ASX newcomer Warrego eyeing big Perth basin discovery

Energy

Energy

Special Report: Is Warrego Energy about to emulate the success of AWE Ltd, which was taken over by Japan’s Mitsui for $600 million last year after making a major onshore gas discovery in Western Australia’s Perth Basin?

That is the big question following Warrego’s (ASX:WGO) arrival on the ASX last month through the reverse takeover of Petrel Energy (ASX: PRL).

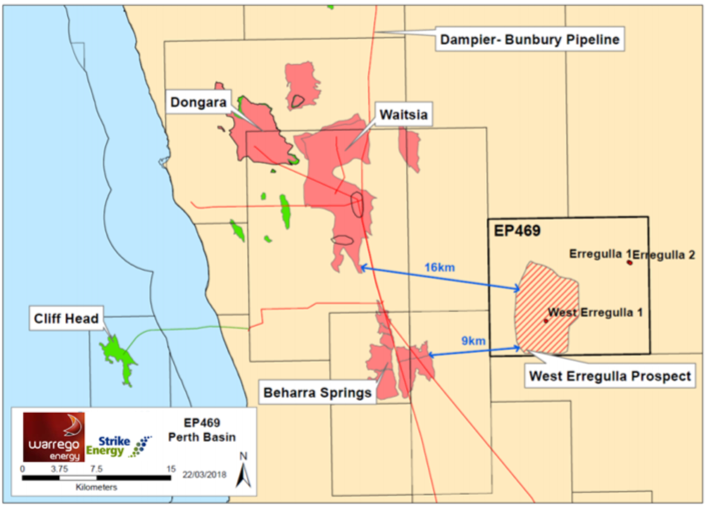

Warrego’s primary asset is a 50 per cent interest in block EP469 in the Perth Basin, which neighbours the Waitsia gas field discovered by AWE in 2014.

Waitsia is now the fifth largest onshore gas field in Australia, and accounted for 83 per cent of AWE’s 2P reserves when the company was taken over by Mitsui.

In March last year, Warrego brought in Strike Energy (ASX: STX) as an equal joint venture partner on EP469, with Strike carrying Warrego for up to $11 million of expenditure and assuming operatorship.

That $11 million is expected to cover the cost of the first well to be drilled under the JV, West Erregulla -2, which is due to spud in the second or third week of May.

Strike managing director Stuart Nicholls expects West Erregulla -2 to be “one of the most closely watched exploration wells drilled onshore Australia in 2019”.

With a planned depth of almost 5,000 metres, it will also be the deepest.

EP469 contains extensions of known commercial plays within the Perth Basin, including the Kingia-High Cliff sand sequence that hosts Waitsia, the Irwin Coal Measures and the Dongara-Wagina formation.

West Erregulla -2 will test these plays, with a P50 (mid-range) target of more than 1 trillion cubic feet (Tcf) of gas estimated for the well, which is larger than Waitsia itself.

Strike has estimated the chance of discovering gas and proving a developable resource in the Kingia-High Cliff formation as 69 per cent, which is unusually high for an oil and gas exploration prospect.

“While there is always an element of risk involve with exploration wells, the West Erregulla-2 well is definitely on the lower end of the risk spectrum, Group CEO & Managing Director Dennis Donald said.

“This really represents an opportunity to leverage the company into an international-scale E&P (exploration and production) business.”

Mr Donald, who resides in Aberdeen, Scotland, worked for Royal Dutch Shell for many years before leaving in 1998 to establish a drilling engineering company, Leading Edge Advantage, (LEA) with business partner Duncan MacNiven.

LEA specialised in advanced drilling techniques such as under balanced and through tubing drilling.

In 2007, Donald and MacNiven established Warrego as a private vehicle, with the idea being to apply their knowledge in new technology and techniques to unlock stranded onshore gas resources.

The first asset the company successfully bid for was EP469.

In 2014, Warrego secured a $40 million farm-in deal with two Dutch groups only to have them pull out a year later when the oil price crashed.

The upside was that the company regained 100 per cent ownership of the block.

In September last year, a mutual acquaintance in London introduced the Warrego principals to Petrel. From there, the reverse takeover came together quickly.

Since announcing the deal, Petrel/Warrego has boosted its Perth Basin knowledge base with former AWE boss David Biggs joining the board as a non-executive director.

Biggs was managing director at AWE when Mitsui came knocking.

As a complement to EP469, Warrego recently exercised an option on a neighbouring block, EPA-0127, which is the largest exploration permit in the Perth Basin and hosts several prospective formations including the Kingia-High Cliff sequence.

The company is in the process of completing Native Title agreements and investigating farm-out opportunities for the block.

Like EP469, EPA-0127’s proximity to existing infrastructure in the form of the Dampier-to-Bunbury gas pipeline should mean that any discovery is easier to commercialise.

Warrego also has an international presence with potential company-making assets in Spain and Uruguay brought to the venture through the reverse takeover with Petrel.

A geophysical survey is nearing completion at the Tesorillo project in Spain, in which the company owns an 85 per cent interest reducing to 50.1 per cent under an agreement with AIM-listed Prospex Oil and Gas.

Tesorillo also has 1 Tcf potential, with the partners proposing to drill a well in 2020 targeting the Almarchal-1 gas discovery made in 1956.

Following the completion of the reverse takeover, Warrego will undertake a detailed strategic review of its extensiveUruguayan assets.

These were Petrel’s primary focus at one point in time.

Warrego takes its name from the HMAS Warrego (pictured above), a River Class destroyer that was built in the Clyde shipyards in Scotland in the lead-up to World War I and then disassembled and shipped to Australia.

Australian shipbuilders gained practical experience in building destroyers through reassembling the Warrego.

Donald and MacNiven settled on the name as a nod to the support and technology transfer between Scotland and Australia not being a new occurrence.