Winchester hits $16k a day paydirt after Texas turnaround triples oil production

Energy

Energy

Special Report: Winchester Energy has hit paydirt at its Texas plant, tripling its oil production and adding more than $US10,000 a day to its revenue.

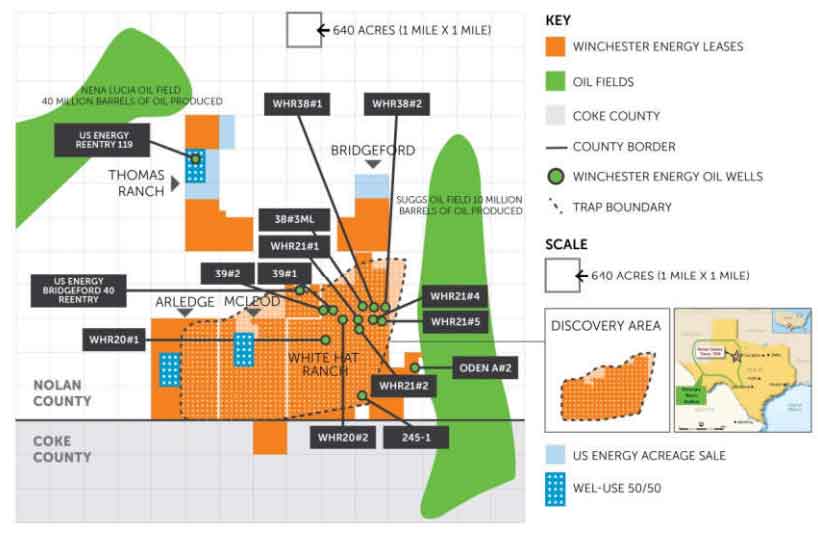

Winchester Energy’s (ASX:WEL) White Hat 20#3 well is producing an average of 306 barrels of oil per day (bopd) from the Strawn sands in the Mustang field in Texas.

Its share of production, from working interests and after royalties, has gone from 50 bopd to 200 bopd which at Monday’s WTI oil price is a daily payout of $US11,600 ($16,750).

It’s quite a turnaround from where it was a year ago, when the share price had dipped from 12c to 2c and the company was trying to squeeze oil out of an area that just didn’t want to give it up.

“We were pushing the Ellenburger limestone, which is next door to where we are now, but after initial success, recent drilling was a disappointment,” chairman John Kopcheff told Stockhead.

“Some people call limestone a heartbreaker: you think you’ve got the goods but if it’s not fractured, it won’t flow.”

So the company moved sideways to drill the shallower Strawn sands, a more predictable, “infinitely easier” geology to drill and crucially, a formation where Winchester has the “recipe” right for oil production.

It’s got another 11 to 15 locations for wells in the area, and the production well also confirmed the Mustang prospect, in which the Strawn sands sit, as an oil field.

Kopcheff is an oil industry veteran who led Senex (ASX:SXY) when it was still Victoria Petroleum, before coming out of retirement to become chairman of Winchester in 2017 to work with Winchester managing director Neville Henry, based out of Houston.

He says Texas is a critical factor in Winchester’s success because the huge amount of oil infrastructure leads to a very low cost of production.

Winchester is looking at a cost of $US10 a barrel to produce from Strawn with the well paying for itself in just six months, compared to the $15 it was predicting in 2017 for the Ellenberger.

“This is one of the reasons why we’re there. The cost in the Cooper Basin [in Queensland] is more like $US20 barrel,” he said.

“I like to tell people that 300 bopd in the US is like 600 bopd in Australia.”

Each well in the Strawn costs $750,000 and is a simple vertical well — no expensive horizontal drilling is required — and it’s covering geology that has been drilled before.

The difference is that new technology means it’s able to get a gusher like White Hat 20#3, whereas “the good old boys” in the past were only able to produce 20-30 bopd.

Furthermore, because light sweet crude is so sought after and because the field is close to infrastructure, it will take about five days to find a contracted buyer, Kopcheff says.

With 11-15 locations in the Mustang field to consider, Winchester has plenty to play with for the moment, but it also has prospective resources — once again, those which have been worked over before but not with new technology — to the west.

These are the Spitfire prospect with similar geology to Mustang and the El Dorado prospect which Kopcheff hopes will be as successful as the burgeoning play in the Mustang.