IPO Watch: Resources who? The tech scene is where it’s at now

IPO Watch

IPO Watch

The resources floats are getting fewer and further between as 2019 progresses and the tech teams are now the ones racing to ring the ASX bell.

Investors are not loving the newly minted resources players right now, with more than 68 per cent of companies that have listed in the past year losing ground.

Just three of the 22 recent resources listings have made gains, and three are back trading at their IPO issue price.

Then there’s West Australia-focused gold explorer Coolgardie Minerals (ASX:CM1), which couldn’t even make it a year as an ASX-listed company before going into administration.

Here’s a list of IPO performances over the past year:

Swipe or scroll for full table

| Listing Date | ASX Code | Company | IPO Price | Intra-Day Price April 23 | Percentage Change |

|---|---|---|---|---|---|

| 01/29/2019 | SPT | Splitit Payments | 0.2 | 1.095 | 4.475 |

| 09/21/2018 | AGH | Althea Group Holdings | 0.2 | 0.5 | 1.5 |

| 12/28/2018 | AMS | Atomos | 0.41 | 0.935 | 1.28048780488 |

| 12/18/2018 | EX1 | Exopharm | 0.2 | 0.45 | 1.25 |

| 03/29/2019 | EOF | Ecofibre | 1 | 2.26 | 1.26 |

| 02/13/2019 | UWL | Uniti Wireless | 0.25 | 0.525 | 1.1 |

| 10/15/2018 | SMX | Security Matters | 0.2 | 0.41 | 1.05 |

| 02/22/2019 | MPH | Mediland Pharm | 0.2 | 0.35 | 0.75 |

| 07/18/2018 | KTD | Keytone Dairy Corp | 0.2 | 0.345 | 0.725 |

| 12/13/2018 | EMV | EMvision Medical Devices | 0.25 | 0.39 | 0.56 |

| 05/16/2018 | S66 | Star Combo Pharma | 0.5 | 0.73 | 0.46 |

| 05/29/2018 | PYG | PayGroup | 0.5 | 0.68 | 0.36 |

| 04/18/2019 | NXS | Next Science | 1 | 1.66 | 0.66 |

| 07/20/2018 | CXL | Calix | 0.53 | 0.725 | 0.367924528302 |

| 08/20/2018 | NIC | Nickel Mines | 0.35 | 0.4475 | 0.278571428571 |

| 05/25/2018 | CPV | Clearvue Technologies | 0.2 | 0.24 | 0.2 |

| 07/30/2018 | CR1 | Constellation Resources | 0.2 | 0.235 | 0.175 |

| 04/17/2019 | RDY | Readytech Holdings | 1.51 | 1.76 | 0.165562913907 |

| 08/15/2018 | TMR | Tempus Resources | 0.2 | 0.22 | 0.1 |

| 12/12/2018 | HMD | HeraMED | 0.2 | 0.22 | 0.1 |

| 03/07/2019 | CBY | Canterbury Resources | 0.3 | 0.31 | 0.0333333333333 |

| 12/05/2018 | CRS | Caprice Resources | 0.2 | 0.2 | 0 |

| 12/14/2018 | YRL | Yandal Resources | 0.2 | 0.2 | 0 |

| 02/14/2019 | A1G | African Gold | 0.2 | 0.2 | 0 |

| 07/09/2018 | PGX | Primero Group | 0.4 | 0.39 | -0.025 |

| 11/30/2018 | RDC | Redcape Hotel Group | 1.13 | 1.065 | -0.0575221238938 |

| 12/13/2018 | TYM | Tymlez Group | 0.22 | 0.2 | -0.0909090909091 |

| 07/13/2018 | VEA | Viva Energy Group | 2.5 | 2.405 | -0.038 |

| 09/11/2018 | HLA | Healthia | 1 | 0.9 | -0.1 |

| 11/29/2018 | NWM | Norwest Minerals | 0.2 | 0.18 | -0.1 |

| 06/22/2018 | WGB | WAM Global | 2.2 | 1.91 | -0.131818181818 |

| 09/12/2018 | 14D | 1414 Degrees | 0.35 | 0.305 | -0.128571428571 |

| 07/05/2018 | RMY | RMA Global | 0.25 | 0.2 | -0.2 |

| 05/30/2018 | KRX | Koppar Resources | 0.2 | 0.16 | -0.2 |

| 07/06/2018 | WOA | Wide Open Agriculture | 0.2 | 0.16 | -0.2 |

| 07/27/2018 | NSB | NeuroScientific Biopharmaceuticals | 0.2 | 0.16 | -0.2 |

| 10/17/2018 | ID8 | Identitii | 0.75 | 0.56 | -0.253333333333 |

| 09/17/2018 | VEN | Vintage Energy | 0.2 | 0.15 | -0.25 |

| 10/23/2018 | CRN | Coronado Global Resources | 4 | 2.92 | -0.27 |

| 08/24/2018 | KWR | Kingwest Resources | 0.2 | 0.155 | -0.225 |

| 05/29/2018 | GAL | Galileo Mining | 0.2 | 0.125 | -0.375 |

| 10/31/2018 | WWG | Wiseway Group | 0.5 | 0.335 | -0.33 |

| 09/21/2018 | AR9 | Archtis | 0.2 | 0.12 | -0.4 |

| 05/14/2018 | ED1 | Evans Dixon | 2.5 | 1.6 | -0.36 |

| 09/13/2018 | ARN | Aldoro Resources | 0.2 | 0.12 | -0.4 |

| 02/19/2019 | CLB | Candy Club Holdings | 0.2 | 0.12 | -0.4 |

| 06/13/2018 | VN8 | Vonex | 0.2 | 0.105 | -0.475 |

| 10/02/2018 | SGI | Stealth Global Holdings | 0.2 | 0.1 | -0.5 |

| 10/19/2018 | QEM | QEM | 0.2 | 0.1 | -0.5 |

| 11/07/2018 | MOH | Moho Resources | 0.2 | 0.09 | -0.55 |

| 11/08/2018 | GSM | Golden State Mining | 0.2 | 0.088 | -0.56 |

| 11/30/2018 | NVU | Nanoveu | 0.2 | 0.081 | -0.595 |

| 12/20/2018 | FIJ | Fiji Kava | 0.2 | 0.081 | -0.595 |

| 08/16/2018 | SLZ | Sultan Resources | 0.2 | 0.056 | -0.72 |

| 07/26/2018 | RFR | Rafaella Resources | 0.2 | 0.07 | -0.65 |

| 06/19/2018 | B2Y | Bounty Mining | 0.35 | 0.11 | -0.685714285714 |

| 06/21/2018 | RZI | Raiz Invest | 1.8 | 0.53 | -0.705555555556 |

| 04/27/2018 | SIL | Smiles Inclusive | 1 | 0.165 | -0.835 |

| 08/30/2018 | CM1 | Coolgardie Minerals* | 0.2 | 0.052 | -0.74 |

*Administrators appointed to Coolgardie Minerals on February 28.

So it’s probably not surprising that there are only three resources players that have launched IPOs that are still trying to make it onto the ASX — and they are all in gold.

The trend seems to be geared towards small cap tech stocks.

And it’s the most evident in the buy now, pay later space.

Splitit (ASX: SPT) has been the most closely watched stock since it lit up the boards on January 29 this year.

The IPO came on the back of a strong year for competitors Afterpay (ASX: APT) and ZipCo (ASX: Z1P), which both posted strong gains in 2018.

And the platforms stayed front and centre into the new year, ahead of a Senate committee review on the sector at the end of February.

The committee was formed in response to community concerns that buy now, pay later platforms constitute a form of predatory lending.

But critically, lawmakers stopped short of a ruling that would’ve forced companies in the space to implement stricter credit checks — similar to the standards imposed on a bank.

Splitit has been the greatest beneficiary of this sector growth and the positive Senate outcome — hitting an all-time intraday high of $2 a share on March 11, making it a 10-bagger in just under a month and a half.

It is still up nearly 450 per cent at $1.10.

Atomos (ASX:AMS), which makes and sells camera add-ons for amateur Instagrammers and professional photographers, has also done pretty well for itself, gaining 128 per cent since listing at the end of 2018.

It is trading around 94c at the moment.

Brand protection, supply chain integrity and blockchain tech company Security Matters (ASX:SMX) has more than doubled its share price to 41c.

The tech space is pretty vast, ranging from software and website development right through to hardware and social networking, according to Dean Fergie, director & portfolio manager at Cyan Investment Management.

“I guess the whole sector is just rife with entrepreneurs that are looking to try and do the next big thing,” he told Stockhead.

“The beauty in I suppose the Australian market is it’s so broad that if you want to be looking at online security or recruitment or online textbooks or whatever, you can do all that in the small cap market of Australia.”

>>Read more about Dean Fergie’s thoughts on the tech space here

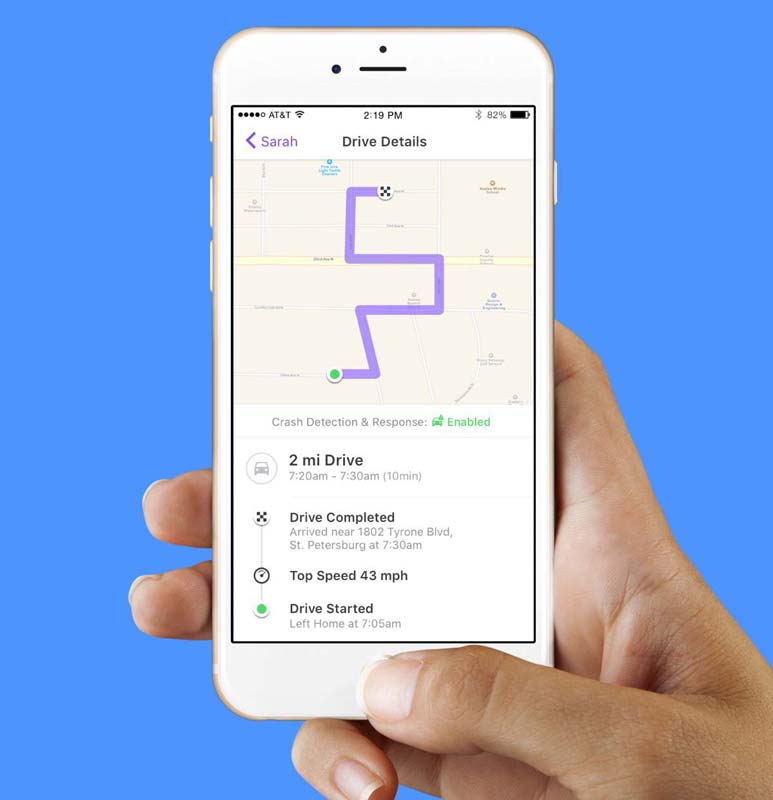

Life360 (ASX:360) has recently launched its IPO.

The company’s flagship product is a smartphone app that provides families with information like where their loved ones are, details on their driving performance and even how close they might be to a potential crime.

The San Francisco-based company operates what is called a “freemium” model, which means users can subscribe for free but have to pay to unlock premium subscription options.

Life360 is aiming to raise $145.43m by issuing CHESS Depository interests (CDIs) priced at $4.79 each.

CDIs are a proxy for trading foreign shares on the ASX.

If Life360 is successful, the company will have a market value of nearly $820m on listing – which is slated for May 17.

Powerwrap (ASX:PWL) is also planning its debut, which is penned in for May 23.

The company has developed a tech-based platform that helps wealth advisors manage their clients’ investment portfolios.

Powerwrap is hoping to raise $17.4m by selling shares at 35c each.

Also eventually said to be launching an IPO in September this year is artificial intelligence start-up MyWave.

The AFR reported last week that the company, which was founded by National Australia Bank director Geraldine McBride, had raised $3m in seed funding.

MyWave takes customer data from big energy companies, banks and insurers and applies artificial intelligence to provide more personalised experiences for customers.

It can help with things like savings or determining the best energy or insurance plan for a customer.

Here’s a list of upcoming floats:

Swipe or scroll for full table

| Company | ASX code | IPO status | Focus | Fund raising | Issue price |

|---|---|---|---|---|---|

| AltoStratos | ATO | Withdrawn | Supply chain delivery technology | $16-$25m | 40c |

| Australian Family Lawyers | AFL | Offer closes April 29; Listing set for May 10 | Law firm | $4-$6.5m | 20c |

| Australian Industrial Minerals | AAM | Withdrawn | Industrial minerals | $5m | 25c |

| Australian Nutrition & Sports | AN1 | Was due to list Apr 3; ASIC has issued an interim stop notice | Dairy formula | $5-$8m | 20c |

| AXS Group | AXS | Offer date extended to April 19; Listing date extended to April 26 | Software provider to the finance, insurance and funds sector | $7m | 25c |

| Carnaby Resources | - | Prospectus not yet issued; Considering listing in 2019 | Gold | - | - |

| Expose Resources | EXX | Listing date extended to April 10 | Gold | $4.5m | 20c |

| Frugl | Pre-IPO funding; planning listing | Grocery price comparison | - | - | |

| Gold Tiger Resources | GRA | Offer closing May 10; Listing planned for May 22 | Gold | $4-$5m | 20c |

| irexchange | IRX | Withdrawn | Retail tech | $17.5m | 90c |

| Jobstore Group | JOB | Was due to list Dec 5 | AI-powered recruitment | $6.6-8m | 20c |

| Koligo Therapeutics | KOL | Closing date extended to April 23; Listing date extended to May 7 | Regenerative medicine | $6-$7m | 20c |

| Life360 | 360 | Offer due to close May 8; Listing penned in for May 17 | Location-based services applications | $145.43m | $4.79 |

| Melior Resources | Seeking ASX-listing in 2019 | Mineral sands | $5m | ||

| Mont Royal Resources | MRZ | Listing set for May 15 | Gold | $5m | 20c |

| Powerwrap | PWL | Offer closes May 3; Due to list May 23 | Investment software platform | $17.4m | 35c |

| Rolek Resources | RLK | Backdoor listing cancelled | Manganese | $5m | 2c |

| Trigg Mining | TMG | Postponed until 2019 | Potash | - |