IPO Watch: Will Candy Club get eaten before it makes it to the ASX?

IPO Watch

IPO Watch

Australia’s sweetest investment deal may not make it to an Initial Public Offer if an American stalking horse has an early takeover in mind.

US-based subscription sweets business Candy Club is running a $3 million pre-IPO fund raising round for select investors in Australia, as it gears up to a promised listing at the end of the year.

But Candy Club chief and founder Keith Cohn says he’s about to have his seventh meeting with a major US confectionary company next week which wants a majority stake.

Mr Cohn expects the business to be taken over within five years.

He believes it’s unlikely a bigger company will want to go through the faff of setting up a small scale online subscription candy business, when they could just buy his.

Mr Cohn is a veteran of setting up and selling companies, having sold toys and ads in the US since the late 1980s. He started Candy Club out of LA in 2014.

Candy Club is focused entirely on the $36 billion US sweets market but is hitting up Australian investors for a few reasons: they’ve already got James Baillieu, the nephew of former Victorian premier Ted, and rich lister cum writer Adam Schwab on board.

Mr Cohn says he doesn’t want to get lost in the noise of the Nasdaq — they’ll only be looking for a post-IPO market cap of about $20-22 million.

If anyone in the US is out to copy Candy Club, he thinks it’s easier to fly under the radar in Australia.

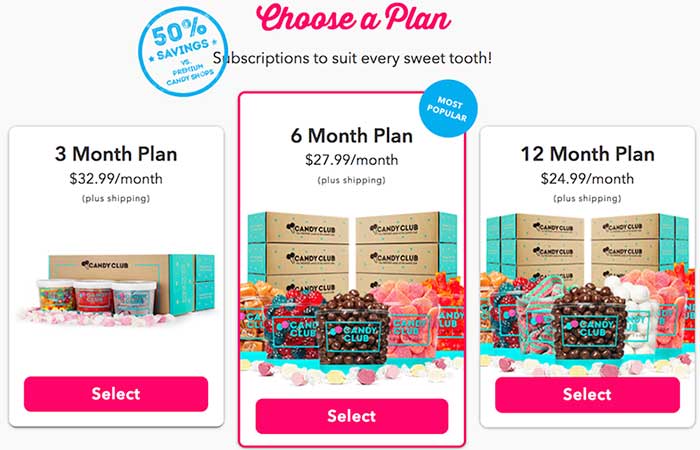

The company is making money from “soccer mums”, urban couples with no kids, and seniors with grandchildren, who take out monthly subscriptions for boxes of three or six tubs of lollies.

Sweets range from spicy jalapeno jelly babies to Hersey’s peanut butter cups and jellybeans.

Mr Cohn says he can make $15 million in revenue from the 22,000 subscribers and a handful of corporate customers this year.

The business is expected to be profitable by the end of 2018 and has set an ambitious three-year revenue target of $50 million.