Fliers, flameouts and fakers: what happened in biotechland in 2018

Health & Biotech

Biotech Daily editor David Langsam’s tongue-in-cheek review of all the happenings in biotech-land in 2018.

The year for biotechs started exceptionally well, with a series of acquisitions, deals and good results.

Varian offered $1.56bn for Sirtex, and while waiting for CDH China to raise the bid to $1.9bn, Merck bought Viralytics for $502m.

2018 was dotted with under-rated very good news, including Prana (ASX:PBT) back in the clinic with PBT434 for Parkinson’s disease, Patrys (ASX:PAB) cleaning up its act to bring PAT-DX1 close to the clinic for brain and breast cancer, Benitec (ASX:BLT) claiming a $892m Axovant deal and Neuren (ASX:NEU) winning Acadia as a $630m backer.

But along the way the sector played the roller-coaster with some bad news, some weird news and some news no one understood.

January saw a rush of medical marijuana announcements. The 15 or so companies on that particular bandwagon are starting to sort themselves out and we are beginning to weed the dope from the grass.

Several others appear to be part of the growing, import-export, bit-of-this-and-that chain, but sadly for patients it is still near impossible – despite all approvals being in place – to actually go to your doctor and be given a script for any form of medical marijuana.

Valuations

Despite all the shocks, for the year to November 30, 2018 the benchmark ASX200 has only marginally outperformed the Biotech Daily Top 40, with the ASX200 down 5.1 per cent and the BDI-40 down 5.9 per cent.

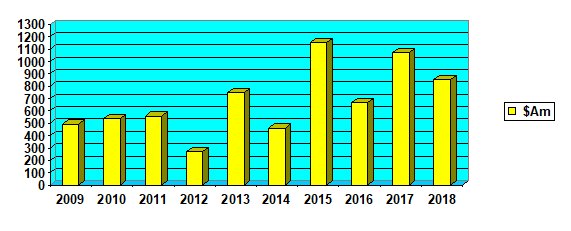

While the total funds raised by the ASX listed biotechs for human health was down 23 per cent from last year at $856 million so far, it was the third highest on record and well above the 10-year average of $677 million.

Kamikaze of the Year

Unfortunately, there have been several contenders for the ignoble prize, again.

The marijuana companies have not been backward in coming forward, with Esense’s (ASX:ESE) internal brawling making it sound more like nonsense, not to mention THC (ASX:THC) having similar but faster results.

Optiscan (ASX:OIL) was clearly in the mix, having been rebuilt by Archie Fraser only to be brought undone: there was a board spill and it’s now trying desperately to maintain the Zeiss contract.

But for all-round “we have no idea what you are doing and don’t think you do either” the award has to go to Admedus (ASX:AHZ) for taking a top Biotech Daily 20 company and putting it in a suspension for four months for a recapitalisation, having taken the blue-sky virus vaccine business and spinning it into a private company, majority-owned by Hong Kong.

Most of the December $19m capital raising appears to be at rates of 12.5 per cent for the first $6m and possibly even 25 per cent for the rest.

The company has had four company secretaries in 12 months.

Admedus is a train wreck.

Trouble in the boardroom

There was “trouble at mill” for several companies, with Medibio (formerly Bioprospect – ASX:MEB) losing CEO Jack Cosentino, followed by the re-emergence of Leo ‘The Gun’ Khouri, formerly a major shareholder and director of Bioprospect, and a spill that ultimately failed but dampened enthusiasm for the company.

We were shocked to see Archie Fraser depart from Optiscan and then dismayed by a board spill that left the company winged, despite the Carl Zeiss contract continuing.

THC also had a board spill with the old guard resuming control, but instead of pursuing equipment sales, joined the pack in growing and selling the much-vaunted medical marijuana.

All the biggest companies news you could want

Medical Developments (ASX:MVP) spent much of the year announcing European – and other – approvals for its Penthrox methoxyflurane inhaled analgesic, just a short 20 years or so after the Victoria Ambulance Service accepted it as the first-line treatment for moderate to severe trauma pain.

Proteomics (ASX:PIQ) launched its Promarkerd for diabetic kidney disease, Sienna (ASX:SDX) claimed its first European sale of its telomerase-based adjunct cancer test, Orthocell (ASX:OCC) claimed its first European sales of Celgro for dental implants, Invitrocue (ASX:IVQ) launched its Onco-PDO personalised cancer test, Atcor changed its name to Cardiex (ASX:CDX) to market wearable sensors.

And Uscom’s (ASX:UCM) Prof Rob Phillips continued expanding the company’s product portfolio, wearing out shoe leather and frequent flyer points only to see the share price fall.

Innate became Amplia (ASX:ATX), and in a case of very bad timing, the US Justice Department and FBI began proceedings against former director Chris Collins in relation to share dealing during a trading halt.

Nuheara (ASX:NUH) caught the Biotech Daily ear with its Iqbuds Boost for mild to moderate hearing loss.

Very cheap and able to do the job of filtering sound without the cost of a proper hearing aid. The most recent announcement of a device that allows a hearing challenged baby boomer to balance the television with the conversation in the room is a clear vote-winner.

Compumedics (ASX:CMP) announced a $133 million deal with China Health 100, which fell over, but its China revenue stream continues.

Dr Greg ‘Hercules’ Collier has cleaned out the Invion (ASX:IVX) stable, acquiring a light sensitive cancer treatment and packaged the Dr Mitch Glass respiratory assets he inherited into a new company, along with Dr Glass, leaving Invion free to focus on cancer.

Biotron (ASX:BIT) had good news that it downplayed with BIT225 showing “significant benefit” for HIV, while Bionomics’ (ASX:BNO) anti-anxiolytic BNC210 showed no benefit for post-traumatic stress disorder.

Kazia (formerly Novogen – ASX:KZA) started its long-awaited glioblastoma trial, while Avita (ASX:AVH) and Volpara (ASX:VHT) both won US regulatory approvals, as did Optiscan’s Carl Zeiss microscope and Resonance Health’s (ASX:RHT) Ferrismart.

ResApp (ASX:RAP) claimed success in its US Smartcough-C-2 trial, despite having missed its stated first primary endpoint, saying that its smartphone algorithm was better than the doctors with stethoscopes. The market disagreed.

Trouble in Canberra

August began well, with Acadia offering $630 million for the rights to Neuren’s Trofinetide for North America, and the two companies are currently negotiating a deal for the rest of the world.

But August was the month the Liberal-National Party — at the behest of Murdoch publications and a little man on Sydney radio — dumped the Prime Minister for Innovation Malcolm Turnbull.

He’d promised to put innovation at the centre of his Government, but instead implemented cuts to the R&D Tax Incentive and had five different Innovation Ministers in three years.

November was the month to forget

November gave us many much unwanted “firsts”.

At 9.01am on Monday, November 12, we started the week with the news that Phosphagenics (ASX:POH) had lost its hoped-for $415m Mylan case.

Seven minutes later came the news buried after the market closed the previous Friday that Bionomics would lose long-standing CEO Dr Deborah Rathjen and review its assets.

And if that wasn’t a bad enough start to the day, at 11.17am we found out that Mesoblast’s (ASX:MSB) much heralded end-stage heart failure trial had missed its primary endpoint.

Now that the trial showed the stem cells don’t work for the endpoint cited, we all know it was not actually a Mesoblast trial but an independent investigator led study, funded entirely by the US government, and results that had never been mentioned previously about gastro-intestinal bleeding could be the indication for which the FDA approves the stem cells.

But it didn’t stop there. Just when you thought it was safe to go back into the biotech waters on Wednesday, November 14, Factor Therapeutics (ASX: FTT) missed its phase II venous leg ulcer endpoint.

Four sets of bad news in three days. Not the record we wanted.

It is a very clear message that what goes down can go up, with three of the four returning to the Top 40 having had a brief vacation while finding new technologies or further developing existing ones.

This column first appeared in Biotech Daily.