Another Lev Mizikovsky company made an ‘unexpected’ profit in January

News

News

If it’s a company involving eccentric Brisbane businessman Lev Mizikovsky, you can be sure its announcements will be entertaining.

AstiVita, home fit-out supplier, is no exception: this morning it innocently, sweetly announced it had made an “unexpected” profit for the month of January.

The unaudited, before-tax profit of $30,000 came despite the company’s frank admission January is traditionally its slowest trading month, with “the building industry on holidays for the first two weeks and general retail sales slow after the Christmas break”.

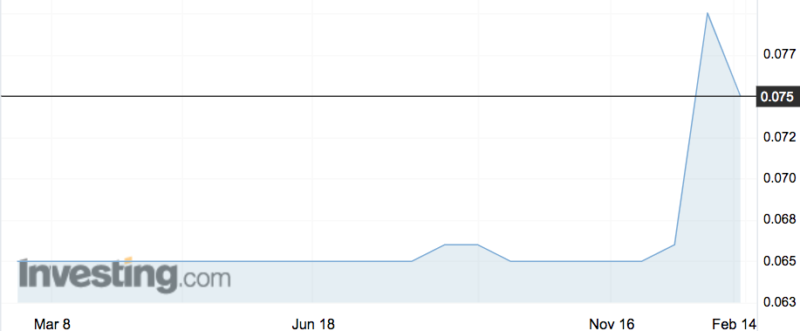

AstiVita (ASX:AIR) shares fell slightly on the news however, down 6 per cent to 7.5c.

That share price jump in January looks extreme but represents only 21 per cent – the company’s shares traded between 6.5c and 6.6c from mid-October 2017 until late January 2019.

Mr Mizikovsky has had a rollercoaster start to the year, with one of his companies, Tamawood (ASX:TWD) announcing a profit downgrade while another, Advance Nanotek (ASX:ANO), has been using the ASX to respond to randoms on popular stock gossip forum HotCopper.

He is also a significant shareholder in debt agency Collection House (ASX:CLH), which has its own tumultuous back story.

“AstiVita continues to work hard on its e-commerce business and diversification strategy into new non-traditional product lines,” Mr Mizikovsky told shareholders.

“Significant progress has been made in utilising Amazon fulfilment capabilities for logistics and warehousing, creating further savings. The pre-existing range of products has been further consolidated with progress being made in liquidating aging stock.

“The lease on our new premises has been signed, including 50% reduction in annual rate and rent free period until 30 June 2019. The Board is of the belief that in FY20, the company should start producing acceptable results.”