets ETF is a barometer of attitudes towards international travel and investor optimism about life post-COVID.

At lunchtime in Sydney, the ASX All Ordinaries index was fractionally in the green at 7,053 points, up 0.6 per cent on Tuesday’s market close.

All three major US stock indexes fell overnight, with the S&P 500 down 0.8 per cent, the Nasdaq 1.7 per cent lower, and the Down Jones 0.4 per cent lighter.

Bitcoin’s price was hovering around $62,000 in Australian terms, and has whipsawed around since peaking at $74,000 in late February.

The price of gold in US dollars slipped to $US1,735 per ounce ($2,215/ounce) as the market awaited news of the US government’s latest COVID-19 economic stimulus.

Ten-year bond prices were steady after a volatile few days of trading, with the US yield at 1.41 per cent and Australia’s at 1.71 per cent.

Here are the best performing ASX small cap stocks at 12pm Wednesday March 3:

Swipe or scroll to reveal the full table. Click headings to sort.

| CODE | NAME | PRICE | % CHANGE | VOLUME | MARKET CAP |

|---|---|---|---|---|---|

| ANL | Amani Gold Ltd | 0.0015 | 50 | 1617902 | $ 10,786,996.75 |

| CLZ | Classic Min Ltd | 0.0015 | 50 | 17037500 | $ 17,556,867.35 |

| BRK | Brookside Energy Ltd | 0.014 | 27 | 80279963 | $ 18,166,044.52 |

| DAV | Davenport Resources | 0.079 | 25 | 4233263 | $ 26,658,231.77 |

| EZZ | EZZ Life Science | 0.625 | 25 | 1567664 | $ 6,000,000.00 |

| DDD | 3D Resources Limited | 0.005 | 25 | 4460753 | $ 14,481,488.37 |

| FSG | Field Solu Hldgs Ltd | 0.088 | 24 | 1167960 | $ 37,895,491.22 |

| VML | Vital Metals Limited | 0.076 | 23 | 63232987 | $ 165,831,066.56 |

| OBM | Ora Banda Mining Ltd | 0.3 | 22 | 1974223 | $ 206,344,379.47 |

| ALT | Analytica Limited | 0.003 | 20 | 1000000 | $ 8,799,030.83 |

| NPM | Newpeak Metals | 0.003 | 20 | 1176682 | $ 12,185,403.25 |

| ROG | Red Sky Energy. | 0.003 | 20 | 4608077 | $ 11,503,555.49 |

| SHE | Stonehorse Energy Lt | 0.024 | 20 | 18905221 | $ 9,900,919.22 |

| ARN | Aldoro Resources | 0.225 | 18 | 381951 | $ 12,935,352.57 |

| AX8 | Accelerate Resources | 0.059 | 18 | 14255086 | $ 7,842,389.70 |

| CWX | Carawine Resources | 0.4 | 18 | 3122827 | $ 37,022,566.68 |

| BMN | Bannerman Resources | 0.12 | 17 | 3555389 | $ 124,859,466.69 |

| GBZ | GBM Rsources Ltd | 0.115 | 15 | 665832 | $ 43,301,806.00 |

| HWK | Hawkstone Mng Ltd | 0.046 | 15 | 166730729 | $ 65,136,430.92 |

| MRD | Mount Ridley Mines | 0.004 | 14 | 635706 | $ 13,582,185.13 |

| BOE | Boss Energy Ltd | 0.16 | 14 | 10517056 | $ 258,432,736.80 |

| AVH | Avita Medical | 6.48 | 13 | 569281 | $ 385,428,585.60 |

Gold explorer Accelerate Resources (ASX:AX8) raced out of the starting gate Wednesday on announcing impressive drilling hits at its Rossland gold project in British Columbia.

Three drill holes at the company’s Gertrude prospect showed hits including 17.68 grams per tonne (g/t) gold over 1.87m from 4.14m, and 0.29m at 110 g/t gold from 4.75m.

Accelerate Resources said it will carry out further drilling on specific targets at its Gertrude prospect within its Rossland gold project in Western Canada.

Consumer health products company EZZ Life Science Holdings (ASX:EZZ) was in demand after the company listed on the ASX in a $6m IPO.

EZZ Life Science’s product offering includes branded skin care products which it distributes through supermarkets, pharmacies and retailers in Australia and New Zealand.

Tesla spodumene concentrate supplier Piedmont Lithium (ASX:PLL) was another climber Wednesday as it progressed its plans to list on the US Nasdaq stock exchange.

A shareholder meeting has been convened for April to approve the move of the company’s primary listing to the US and it will retain a secondary listing on the ASX in Australia.

Piedmont Lithium has operations in the US state of North Carolina and will supply raw material for Tesla’s EV lithium-ion batteries made at its US Gigafactory.

Here are the worst performing ASX small cap stocks at 12pm Wednesday March 3:

Swipe or scroll to reveal the full table. Click headings to sort.

| CODE | NAME | PRICE | % CHANGE | VOLUME | MARKET CAP |

|---|---|---|---|---|---|

| NCL | Netccentric Ltd | 0.205 | -31 | 2,064,197 | $77,437,500 |

| CCE | Carnegie Cln Energy | 0.0045 | -25 | 232,894,867 | $76,488,519 |

| WTL | WT Financial Group Ltd | 0.09 | -22 | 34,175 | $19,224,769 |

| GLE | GLG Corp Ltd | 0.285 | -19 | 21,977 | $25,935,000 |

| CAE | Cannindah Resources | 0.045 | -18 | 804,895 | $15,754,456 |

| DDD | 3D Resources Limited | 0.005 | -17 | 8,517,256 | $21,722,233 |

| GTG | Genetic Technologies | 0.01 | -17 | 37,934,468 | $108,170,721 |

| MLS | Metals Australia | 0.0025 | -17 | 26,907,016 | $12,572,711 |

| ATR | Astron Corp Ltd | 0.35 | -15 | 36,500 | $50,215,602 |

| DDT | DataDot Technology | 0.006 | -14 | 272,714 | $8,693,086 |

| TYX | Tyranna Res Ltd | 0.007 | -13 | 100,000 | $10,258,885 |

| BEM | Blackearth Minerals | 0.105 | -13 | 2,688,359 | $20,139,298 |

| ISD | Isentia Group Ltd | 0.097 | -12 | 855,716 | $22,000,000 |

| RCP | Redbank Copper Ltd | 0.115 | -12 | 2,351,619 | $53,315,677 |

| ONX | Orminexltd | 0.033 | -11 | 234,602 | $20,012,733 |

| INF | Infinity Lithium | 0.17 | -11 | 1,361,663 | $76,171,335 |

| VML | Vital Metals Limited | 0.07 | -10 | 59,700,785 | $208,626,181 |

| VR1 | Vection Technologies | 0.089 | -10 | 7,066,744 | $95,619,056 |

| KTE | K2 Energy Ltd | 0.045 | -10 | 801,000 | $15,032,858 |

| AMD | Arrow Minerals | 0.009 | -10 | 5,521,725 | $13,323,818 |

| AMG | Ausmex Mining Gp Ltd | 0.056 | -10 | 2,165,468 | $34,091,333 |

| PLL | Piedmont Lithium Ltd | 0.96 | -10 | 6,094,805 | $1,481,279,195 |

Exploration company Sabre Resources (ASX:SBR) sustained a heavy share price fall in early trade after announcing disappointing drilling results for its Bonanza gold project.

Trending structures identified last August in an aeromagnetic survey were interpreted to be splays off the Youanmi Shear that hosts the Penny West gold project in WA. Assay results received for a drilling program at Bonanza in January showed “no significant gold intersections”, said the company.

Biopharma company Bionomics’ (ASX:BNO) share price fell in early trade despite completing a capital raising for $15.9m in a share placement priced at 14.5 cents per share.

The company is developing treatments for Alzheimer’s disease in partnership with Merck & Co and for post traumatic stress disorder.

Profit-taking knocked down the share price of casino stock Aquis Entertainment (ASX:AQS) in Wednesday trade after its share price gained 1,100 per cent in February.

The strong run-up in Aquis Entertainment’s share price was based on little discernible news from the company during the month.

The company released on Friday its preliminary financial report for the half-year ended December 2020 that showed a 23.7 per cent year on year decrease in revenue to $18.9m. Net profit for the half year increased 120 per cent on year to $798,000, following a loss of $3.9m for the December 2019-ended half year.

Aquis Entertainment’s share price took off as its competitor Crown Resorts (ASX:CWN) faced inquiries into its Melbourne and Perth operations after a probe into its Sydney casino.

Technology company TZ Limited (ASX:TZL) traded lower without releasing any update and after reporting a loss of $539,880 for the December 2020-ended half year.

The company said it is seeing more interest in its smart locker product from companies needing storage for staff belongings and IT equipment in a COVID-19 environment.