Will Resonance Health profits prove more than a purple patch?

Health & Biotech

Health & Biotech

Given all the marketing hard-sell of iron supplements from the likes of Swisse and Blackmores, it’s easy to forget that having too much of the ferrous metal in one’s organs and blood stream can be decidedly non-conducive to wellness.

In fact, it can be fatal.

Deficient iron is a lot easier to remedy than too much iron and in the case of the latter, patients can be consigned to a life of difficult “chelation” procedures to remove it.

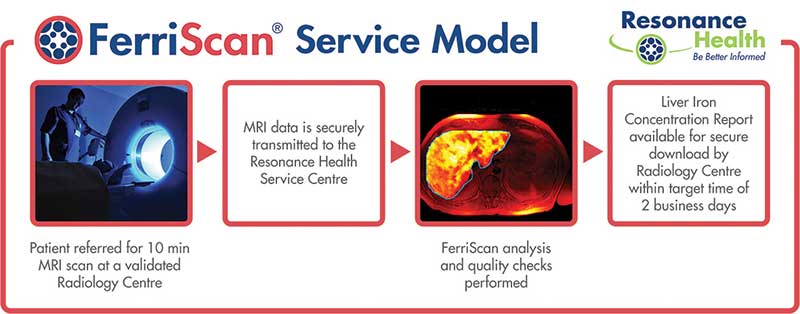

A provider of non-invasive medical imaging software and analysis, Resonance’s focus as a listed company (ASX:RHT) has been on commercialising its flagship device Ferriscan, which measures liver-iron concentration.

The company has now expanded into improved products to do the same thing, as well as measuring fat levels in the liver and the pancreas.

“Because it’s such a big product Ferriscan has been our big focus,” CEO Alison Laws says. “But there’s a new culture and willingness to accept new revenue streams.”

A brief history of Resonance

Ferriscan was devised by the clever bods in the University of Western Australia’s physics department, where it was nurtured for four years.

The intellectual property was housed in a company called IVB Technology, which was acquired by the listed GEO2 in 2003 before changing its name.

Resonance initially was chaired by Dr Michael Wooldridge, who had resigned in 2001 as Health Minister in the Federal Government of John Howard.

Resonance recently has been managed by a triumvirate of three directors. But in February the company appointed Ms Laws as CEO.

Ms Laws joined the company a year earlier as global account manager and held other roles including business development manager.

Building a better mousetrap

The Resonance story is a common one about expanding from an initial product with improved and wider offerings.

To this day Ferriscan is the standard-of-care for thalassemia, a hereditary condition afflicting Mediterraneans and South East Asians.

A debilitating form of anaemia, thalassemia is usually terminal if patients do not receive blood transfusions.

And it is the red blood cell transfusions that lead to the iron overload, so kidney dialysis patients can also have iron overload.

In fact, thalassemia is the third most serious public health problem in South East Asia, behind malaria and HIV. But migration also means the disease is found in Western countries

While the incidence of thalassemia is hard to pin down, the World Health Organisation estimates that about 330,000 children are born with the ailment each year.

>> Ten ASX medical imaging stocks that make a pretty picture

>> Medtech guide: these high-tech health stocks have the machines that go ‘ping’

Other causes of iron overload relevant to Ferriscan are transfusions for sickle cell anaemia (75,000-100,000 cases in the US annually) and myelodysplastic syndrome (a bone marrow deficiency resulting in lack of red blood cells).

Then there is hereditary haemochromatosis – with patients inheriting a primary iron overload – and affecting about one in 250 people of Northern European descent.

While a biopsy covers only a minute liver sample, a Ferriscan measure covers five to 20 percent of the organ and is thus more accurate.

Of course, such a non-invasive procedure is also much, much, less painful.

Based on artificial intelligence, Ferrismart is a bells-and-whistles version of Ferriscan that measures liver iron from a magnetic resonance imaging (MRI) readout.

It’s designed for acute care situations and for developing countries.

Ferrismart is much quicker than Ferriscan, producing a result in seconds rather than around 40 minutes.

Ferrismart performs the tests in real time, with an added feature of a QR (“quick response”, if you really want to know) code to prevent counterfeit results.

But the real benefit is that using artificial intelligence reduces labor costs, which makes the tests more affordable in countries such as The Philippines and Vietnam where health subsidies are not exactly generous.

Another Resonance product, Hepafat scans for liver and pancreatic fat loads, which means Resonance is playing in obesity-related diseases such as non-alcoholic steatohepatitis (NASH) and diabetes.

On a related theme, the Resonance DR Grader tests for diabetic retinopathy.

Tests in Singapore show the device can test for the disease with 92 percent efficiency by using images of the eye.

Finally, Cardiac T2 measures heart iron loading and is usually used with Ferriscan to capture heart and liver measures in the one sitting.

Cardiac T2 is approved here and in the US and Europe.

Finances and performance

As of March, Resonance had sold 45,000 Ferriscans in 45 countries.

Ferriscan has had US Food & Drug Administration approval since 2005 and also has European CE mark and local Therapeutic Goods Administration approval.

To date 10,000 Ferriscan procedures have been done in the US.

In mid-July, Ferrismart also won local TGA approval, as well as CE mark certification. The company plans to submit an FDA dossier by the end of July.

Also in July, Resonance announced a distribution tie up with Blackford Analysis, a global medical image analysis platform.

Currently, 80 percent of Ferriscan’s revenues derive from the US and the UK. However through major pharmaceutical companies there is some funding for private use in developing countries.

Ferriscan is reimbursed by the UK, German and Canadian governments and also has won the crucial private health insurance codes in the US.

Management reported $2.4 million of revenue for the financial year to April 30, 2018, an improved run rate of turnover of $2.5 million for the whole 2016-17 year.

The June quarter results — a 23 per cent revenue uptick to $766,000 and a small cash surplus of $49,000 — were also encouraging.

Management expects a net profit of $100,000 to $200,000 for the 2017-18 year, compared with a $304,000 loss in 2016-17 and a $384,000 deficit in 2015-16.

Revenue should also be boosted by a recently announced deal to provide $US677, 000 of tools to three pharmaceutical companies for clinical research.

Over the last 12 months, Resonance shares have traded between 1.9c (late September 2017) and 3c (mid-June 2017).

Ms Laws says the take-up of Hepafat has been slower-than-expected, probably because there is no effective current drug for NASH despite many developers working on it.

Dr Boreham’s diagnosis:

Given Ferriscan has been approved — and around — for a while, sales are still modest (bearing in mind the developing world skew of its patient base).

“Resonance has done well with what it has, but as an ASX-listed company we understand we have a smaller market cap than potentially investors would like to see,” Ms Laws says.

We couldn’t have put it better!

Ms Laws says her number one priority is to ensure the platform is stable and revenue generating and then expand the company from there.

To achieve this, Resonance intends to pursue in-house development and partnerships, as well as distributor services for products “that are an excellent fit with the Resonance core business and distribution network”.

The company is talking to scanner manufacturers and “various other parties in Australia to do with licencing or something corporate”.

The company should gain more resonance with investors if the current profitability proves to be more than a purple patch.

This column first appeared in Biotech Daily

Disclosure: Dr Boreham is not a qualified medical practitioner and does not possess a doctorate of any sort. He has never been mistaken for an Iron Man and perhaps that’s all for the better.

The content of this article was not selected, modified or otherwise controlled by Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.