Tap Oil Board brawl broadens as allegations fly about motivation to sell oil asset

Energy

Energy

Tap Oil says two of its major shareholders want to liquidate it because they want to use it to get out of a separate sticky situation.

Earlier this week Singaporean investor Risco Energy Investments said it wanted to remove three Tap Oil directors and replace them with two of its own people.

In a nine-page response, the three non-aligned Tap (ASX:TAP) directors — James Menzies, Peter Mansell and Andrea Hall — outlined a plan they say was put to them to sell the company’s only producing asset to shore-up the bank balances of its two major shareholders, Risco and Northern Gulf.

Risco and Northern Gulf own 45 per cent of Tap.

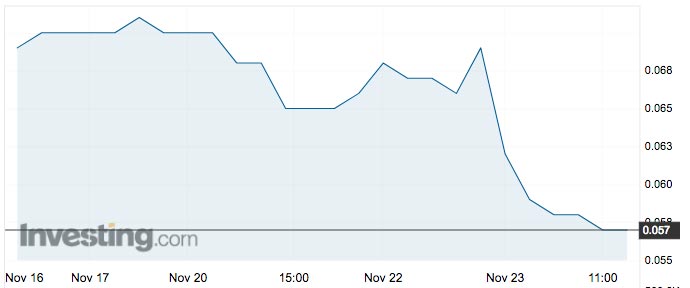

Tap Oil shares fell 17 per cent to 5.7c after the response was today published as an ASX announcement.

The non-aligned directors said that in September, Tap chairman Mr Menzies was asked to meet with an advisor to Kindarto Kohar — who was referred to as the ultimate controller of Risco’s shareholding in Tap — and Northern Gulf founder Chatchai Yenbamroong.

According to the response, the advisor and Chatchai said they’d agreed to a “game plan” for Tap.

They didn’t have the money to fund the company’s growth, but didn’t want to be diluted. Their strategy, then, was to sell Tap’s share in the Manora oil field.

They also said Tap should renege on a settlement reached with the Manora operator, Mubadala Petroleum “so Tap could become party to ongoing disputes between Chatchai’s Northern Gulf companies and Mubadala”.

“This would place commercial pressure on Mubadala to buy Tap out of its interest in Manora,” Mr Menzies, Mr Mansell and Ms Hall said in a letter sent to investors on Thursday.

“Chatchai has subsequently confirmed that this is a ‘do or die thing” for him and Kindarto,” the letter said.

Northern Gulf has been in a payment dispute with Mudabala — which also involved Tap.

Tap settled, agreeing to give up any potential claims on Mubadala, which — according to the non-aligned directors’ response — the advisor and Chatchai said was a “mistake”.

Replacing the Tap board would let them renegotiate that deal and “enable Tap to align itself with Northern Gulf in relation to these disputes and jointly pursue an agitation strategy against Mubadala”.

According to the response, the advisor and Chatchai said they believed Tap shareholders “would be supportive of this strategy, but if it had a negative impact on Tap’s share price, it could create a “good buying opportunity” for them”.

The three directors — Mr Menzie, Mr Mansell and Ms Hall — are recommending investors vote against the move.

Ms Hall has said she will step down if the Risco move goes through, meaning the company may not have enough Australia-based directors to continue trading on the ASX.

Risco says it doesn’t intend to nominate a new director at this time, which could mean Tap’s suspension from trade.

Further, Risco CEO Tom Soulsby is one of the directors his boss wants off the board – he declined to explain why he has requisitioned a meeting for his own removal.

As reasoning for why it wants the board gone, Risco is claiming Tap’s current strategy is not working, the Manora field is in decline, the board is too expensive, and the share price has fallen under Mr Menzies’ leadership.