The Pot Seat: Botanix’s Matt Callahan says synthetics are the future of cannabis drugs

Health & Biotech

Health & Biotech

Synthetic versus natural extract is a major debate in the cannabis sector, but it’s black and white for Botanix Pharmaceuticals boss Matt Callahan.

He’s a synthetic guy all the way.

Botanix (ASX:BOT) is trialing a synthetically-derived cannabidiol (CBD) treatment for acne, psoriasis and dermatitis, which it hopes to turn into some of the first registered cannabis drugs for serious skin ailments.

It differs from other ASX biotechs CannPal (ASX:CP1), Medlab Clinical (ASX:MDC) and Zelda (ASX:ZLD) which are using natural extracts that comprise all of the cannabinoids contained in the plant.

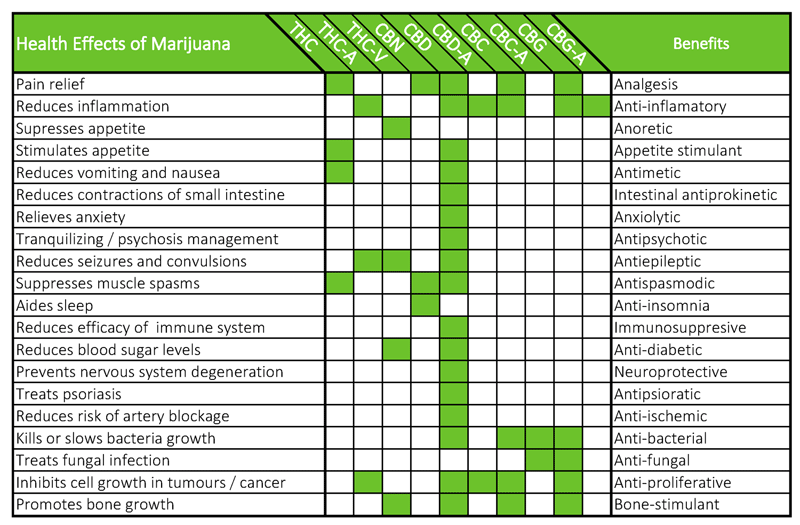

The theory behind that approach is the combined effect of everything in the plant will be more helpful that one single isolated cannabinoid.

But Mr Callahan says drugs using natural extracts will be very difficult to get past the all-powerful US Food and Drug Administration (FDA).

“Ignore that fact for a moment that someone is using a plant and someone is using a synthetic extract. The FDA has a rule that if you have more than one drug in your drug delivery route, you have to know exactly what those drugs do together, and alone,” he told Stockhead.

“The plant is the inspiration; it’s not necessarily the source of the material that you use in the drug.”

There are eight major cannabinoids in cannabis and more than 80 all up – that we know of.

The FDA considers each cannabinoid to be a separate drug.

The issue is that it’s quite difficult to isolate these from a whole plant extract.

Epidiolex was approved for childhood epilepsy, but used only synthetic CBD, while separate treatments for weight loss in AIDS patients have also been approved that contain only the synthetic THC molecule.

Whole plant drugs do have a place in the FDA rainbow, under the title of botanical drug development, but the quality control requirements are high, including maintaining the same level of potency from crop to crop, using the exact same collection methods, and keeping the same mixture of molecules.

The other issue is safety.

In early February a major phase 3 clinical trial in Canada was thrown into disarray after the company involved, Tetra Bio Pharma, found potentially dangerous microbes called mycotoxins in its fibromyalgia drug candidate.

“Botanical drugs have unique challenges because of the potential for microbial contamination known as mycotoxins,” the company said.

“[We have] temporarily suspended the phase 3 clinical program due to impurities found in its PPP001 investigational drug being administered to patients.”

Mr CallIahan says this higher risk of “nasty things that can kill” in natural extracts is why they use fully synthetic molecules and why everyone else should, too.

Botanix (ASX:BOT) is moving down a route that other ASX pot stocks are only just getting started on — pure pharmaceutical drug maker.

Data from the Phase 1b study on the psoriasis treatment is due in April.

Then comes the acne phase 2 data by September, followed by the dermatitis phase 2 towards the end of 2019.

And it plans to have a study designed for the new anti-microbial skin infection indication “within the next quarter or two”.

As dermatology treatments are typically licensed or partnered up after phase 2 results are in, it’s “entirely possible” Botanix has a deal on the table for the acne drug this year.

Of course that’s if it can produce convincing clinical trial data and pass regulatory muster, which is not a cheap or quick feat.

Botanix went the registered drug route because these are medications that don’t need a special approval and can almost name their price: doctors trust the regulatory nod, globally insurers will cover them so they’re cheaper for users, and the hurdle for competition is that much higher.

And crucially it can be sold in the world’s largest pharmaceutical market, the US.

Mr Callahan has said a few times now they don’t consider themselves a cannabis company.

Yet Botanix compares itself in its reports to local companies like Cann Group (ASX:CAN), hemp grower Elixinol (ASX:EXL) and AusCann (ASX:AC8) which wants to be a pharmaceutical manufacturer.

Cann and AusCann are two of the most established names on the ASX and Mr Callahan sees the beginnings of a pharmaceutical business in each, while Elixinol has revenue and is there as baseline for what is possible in the industry.

“Everyone seems to be jumping into pharmaceuticals. All of these companies that raised lots of money for growing operations and extraction operations have figured out that that is called farming, and whoever is the lowest cost producer in the correct geography will win,” Mr Callahan said.

“Turns out we’re two and a half years ahead of most people.”