You might be interested in

Experts

PETER STRACHAN: Australian oil and gas is at the crossroads, but these 3 stocks are heading down the right path

News

CLOSING BELL: $35 billion in sweet, sweet divvies suddenly makes it all seem worthwhile

Experts

Energy

Whoever named Horizon Oil must have had a sense of humour given the company’s history of seeming to always be on the edge of something significant — though not quite within reach.

Oil prices above $US80 a barrel are changing everything for Horizon — just as it is for the entire oil and gas sector, especially as a move up to $US100/bbl (and beyond) is being openly discussed in the industry.

Small by the standards of a business sector dominated by giants, Horizon is already generating modest profits from a share of oil producing assets off the coasts of China and New Zealand.

But the big game is the potential for liquefied natural gas (LNG) production in Papua New Guinea, a country which already hosts the handsomely profitable PNG LNG project of which ASX-listed Oil Search has a substantial stake.

A lot needs to go right for Horizon if it is to achieve its biggest goal — the development of the Western LNG project in PNG in conjunction with the Spanish oil giant Repsol.

In some ways Horizon and its PNG plans give it the appearance of a mini version of Oil Search — a view aided by a comparison of stock-market value.

Horizon at $195 million and a share price of 16c, versus Oil Search at $13.9 billion and a share price of $9.07.

What the two companies share is a big footprint covering oil and tenements in central and western PNG with Oil Search blazing a trail in terms of the size of what it’s found and the development of a substantial oil and gas business which includes LNG production.

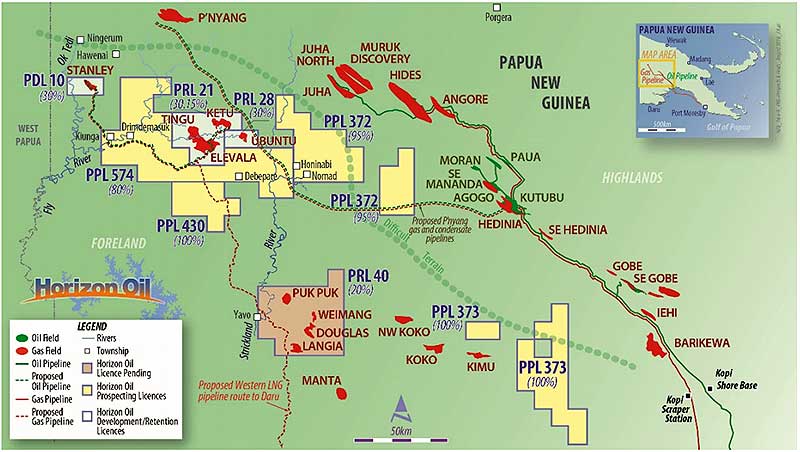

Horizon and Repsol are following Oil Search and have a similarly diverse spread of discoveries which need to be connected by a common pipeline to deliver gas to a proposed LNG facility on the southern PNG coast at Daru Island.

Hurdles remain for Horizon to clear, most notably a dispute with the PNG Government over one of the tenements, PDL 10, which contains the liquids rich Stanley field.

But, with LNG the flavour of the decade among energy consumers because it generates less pollution there is an impetus developing behind the Western LNG proposal which is for a relatively small project with an annual output of between 1.5 and 2 million tonnes of liquefied gas a year.

Company-making investment

Exact details are still being worked out by Horizon and Repsol but the major components of what could be a company-making investment are a 520km pipeline from gasfields in a PNG region known as the western forelands and the liquefaction facility on Daru Island. (See map below).

Concept engineering and design studies are underway for the Western LNG project which could “monetise” gas in fields such as Puk Puk, Douglas, Weimang and Langia with the aggregated material piped to the coast.

Ownership of the gas varies between tenements but the broad breakdown is roughly 28% Horizon and 41% Repsol with other interested parties including PNG’s national oil company, Kumul Petroleum, as well as Japan’s Osaka Gas.

Target markets for LNG include islands in neighbouring Indonesia, the South China Sea rim, and the bigger gas consumers, China and India.

Joining the dots which will eventually lead to a viable LNG development is one reason for investors to refresh their interest in Horizon, another is that the company has a solid oil-producing business which last financial year generated revenue of $US100 million.

Earnings before interest, tax, and other charges totalled $US68.5 million, good enough to retire debt totally $US20 million and leave the company with $US27.6 million in cash.

The outlook for the next few years is much of the same with production from a 26.95% stake in the Beibu Gulf oil fields off China and 26% in the Maari/Manaia oil fields off New Zealand expected to continue generating 5500 barrels a day for Horizon at a low operating cost of less than $US20/bbl.

Rated a buy

Not widely researched by big-name investment banks, the most recent analysis of Horizon is from Perth-based stockbroker Euroz which, in its September quarterly, rated Horizon as a buy.

Since the Euroz report Horizon has risen from 12c to 15c, up substantially on the stock’s low point for the past 12-months of 5.3c, but with Euroz seeing 20c as the target price.

It could be better for Horizon as planning for the Western LNG project moves ahead, with close interest being paid to the PDL 10 dispute with the PNG Government.

“The uncertainty of PDL 10 is disappointing as it has inevitably stoked market concerns regarding sovereign risk in PNG,” Euroz wrote.

“We view that this issue will be rectified in due course, effectively removing the cap to the current share price upside.

“To that end the current share price is underwritten to 15c by the producing assets.”

In other words, Horizon is a straight-forward oil production investment with LNG upside to come.