Rise of sepsis drives demand for medical safety technology

Health & Biotech

Health & Biotech

One of the hottest sectors during the last tech boom was medical safety devices.

The ASX saw a profusion of players developing retractable syringes and other ways of preventing needle-stick injury.

Today, the only survivor is ITL Health Group (ASX:ITD) which designs and manufactures a range of medical devices for use in the international blood-banking industry and for the domestic hospital operating theatres.

Not only is it surviving — it is prospering. It’s patented devices are sold in more than 50 countries and in the 12 months its shares have trebled in price.

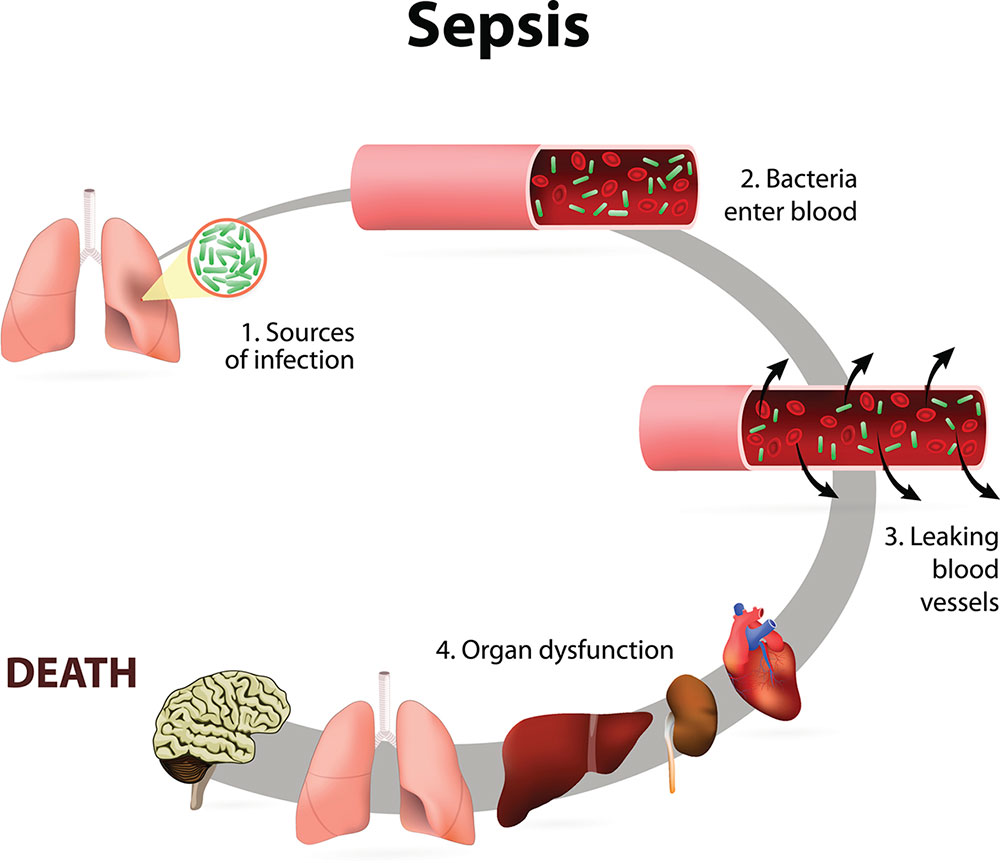

One of the main catalysts has been the rising global incidence of sepsis, a life-threatening illness where the immune response to blood infection causes tissue damage.

More than 15,000 people end up in Intensive Care in Australia and New Zealand each year for severe sepsis, according to the Ausrtalian Sepsis Network.

Most patients are tested for sepsis multiple times. Along with underlying drivers from the ageing population, that has driven a compound annual growth rate of more than 8 per cent in the blood culture testing market.

ITL has been a direct beneficiary and now supplies 30 million safety devices per year to the blood-banking industry.

It’s core products are the Donorcare Needle Guard and the Samplok Sampling Kit (“SSK”), Safety Sub-Culture unit and tube holder.

Clients include the American Red Cross, One Blood (a major US blood bank) and major medical product distributors like bioMerieux, with whom ITL has recently signed a global alliance.

bioMerieux’s bacT/ALERT is the dominant system used in the process of testing platelets for bacteria in the global blood banking market. SSK is used as an ancillary product as part of that system.

Higher capacity use at ITL’s Malaysian production facility is translating into better earnings margins. An expansion and automation program started three years ago now looks prescient.

ITL’s Healthcare Australia division is a supplier of procedure kits to the local hospital market where it has designed proprietary products for inclusion in the kits assembled at an accredited facility in Braeside, Victoria.

This division has lower margins but it is a source of consistent cash generation that helps fund an R&D budget in excess of $4 million a year.

ITH Healthcare has eked out a significant slice of the local market in operating room kits and invasive blood pressure monitoring packs that could be strategically valuable to a larger competitor.

Across the two divisions, ITL has a library of almost 50 international patents. Buoyed by a strong market, it is planning to release up to 14 new products in the next year or so.

The Group has also acquired, and invested in, My HealthTest, an online blood collection and diagnosis platform.

My HealthTest allows consumers to manage their own health in a convenient and safe manner by applying online for relevant disease tests.

A secure online ordering system makes the test request process a quick and simple task, and the subscription service allows users to set-and-forget the planning for their regular testing needs.

The platform was launched with a test for diabetes which is the most prevalent chronic disease in the world. It is estimated 400 million people suffer from it globally, half of them undiagnosed.

My HealthTest has formed partnerships with a range of diabetes organisations and has been accepted into HCF’s Health Accelerator Programme. It provides a potentially lucrative longer term growth avenue in the global blood testing market.

Despite its run, the stock is trading on a prospective PER for the current financial year of less than 13 times, which is way below the sector average of 30 times — inflated by the global success of major players like Resmed and Cochlear.

Over the past year ITL’s shares have traded between 15.5c and 66c. The shares closed at 46.5c yesterday, giving it a market cap of $45 million.

Tim Knapton is the founder and CEO of online tech research and finance marketplace TechVoyage. Its video/financial database and digital broadcast platform provide a more efficient way for investors to appraise listed and unlisted tech companies and for entrepreneurs to finance, acquire and exit them.

Previously Tim was Head of Corporate Broking at Deutsche Australia and before that ran a research department for a leading broking house. Tim has also been a freelance tech/finance journalist for more than 20 years and a columnist with The Australian Financial Review, The Bulletin, BRW, Shares and Australian Business.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.