IPO Watch: Helium play Renergen is here to keep the party going

IPO Watch

IPO Watch

A US-based party supplier has just closed 45 outlets citing, at least partially, the lack of helium supply.

This usually wouldn’t make the news over here, but it has renewed fears that we are running low on a very important resource. And it’s not the party balloons we should be worrying about.

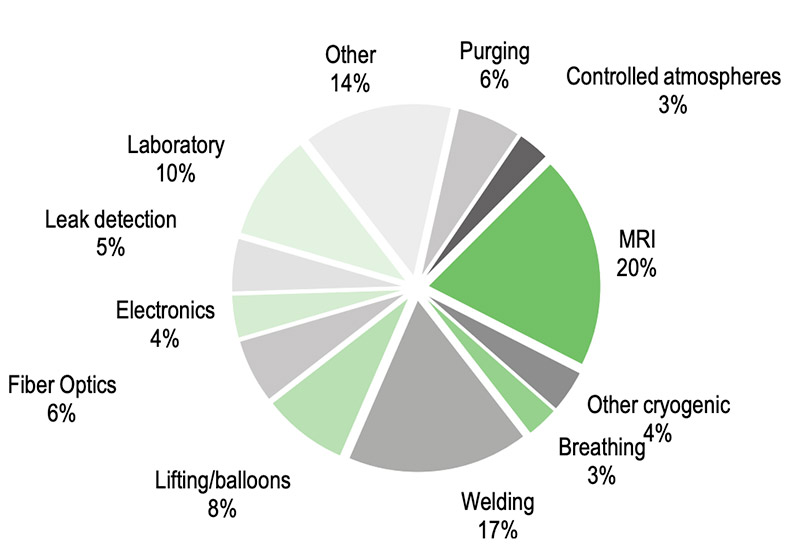

Helium is used for space exploration, rocketry, high level science, in the medical industry for MRI machines, fibre optics, electronics, telecommunications, superconductivity, underwater breathing, welding, nuclear power stations and lifting (big) balloons.

The US Bureau of Land Management (BLM), which controls about 20 per cent of global supply, will shut up shop in 2021. According to Edison Research, there’s likely to be a global shortage starting this year and continuing until new planned projects in Qatar and Russia come online in 2020 and 2022 respectively.

“[But] any delay in production from these two sources will materially adversely impact on global supply of helium,” Edison writes.

“Continued demand for helium by a particular user or class of users will depend on a variety of factors, but for many users, helium is unique and must be used, regardless of price.”

There is no way of manufacturing helium artificially, and existing resources, usually a by-product of natural gas processing, are finite.

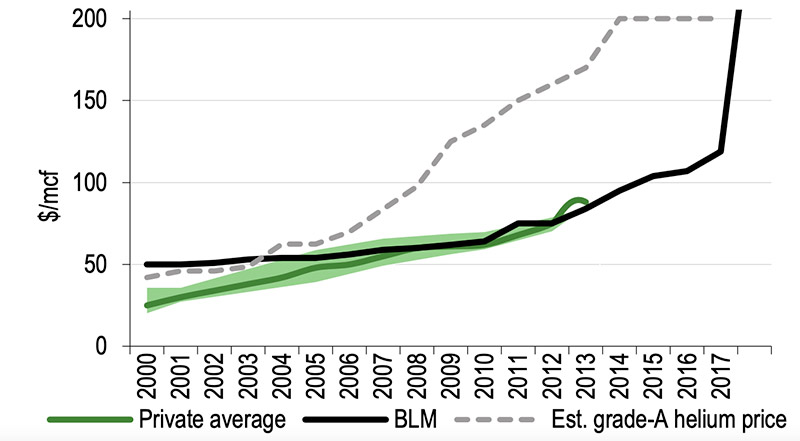

Helium is traditionally traded on confidential long-term private contracts, keeping prices opaque, but we do know that in September last year, the US Bureau of Land Management (BLM) annual helium auction fetched an average price of $US160.64/Mscf — up 135 per cent from the previous year.

That’s a hefty spike:

JSE-listed LNG and helium play Renergen has just announced plans for a secondary listing on the ASX, where it aims to raise between $5m and $10m in an initial public offering.

The offer, which closes May 22, is priced at 80c per CHESS Depositary Interest, or CDI — which is a proxy for trading foreign shares on the ASX.

At listing, there will be about 112.6 million shares on issue and the company will have a market cap around $90m. Renergen expects to begin trading on the ASX on May 31.

Its main business is Tetra4 in South Africa, which owns the undeveloped, helium-rich Virginia gas project.

Helium becomes economically viable to extract from natural gas at concentrations as low as 0.1 per cent, Renergen says. Virginia boasts an average concentration of 3.9 per cent, and its most recent well produced 11 per cent helium.

The Virginia Gas project will be built in stages. The fully funded Stage One will produce about 350kg of liquid helium and 50 tons of LNG a day. The funds raised under the Australian IPO will be used to drill additional production wells in Tetra4’s proven gas reserves and fund a feasibility study into Stage 2.

A helium offtake agreement with Linde Global Helium for up to 24,000 mcf per year is already locked in, and the company says it has a “ready market” for its LNG, having entered into gas sales agreements with companies like Megabus, Anheuser-Busch and Black Knight Logistics.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Any documents linked or referred to in this article were not selected, modified or otherwise controlled by Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in the documents linked or referred to in this article.