IPO Watch: Resources floats have been scarce in 2019, but that might be about to change

IPO Watch

IPO Watch

The start of 2019 has been a little subdued for resources plays, with just African Gold (ASX:A1G) so far successfully making its debut on the local bourse.

But it was some kind of entrance – A1G doubled its share price in the first eight minutes as a publicly listed company. It’s still trading at a 20 per cent premium to its 20c issue price.

Next, copper and gold explorer Canterbury Resources is aiming to light up the ASX boards. It has penned in an expected date of February 28, but has not yet been admitted to the “Official List”.

Canterbury, which has copper and gold exploration projects in Papua New Guinea and Queensland, was originally hoping to be listed by the end of October last year.

But the “headwinds of volatile markets” and “Donald Trump’s tweeting” made it a little challenging, director Grant Craighead told Stockhead last month.

Canterbury closed its reduced $6m IPO on December 28 and thought it might make its debut in the “latter part of January”.

The company had the cash, but just needed the spread of shareholders required by the ASX, so it extended the offer to February 20.

In the March quarter of 2018, there were a total of 20 new IPOs, but so far in the first quarter of this year we have only seen about five new IPOs, with another eight potentially to list before the end of the quarter.

Just three of those eight still to come this quarter are resources companies.

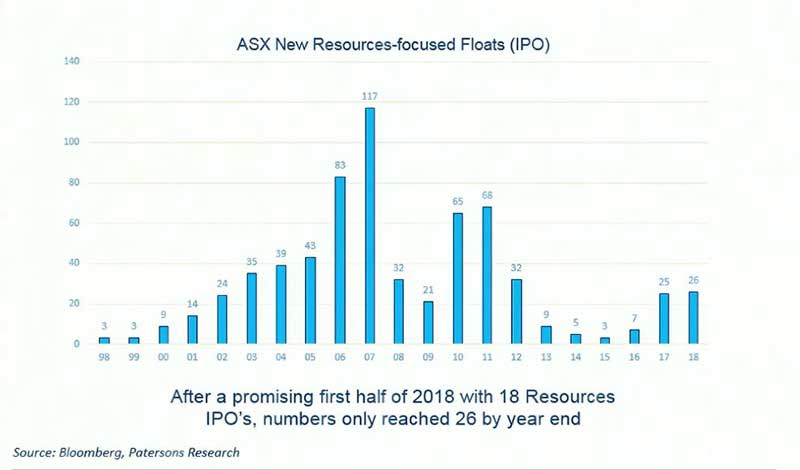

This might look a little gloomy for the resources sector, but Patersons Securities resources analyst Xavier Braud told delegates at the RIU Explorers Conference in Fremantle, WA last week that it looks like it could be the start of an uptick in the cycle, mimicking what happened between 1999 and 2003.

There were just three resources floats in 1999, but that increased to 35 by 2003 – before continuing the run up to a record 117 new floats in 2007.

Of course the GFC hit in 2008 and the number of IPOs has dropped off substantially since then.

“The IPO market was not the flashest of all for last year,” Mr Braud said. “The beginning of the year was good. Unfortunately it started slowing down.

“It’s still growing a little bit, and when I look at this one I can’t help but think it looks very much like ’99 to 2002/2003.

“To me it looks like it could be the beginning of [a cycle].”

Right now the only other resources players still in the queue to list besides Canterbury are gold explorer Expose Resources, base and precious metals explorer XS Resources and Australian Industrial Minerals, which is developing the Harts Range mine that hosts garnet and hornblende.

Garnet is typically used in abrasive blast cleaning, waterjet cutting and water filtration applications, while hornblende is usually only used in abrasive blast cleaning.

Expose and XS Resources were hoping to be listed last year, but are now down for April 10 and March 4 respectively.

Manganese explorer Rolek Resources, meanwhile, is looking to be relisted by April.

The company’s goal since September last year has been to complete a backdoor listing through the shell of Shaw River Manganese (ASX:SRR).

Supply chain delivery technology company AltoStratos was penned in to make its debut next week — on March 5 — but has extended that to the end of April.

Software provider AXS Group was looking to be listed by the end of February, but has pushed the deadline to March 15.

irexchange, which describes itself as a “disruptive technology and next-generation business” aimed at improving “fairness, transparency and efficiency” to the retail sector, has withdrawn its IPO.

Here’s a table of upcoming floats:

Swipe or scroll to reveal full table. Click headings to sort

| Company | ASX code | IPO status | Focus | Fund raising | Issue price |

|---|---|---|---|---|---|

| AltoStratos | ATO | Listing extended to April 30 | Supply chain delivery technology | $16-$25m | 40c |

| Australian Industrial Minerals | AAM | Offer opens Feb 18; Due to list Mar 28 | Industrial minerals | $5m | 25c |

| Australian Nutrition & Sports | AN1 | Offer opened Feb 15; Due to list Apr 3 | Dairy formula | $5-$8m | 20c |

| AXS Group | AXS | Due to list Feb 28 | Software provider to the finance, insurance and funds sector | $7m | 25c |

| Canterbury Resources | CBY | Listing date extended to Feb 28 | Copper, gold | $7.8m | 30c |

| Carnaby Resources | - | Prospectus not yet issued; Considering listing in 2019 | Gold | - | - |

| Ecofibre | Offer opens Feb 18; Due to list Mar 29 | Hemp products | $15-$20m | $1 | |

| Expose Resources | EXX | Listing date extended to April 10 | Gold | $4.5m | 20c |

| Frugl | Pre-IPO funding; planning listing | Grocery price comparison | - | - | |

| irexchange | IRX | Withdrawn | Retail tech | $17.5m | 90c |

| IXT | IXT | Was due to list Dec 21 | Services and software | $7m | 20c |

| Jobstore Group | JOB | Was due to list Dec 5 | AI-powered recruitment | $6.6-8m | 20c |

| Koligo Therapeutics | KOL | Offer opens Feb 18; Due to list Mar 29 | Regenerative medicine | $6-$7m | 20c |

| Rolek Resources | RLK | Backdoor listing via Shaw River (ASX:SRR); Listing expected by April | Manganese | $5m | 2c |

| Trigg Mining | TMG | Postponed until 2019 | Potash | - | |

| XS Resources | XS1 | Listing extended to Mar 4 | Precious, base metals | $4.5m | 20c |

Meanwhile, a large chunk of companies that made their debut in the past year haven’t done all that well.

Around 62 per cent have made no gains or have sunk lower than their IPO issue price.

A fair few resources companies are among the losers, including Bounty Mining (ASX:B2Y), Coolgardie Minerals (ASX:CM1), Podium Minerals (ASX:POD) and Tao Commodities (ASX:TAO).

Bounty has wiped off nearly 78 per cent since it listed mid-last year and is now trading at 7.8c, while Coolgardie is down 74 per cent to 5.2c, Podium slipped 72 per cent and Tao retreated nearly 56 per cent.

Payments provider Splitit (ASX:SPT) is still the best performing float over the past year, gaining 318 per cent to trade at 83.5c.

Splitit is the latest competitor in the buy-now, pay-later market with companies such as Afterpay and ZipCo.

Nickel Mines (ASX:NIC) is the best performing resources company, adding 24 per cent to its share price to reach 43.5c.

Here’s a list of IPO performances over the past year:

Swipe or scroll to reveal full table. Click headings to sort

| Listing Date | ASX Code | Company | IPO Price | Intra-day Price Feb 26 | Percentage Change |

|---|---|---|---|---|---|

| 01/29/2019 | SPT | Splitit Payments | 0.2 | 0.835 | 3.175 |

| 12/18/2018 | EX1 | Exopharm | 0.2 | 0.5 | 1.5 |

| 09/21/2018 | AGH | Althea Group Holdings | 0.2 | 0.415 | 1.075 |

| 07/18/2018 | KTD | Keytone Dairy Corp | 0.2 | 0.4 | 1 |

| 12/28/2018 | AMS | Atomos | 0.41 | 0.75 | 0.829268292683 |

| 05/25/2018 | CPV | Clearvue Technologies | 0.2 | 0.355 | 0.775 |

| 10/15/2018 | SMX | Security Matters | 0.2 | 0.355 | 0.775 |

| 12/13/2018 | EMV | EMvision Medical Devices | 0.25 | 0.425 | 0.7 |

| 07/20/2018 | CXL | Calix | 0.53 | 0.83 | 0.566037735849 |

| 12/13/2018 | TYM | Tymlez Group | 0.22 | 0.335 | 0.522727272727 |

| 05/29/2018 | PYG | PayGroup | 0.5 | 0.72 | 0.44 |

| 08/20/2018 | NIC | Nickel Mines | 0.35 | 0.435 | 0.242857142857 |

| 07/30/2018 | CR1 | Constellation Resources | 0.2 | 0.245 | 0.225 |

| 08/15/2018 | TMR | Tempus Resources | 0.2 | 0.245 | 0.225 |

| 05/16/2018 | S66 | Star Combo Pharma | 0.5 | 0.605 | 0.21 |

| 12/14/2018 | YRL | Yandal Resources | 0.2 | 0.24 | 0.2 |

| 02/14/2019 | A1G | African Gold | 0.2 | 0.24 | 0.2 |

| 02/22/2019 | MPH | Mediland Pharm | 0.2 | 0.225 | 0.125 |

| 05/11/2018 | 1752 HK | Top Education Group | 0.33 | 0.37 | 0.121212121212 |

| 11/14/2018 | HM1 | Hearts and Minds Investments L | 2.5 | 2.76 | 0.104 |

| 07/09/2018 | PGX | Primero Group | 0.4 | 0.43 | 0.075 |

| 12/12/2018 | HMD | HeraMED | 0.2 | 0.215 | 0.075 |

| 05/29/2018 | GAL | Galileo Mining | 0.2 | 0.2 | 0 |

| 07/27/2018 | NSB | NeuroScientific Biopharmaceuti | 0.2 | 0.2 | 0 |

| 09/11/2018 | HLA | Healthia | 1 | 1 | 0 |

| 09/12/2018 | 14D | 1414 Degrees | 0.35 | 0.35 | 0 |

| 02/19/2019 | CLB | Candy Club Holdings | 0.2 | 0.2 | 0 |

| 10/12/2018 | TGF | Tribeca Global Natural Resources | 2.5 | 2.42 | -0.032 |

| 05/30/2018 | KRX | Koppar Resources | 0.2 | 0.19 | -0.05 |

| 11/29/2018 | NWM | Norwest Minerals | 0.2 | 0.19 | -0.05 |

| 07/13/2018 | VEA | Viva Energy Group | 2.5 | 2.36 | -0.056 |

| 11/30/2018 | RDC | Redcape Hotel Group | 1.13 | 1.04 | -0.0796460176991 |

| 03/09/2018 | STN | Saturn Metals | 0.2 | 0.18 | -0.1 |

| 12/05/2018 | CRS | Caprice Resources | 0.2 | 0.18 | -0.1 |

| 10/23/2018 | CRN | Coronado Global Resources | 4 | 3.51 | -0.1225 |

| 06/22/2018 | WGB | WAM Global | 2.2 | 1.925 | -0.125 |

| 10/17/2018 | ID8 | Identitii | 0.75 | 0.64 | -0.146666666667 |

| 08/24/2018 | KWR | Kingwest Resources | 0.2 | 0.17 | -0.15 |

| 09/17/2018 | VEN | Vintage Energy | 0.2 | 0.17 | -0.15 |

| 07/05/2018 | RMY | RMA Global | 0.25 | 0.21 | -0.16 |

| 04/18/2018 | JMS | Jupiter Mines | 0.4 | 0.33 | -0.175 |

| 10/31/2018 | WWG | Wiseway Group | 0.5 | 0.4 | -0.2 |

| 03/16/2018 | EM2 | Eagle Mountain Mining | 0.2 | 0.16 | -0.2 |

| 02/13/2019 | UWL | Uniti Wireless | 0.25 | 0.19 | -0.24 |

| 09/13/2018 | ARN | Aldoro Resources | 0.2 | 0.15 | -0.25 |

| 10/02/2018 | SGI | Stealth Global Holdings | 0.2 | 0.15 | -0.25 |

| 04/16/2018 | MKG | Mako Gold | 0.2 | 0.135 | -0.325 |

| 05/14/2018 | ED1 | Evans Dixon | 2.5 | 1.65 | -0.34 |

| 03/16/2018 | TGO | Trimantium GrowthOps | 1 | 0.655 | -0.345 |

| 07/06/2018 | WOA | Wide Open Agriculture | 0.2 | 0.13 | -0.35 |

| 10/19/2018 | QEM | QEM | 0.2 | 0.13 | -0.35 |

| 11/07/2018 | MOH | Moho Resources | 0.2 | 0.13 | -0.35 |

| 11/08/2018 | GSM | Golden State Mining | 0.2 | 0.13 | -0.35 |

| 06/13/2018 | VN8 | Vonex | 0.2 | 0.12 | -0.4 |

| 04/11/2018 | DXN | Data Exchange Network /The | 0.2 | 0.115 | -0.425 |

| 09/21/2018 | AR9 | Archtis | 0.2 | 0.11 | -0.45 |

| 04/30/2018 | MAM | Microequities Asset Management | 0.8 | 0.42 | -0.475 |

| 12/20/2018 | FIJ | Fiji Kava | 0.2 | 0.096 | -0.52 |

| 11/30/2018 | NVU | Nanoveu | 0.2 | 0.09 | -0.55 |

| 04/16/2018 | TAO | Tao Commodities | 0.2 | 0.089 | -0.555 |

| 07/26/2018 | RFR | Rafaella Resources | 0.2 | 0.085 | -0.575 |

| 08/16/2018 | SLZ | Sultan Resources | 0.2 | 0.079 | -0.605 |

| 06/21/2018 | RZI | Raiz Invest | 1.8 | 0.66 | -0.633333333333 |

| 04/27/2018 | SIL | Smiles Inclusive | 1 | 0.29 | -0.71 |

| 02/28/2018 | POD | Podium Minerals | 0.2 | 0.056 | -0.72 |

| 08/30/2018 | CM1 | Coolgardie Minerals | 0.2 | 0.052 | -0.74 |

| 06/19/2018 | B2Y | Bounty Mining | 0.35 | 0.078 | -0.777142857143 |