Director Trades: Which small cap bosses are buying and selling their own stock?

Director Trades

Here’s which ASX small cap directors were buying or selling their own stock in the second week of July:

Croplogic (ASX:CLI) chair Cheryl Edwardes — a former West Australian attorney-general — has bought her first shares in the struggling agronomy business.

Ms Edwardes joined the board in March and there are high expectations that she will be the driving force the company needs to get its act together.

She is also a board member of medical cannabis player AusCann (ASX:AC8), Atlas Iron (ASX:AGO), Vimy Resources (ASX:VMY) and the boss of the West Australian Football Commission.

Croplogic may be a challenge for the Order of Australia member, however.

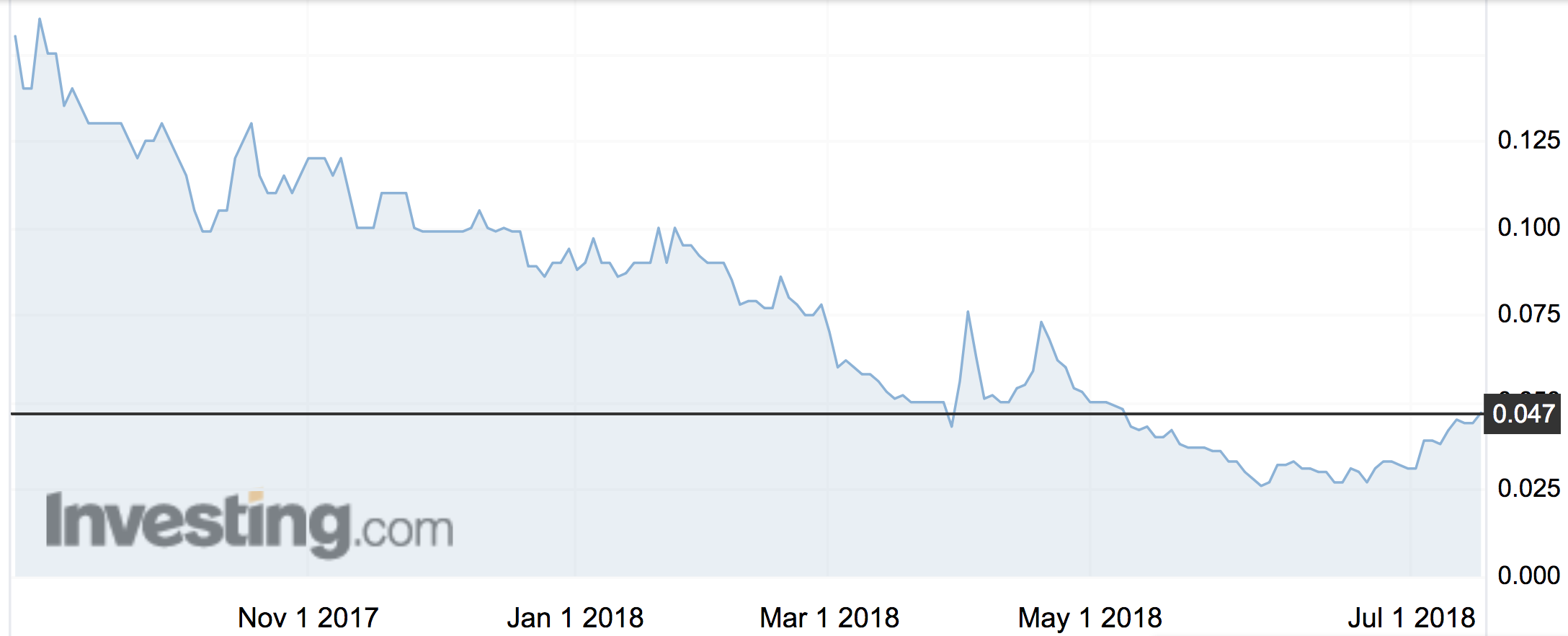

The stock listed in September after raising $8 million at 20c with a plan to sell soil-testing devices to potato farmers in the US.

It hit a low of 2.6c last month but has since climbed back to 4.7c.

Some believe the $8 million IPO was priced too high. The company has changed tack away from a growth-by-acquisition strategy and repositioned geographically to Australia, away from the US and its home base of New Zealand.

Ms Edwardes paid $9890.04 for her first 251,001 shares.

There was a flurry of buying among Venus Metals (ASX:VMC) directors last week.

Executive exploration director Barry Felhberg, who’s been looking for gold, diamonds, iron ore and other base metals for about 50 years, sank $96,000 into the company for 800,000 shares.

He now owns 2.53 million shares, or 3.3 per cent of Venus.

Of 86 director trades in Reward Minerals (ASX:RWD) over the last ten years, 70 have been made by former managing director Michael Ruane.

In fact, he is the only director to buy into the company since June 2016.

Mr Ruane stepped down as MD last year but maintained his frenetic buying which has added up to a total of 41.5 million shares, or 30 per cent of the potash explorer.

Reward closed up 15 per cent last week — it’s a stock which tends to move substantially when it does — after saying it was working on making its flagship “LD” project in the Port Hedland region cheaper.

The managing director of Pepinnini Lithium (ASX:PNN) saw her shareholding drop from just over 19 per cent last week to 17.6 per cent after the company’s latest $2.8 million cap raise.

Rebecca Holland-Kennedy bought 2.7 million shares for $57,678 as part of the entitlement issue, but it wasn’t enough to protect her substantial shareholding from slipping.

Pepinnini launched the entitlement issue to raise money for its Salta Lithium Projects in Argentina.

Unfortunately even after two extensions, the company had to call time: 87 per cent of the shares on offer weren’t taken up.

Investors rarely like to see directors selling, but what’s a bit of option arbitrage between friends?

Lepidico (ASX:LPD) managing director Julian Walsh spent $181,000 to exercise 10 million options worth 1.185c and sold 6 million of them, making $230,819.

These options expire in August and he started getting rid of them in May. He’s still got 10 million of the August options.

Diatreme Resources (ASX:DRX) director Andrew Tsang sold 6 million shares last week, making a tidy $200,000.

The company noted that he made the off-market sale in May, but only got the cash in July.

Mr Tsang controls 111 million shares which, given how many shares the silica-copper-gold-zircon explorer has on issue, only adds up to 11 per cent of the business.

The bankrollers

Land & Homes Group (ASX:LHM) and Ensurance (ASX:ENA) have both turned to their chairmen for new capital.

Developer Land & Homes Group has raised more money via convertible notes and chairman Choon Keng Kho has tipped in again.

Mr Kho said in October he’d pitch in up to $500,000 in as part of $3 million convertible notes raise.

He has so far bought $2.1 million of the 2c notes.

At Ensurance, chairman Tony Leibowitz is either regularly buying in, having debts owed by the company repaid to him, or underwriting its cap raises.

This week, Mr Leibowitz’s stake rose to 48 million shares (that’s just over 31 per cent) after receiving the proceeds of partly underwriting a $6.23 million entitlement offer.

The offer failed to convince investors and $6 million was left hanging.

Mr Leibowitz took up $115,000 of that, with the other underwriters taking up the rest.