What’s a year between friends? Xanadu finally has WA govt nod for next step

Energy

Energy

Almost a year ago to the day Triangle and Norwest Energy said they had a candidate lined up to survey their fruitful new oil find, Xanadu.

Today, the companies said they finally got State Government permission to do said seismic survey.

In September 2017 they struck oil and gas: Triangle (ASX:TEG) saw its share price rocket 74 per cent while Norwest (ASX:NWE) was but 50 per cent. Fellow passenger, Whitebark (ASX:WBE) which has since sold out, rose as well.

Unfortunately, they couldn’t say much more without further testing.

Today the share price result was the same for Norwest: immediately on open investors boosted it 50 per cent to 0.3c.

Triangle was less fortunate this time around, gaining only 4 per cent to touch 13c in the first minutes of trading.

Singing the same tune as Cliff Head?

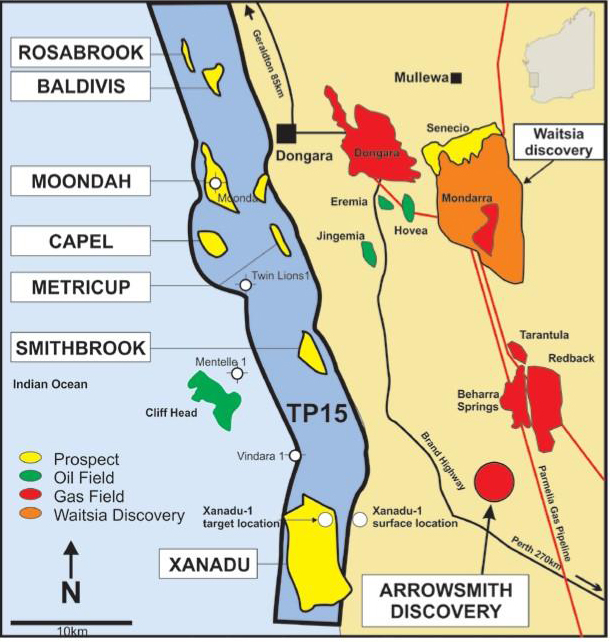

Investors and companies still harbour hopes that the field is analogous with Triangle’s next door offshore Cliff Head field, which produces about 1000 barrels of oil a day through a facility that can process up to 15,000.

Triangle and Norwest, the operator, expect contractor Synterra Technologies to be on site in mid-April and starting the survey a month later.

“Notwithstanding the delays, the timing of this approval has worked in our favour, as the mid-year period usually provides optimal weather conditions relating to wave height and wind strength, which should improve the quality of our data and minimise the acquisition time frame,” said Norwest managing director and CEO, Shelley Robertson.

Competitive neighbourhood

Xanadu, an offshore field, is in the Perth Basin area, one that has become increasingly popular over the last year with oil companies, after Key Petroleum (ASX:KEY) and Strike Energy (ASX:STX) moved into last year.

They join Mitsui and Beach Energy (ASX:BPT) as residents.