Health: The cash keeps pouring in for Osprey, selling US$826k in devices last quarter

Health & Biotech

Health & Biotech

When your sole revenue source is a medical device costing $US350 each, you’d think cash would be difficult to come by. But cash has not been a problem for Osprey Medical (ASX:OSP).

Osprey released their quarterly cash flow report this morning and they revealed they had sold 2,478 units of its DyeVert.

DyeVert is a display unit that monitors and manages contrast dyes. ‘Contrast dyes’ is a fancy term for chemical substances used in medical imaging procedures such as MRI scans. The problem Osprey seek to solve is contrast dyes can be hazardous to patients with kidney problems.

Unit sales were up 73 per cent from the corresponding period in 2018 and up 16 per cent from the December quarter. Osprey declared the quarter its 18th straight quarter of unit growth.

Their total sales revenue for the quarter was $US826,000 ($1.15m), an increase of 56 per cent on the prior corresponding period. This because more hospitals have bought DyeVert: 140 hospitals used the device compared with 114 this time last year.

Osprey has also given a shout-out to its sales representatives, reporting the average unit sales per sales rep was up 66 per cent to 101 each. The company anticipates further contracts in the coming months.

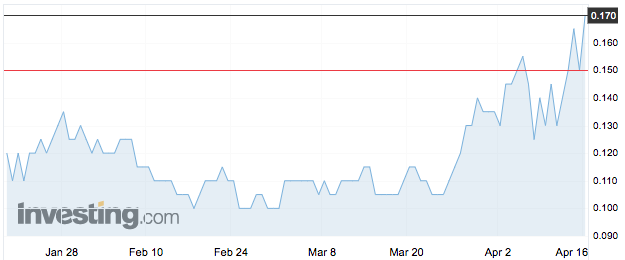

Shares jumped 13 per cent at market open to 17 cents and the stock is now up 70 per cent since the end of February.

eSense-Lab (ASX: ESE) has received its first US and Canada order for its vaping juice. The order came from Californian vaping distributor VaporSpec and comes two months after their distribution agreement was first announced. VaporSpec’s order was for ‘several hundreds’ of bottles and the company expects more in the weeks to come.

eSense CEO Haim Cohen said the company was ‘extremely pleased’ to receive the first order. eSense is also selling its products in Britain through E-Quits group who placed their first order in December.

Living Cell Technologies (ASX: LCT) released their quarterly today and it was a quiet one as the company awaits data from its Phase IIb NTCELL clinical study. There was only $164,000 of cash outflow compared with $806,000 in the previous quarter. The company’s cash balance is $5.4 million. NTCELL is cell therapy that seeks to treat Parkinson’s disease and it has already undergone Phase I and IIa clinical trials with positive results. Living Cell anticipates it could treat other diseases including Alzheimer’s and motor neurone disease.

Noxopharm (ASX: NOX) have released data from pre-clinical studies on its anti-cancer drug candidate Veyonda and they think it’s a “truly versatile drug candidate”.

They want to combine Veyonda with a standard checkpoint inhibitor to “achieve a more potent immuno-oncology effect” in cancers. Checkpoint inhibitors are drugs that block proteins made by cancer cells – thus killing them. They also have other drug candidates in the pipeline.