Why this 29-year-old investor took a six-figure stake in a $17m biotech company

Health & Biotech

Health & Biotech

Investor James Graham is not a big fan of the great Australian dream.

“I prefer to have my money be working for me,” he tells Stockhead. “I don’t want it to be at the beck and call of Trump having a war with China or locked up in the brick-and-mortar housing market which I have no control over.

“I much prefer to create my own destiny than be reliant on things I can’t control and so rather than use my savings to put down a deposit on a house, I am backing what I believe is set to become a great Australian business success story.”

He is referring to superbug-fighting biotech Recce Pharmaceuticals (ASX:RCE).

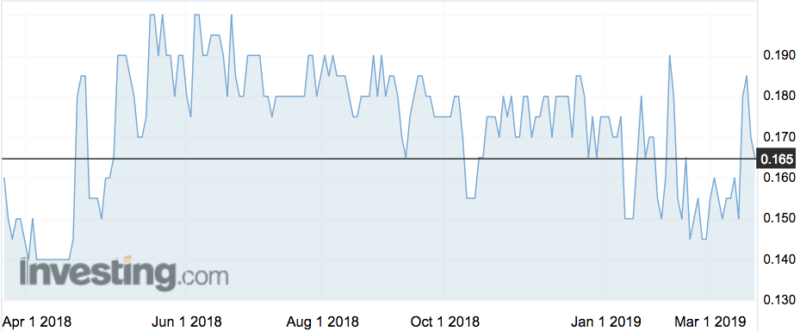

Earlier this month, Mr Graham stumped up more than $100,000 out of his own pocket to buy a significant whack of shares on-market, at an average price of 15.46 cents per share, representing about a 10 per cent premium.

His purchase of 650,000 shares in Recce is proof, he says, of his commitment to a company he believes will ‘make it’ — indeed, his grandfather, Dr Graeme Melrose, former head of research at Johnson & Johnson Australia, is the founder and inventor of their technology.

Recce is developing synthetic antibiotics with broad spectrum activity designed to address the global health problem of antibiotic-resistant superbugs.

“He was tutoring me through university in his retirement,” Mr Graham says. “One day after class he asked me to come by his little lab.

“Went to a cardboard box in the corner, pulled out a vial, swirled it in front of me and said ‘I think this antibiotic properties, what shall we do with it?’

“He’s ex-head of J&J Research for a decade – who was I to say any different?”

Mr Graham became an executive director of the company and said he was backing Recce’s technology and his grandfather’s expertise at a time when the antibiotic pipeline “was drier than ever, at a time when the need is greater than ever”.

“I am a sucker for innovation, creativity and finding new ways of doing things,” he tells Stockhead.

“You’ve got to be in it to win it, and I’m okay with that. Perhaps I have an abnormally high risk tolerance. I’m either crazy or really smart, it will either put dinner on the table or I’ll be eating a Happy Meal on the corner.

“But this really does have the potential to be the biggest thing since penicillin, if we can solve it. Our lead focus is tackling sepsis, which affects about 30 million people worldwide, of which a third die.”

The company’s lead compound is RECCE 327. It was was awarded Qualified Infectious Disease Designation (QIDP) in 2017 under the Generating Antibiotic Initiatives Now (GAIN) Act – labelling giving it ‘fast track’ designation, plus 10 years of market exclusivity post approval.

It is currently in the manufacturing phase, achieving scale and consistency, ahead of in-human therapeutic use.